TikTok is determined to convert itself into an online shopping powerhouse, in order to maximize its revenue opportunities, though users still seem largely perplexed as to why they would go from watching short-form video clips to buying products in the app.

Though it is making inroads, albeit slowly. According to a new report from Dash Hudson, TikTok Shop is now the ninth-largest online beauty and wellness retailer in the U.S., and the second-largest in the U.K. And users are spending more money in the app. But thus far, it hasn’t been able to replicate the in-stream shopping explosion that’s propelled the Chinese version of the app to new heights.

Maybe this will help.

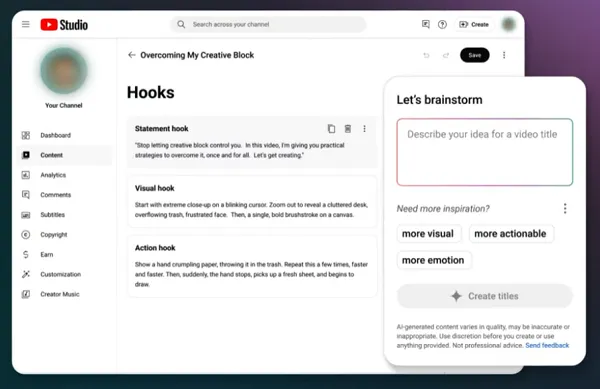

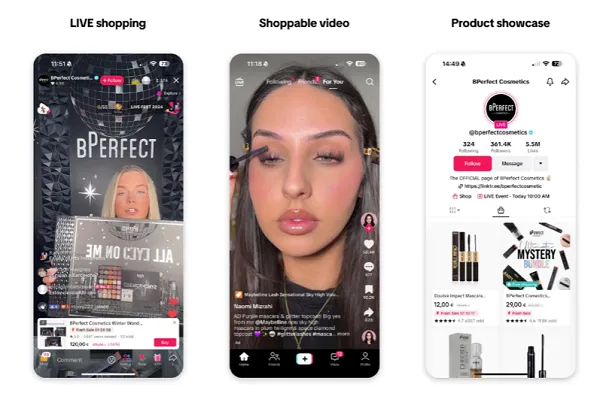

This week, TikTok has expanded its test of image search functionality, which enables users to search for product listings in the app based on a visual example.

As you can see in these screenshots, where available, users can now tap the camera icon in the search bar of the “Shop” tab in the app, which then enables you to take a photo, or use an image in your camera roll, to find similar products.

TikTok’s been testing the option in selected markets over the past year, with users in some regions sharing examples of the experience.

TechCrunch has reported that TikTok’s now added the functionality for all users in the U.S. and in Southeast Asia, where its shopping tools have gained more traction, and are facilitating more significant new opportunities.

Image search in itself is not a new concept, with Google, Pinterest and Amazon all offering their own variations of the same. So it’s not a functional shift that’s likely to prompt significant interest as a result, but it is another element in TikTok’s broader push, which has seen various surges and retreats, as it continues to search for the optimal means to shift user behaviors around product discovery in the app.

In Europe, for example, TikTok made a big push on shopping back in 2022, then scaled it back due to both internal conflicts and lack of user interest. It then came out with a restructured shopping roadmap for the region last year, but now it’s reportedly putting it on hold once again, as it looks to double-down on the U.S. market, where it’s seeing more shopping interest.

Though given it may well be gone from the U.S. within months, that could be a flawed strategy in the long term. According to reports, Mexico and Brazil are also target markets for TikTok’s expanded shopping push.

As noted, the driving force behind this is the success that TikTok owner ByteDance has already seen with eCommerce on Douyin, the Chinese version of the app. In-app sales are now the biggest revenue generator on Douyin, with the app bringing in almost $300 billion from eCommerce sales in 2023.

By comparison, TikTok users spent an estimated $3.8 billion in the app throughout 2023. That still represents a 15% year-over-year increase, so again, it is gaining traction. But it’s nowhere near what ByteDance believes is still possible, if it can get its approach right.

But overall, it mostly seems like Western audiences are just not as enamored by online shopping as those in Asian markets.

Temu is another example of this. The Chinese retailer spent billions on its U.S. market push over the past year, as it sought to take on Amazon, but it’s now scaling back its efforts, in order to focus on other markets. Part of this is due to concerns about U.S. regulatory interference, and the impacts it could have on its business. But also, U.S. shoppers, while they latched onto Temu quickly, have since reduced their spending, by a significant amount.

Which is where there seems to be something of a market variance. Temu, Alibaba, and others remain hugely popular in China with their low priced products. But Western shoppers seem to be less impressed with the quality, and are therefore more inclined to pay extra for brands that they know and trust.

That, seemingly, is one of the key impediments to TikTok’s broader shopping push, that while low prices and deals are of interest, consumers already have established alignment with specific brands and products, which they feel more comfortable purchasing from dedicated retail websites.

So while eCommerce spend is steadily rising in broader terms, there’s still limited appetite for social commerce, with all platforms struggling to convert audience attention into sales.

Maybe TikTok can get it right, but it may not have much time to do it in the U.S., and there are few indicators to suggest that it’s going to reach anywhere near the levels it’s seeing in Asian markets, even among younger consumers.

![Spider-Man Is Back in Black With the Green Goblin in New Funko Pop! Figures [Exclusive] Spider-Man Is Back in Black With the Green Goblin in New Funko Pop! Figures [Exclusive]](https://static1.colliderimages.com/wordpress/wp-content/uploads/2025/03/spider-man-the-animated-series-green-goblin.jpg)