I’ve tried to ignore the endless speculation swirling around Twitter ever since the world’s richest human made an absurdly overvalued offer to buy a company respected (as a business) by virtually no one. But the ironies and lessons learned from this stranger-than-fiction melodrama have proven just too intriguing to ignore.

Twitter is haunted by the specter Elon Musk

For starters, while Twitter is widely viewed as having been mismanaged for years, the company has actually enjoyed greater shareholder value growth over the past 5 years than Google, Snap, Meta, or Amazon — more a reflection of its perceived perennially untapped value potential and Mr. Musk’s unfathomable recent generosity, than the company’s less-than-stellar past performance.

Then too, let’s not forget Twitter’s absentee management issues. After facing criticism for years for being led by a part-time, insouciant CEO (co-founder, Jack Dorsey), and paralyzed for months by Musk’s on-again/off-again gamemanship, Twitter now faces the prospect of being run by a CEO already leading 4-5 companies, depending on how you count CEO, Chairman or lead investor in other endeavors as management distractions.

But these are just my intrigues. As a Columbia Business School faculty member, I’m especially grateful to Twitter for providing so much fertile material that illustrates what may otherwise be thought dry academic theory. The following topics are immediately related.

1. There’s a difference between Creating and Capturing value. Uber and Twitter are two examples of companies that do this. Create lots of user value (as measured by largely happy, loyal customers), but are saddled with weak business models that don’t CaptureValue (as defined by profit, or absence thereof)

2. Strategic priorities need to respond to “the hand you’ve been dealt.” Too often, companies in deep distress wind up merely putting lipstick on their pig, rather than honestly, appropriately, and urgently responding to the severity of their situation. As a case in point, Twitter’s agonizing deliberations over whether to add an edit button to its anemic subscription offering (Twitter Blue) is not even remotely up to the task of reversing the company’s decline.

Lest there be any doubt of the perilousness of Twitter’s current condition, remember that the company is essentially 100% reliant on an ad-based revenue model facing:

· Anemic growth, falling further behind faster-growing competitors (hello TikTok) in the battle for user engagement and digital ad dollars

· An increasingly hostile environment for digital ad spending, given deteriorating macroeconomics and the bite of Apple’s stringent ad-tracking restrictions

· Buyer reluctance to sponsor brand ads on Twitter, given the platform’s unpredictably toxic and polarizing content

· Twitter’s relatively poor analytics and targeting capabilities compared to Meta, YouTube and others

· Additional deep-pocketed competitors entering the digital ad marketplace (Netflix, Uber)

· Chronically low Twitter penetration in market segments attractive to advertisers, notably younger users

· …All contributing to Twitter’s negative and declining operating income and free cash flow over the past few years.

All is not lost. If nothing else, Musk’s impending buyout will shake Twitter out of its strategic slumber, given the urgent need and opportunity to capture more growth and profitability. Musk, where should you start?

Recognizing that Twitter is no longer ad-based, the first step in recognizing this fact is important. Building a global town hall for the exchange of ideas was never an ideal platform to pitch ads, and recent shifts in the market and competitive environment have only exacerbated the hopelessness of relying on ads for the company’s predominant source of revenue.

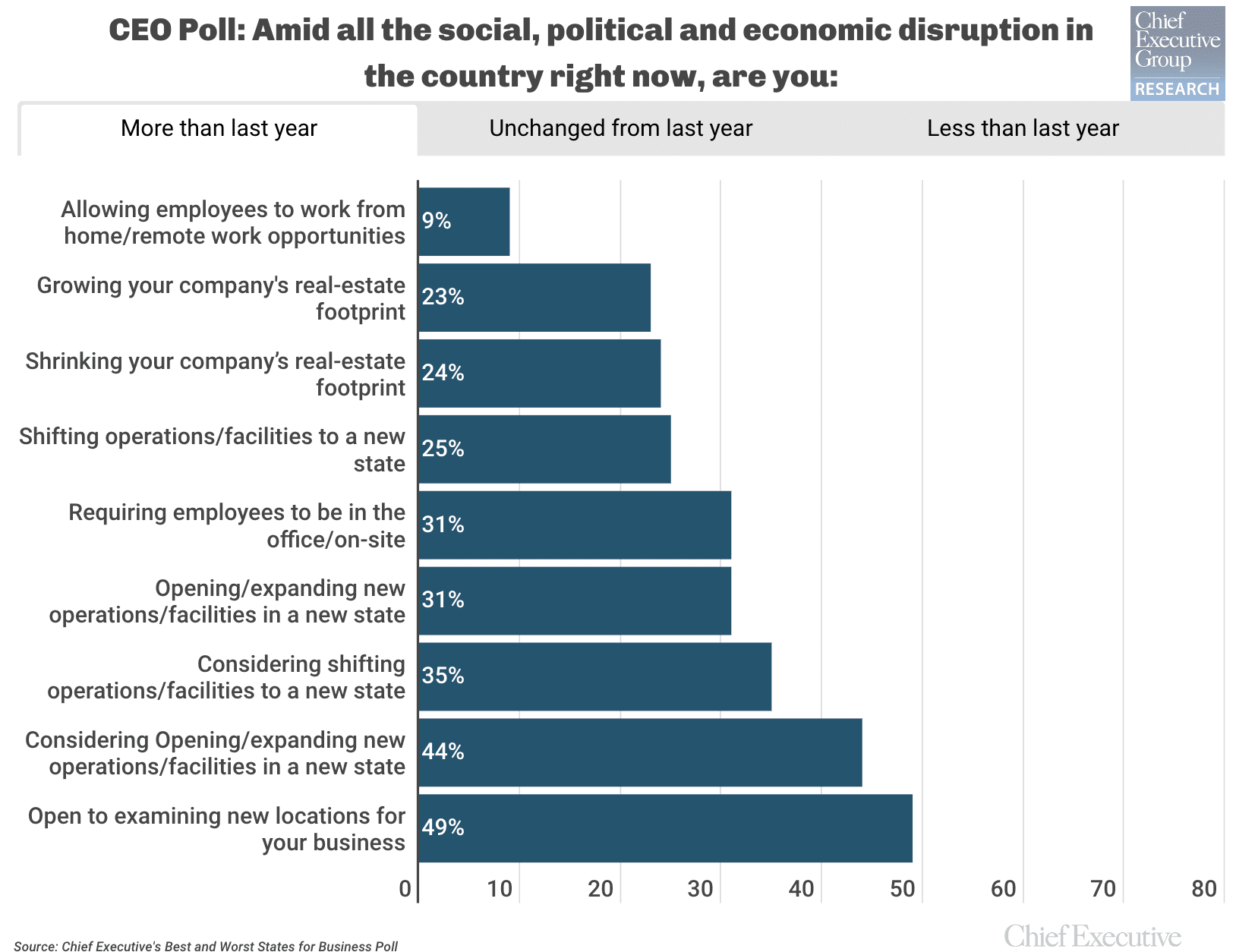

Twitter Users & Engagement on Social Media

Twitter needs to stop playing to its competitors’ strengths in chasing ads! The need for a fundamentally new source of revenue growth is has long been apparent, particularly one that competitors can’t or won’t match.

Fortunately, Twitter has the unique opportunity to capture the value of the space they currently occupy, by launching a serious subscription business — not unlike the successful transformation the New York Times made to a subscription-based model, when it became obvious a decade ago that print ads would no longer sustain the metro — now global — daily newspaper.

As the Times, Twitter can and should launch a freemium subscription model, where the preponderance of casual users would retain metered access to Twitter for free, to maintain the attractiveness of Twitter’s current user base to advertisers. Casual users would be limited in the frequency of frequency of posts they could create, but no limit on consumption, thus retaining Twitter’s advertising value. For the majority of consumers, such a metered pricing structure would not change Twitter’s free access, as a recent Pew Research study confirmed that 75% of current Twitter users in the US produce only 3% of all tweets.

The active content creators are currently enjoying immense value due to their number of followers. It is hard to imagine any other platform that can instantly give users access to their preferred sources of information, entertainment and provocative ideas.

Twitter’s value is especially high for people in content-generating occupations, such as journalism (25%), entertainment and politics. In the extreme, Twitter users with 100 million or more active followers — @BarackObama, @justinbieber, @elonmusk, @katyperry, and @rihanna – can and should be willing to pay the top end of monthly subscription fees, with a sliding scale extending down to, say 500 followers or more, which represent 2-3% of all current accounts.

Some skeptics have suggested that subscriptions could never generate enough revenue to replace Twitter’s current ad business, but this argument lacks merit on two grounds. First, there is no reason that subscription revenues can’t and shouldn’t be pursued Additional to Twitter’s current advertising business – just as most “old media” companies have retained their advertising business along with promoting freemium subscriptions. Second, even with a modest subscription penetration rate at 2% per month paying $10 an average monthly fee, this would still generate $1 billion of incremental high-margin Twitter revenues. Twitter’s potential upside is quite high, even though power users are likely to pay much more.

Twitter’s move in this direction has another advantage: competitors will not follow. Facebook, Snapchat and TikTok all fully support an advertising-driven, high-scale business that is not tied to tiered subscriptions. YouTube already has a subscription service that reaches less than 1% (and fewer globally) of its monthly users. However, Twitter offers more potential for subscription revenues due to the content and user base.

Elon Musk expressed interest in making Twitter a superapp, to compete with Chinese leaders AliPay and WeChat. Maybe Musk could pull off such an amazing feat with the help of Apple and Google as well DoorDash, DoorDash, Uber, DoorDash, DoorDash, DoorDash, DoorDash, DoorDash, DoorDash, DoorDash, DoorDash, and all the other financial service sector players who have significant stakes in the world order. But in the meantime, it’s a safer, quicker bet for Twitter to launch a serious subscription model to finally command the space they’ve long occupied.