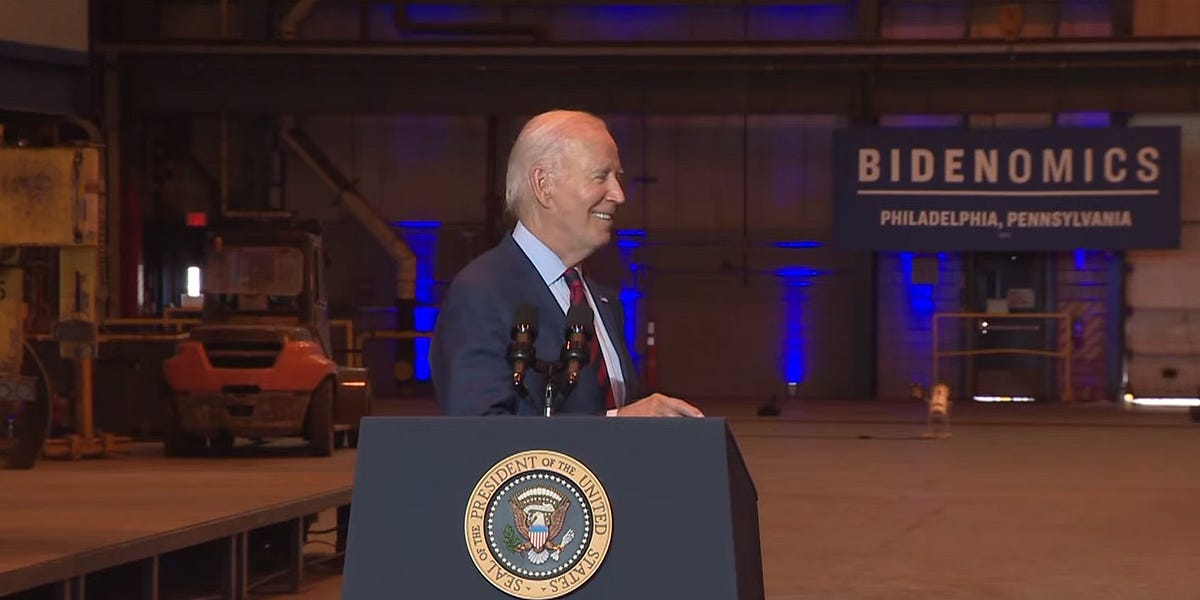

The monthly jobs report from the Bureau of Labor Statistics is out, and it’s another doozy: The economy added 517,000 nonfarm jobs in January, blowing way past the Dow Jones forecast of 187,000, as well as almost doubling December’s job gains of 260,000 — which we’ll add is also an upwards revision of 37,000 from the initial report of 223,000. If you’re counting. Unemployment fell to 3.4 percent, the lowest rate since May 1969, when we were almost seven years old and mostly concerned with the high price of Matchbox cars, which we definitely needed more of. And then just a couple months later, Whitey was on the Moon.

Naturally enough, the good job numbers have inflation-watchers at the Federal Reserve looking at all those newly employed people and thinking oh, noes, inflation! even though inflation in the second half of 2022 dropped from 10.7 percent to 1.9 percent, possibly in response to the Fed’s previous interest rate hikes, or possibly just to fuck with Republicans’ heads.

Wednesday, the Fed increased interest rates a skosh, but by a smaller amount than previous rate hikes, and Fed Chair Jerome Powell said “a couple more rate hikes” were likely, probably in the range of a quarter point each. No telling whether January’s surge in employment will mean more rate increases, or if the Fed will wait to see what inflation does over the next few months; the monetary policy goal is to get to a “soft landing” where inflation eases without such severe interest increases that the economy is thrown into a recession.

Ready for the inevitable entrails-reading from economists? You bet!

“It was a phenomenal report,” said Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. “This brings into question how we’re able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there’s still a lot of pent-up demand for workers where companies have really struggled to staff appropriately.” […]

“Today’s jobs report is almost too good to be true,” wrote Julia Pollak, chief economist at ZipRecruiter. “Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction.”

Well that does sound good! Even if “Mastercard Economics Institute” sounds like something from George Santos’s résumé.

Also too, Black unemployment fell to a lowest-on-record 5.4 percent, with unemployment for Black women also at a record low 4.7 percent, for which we’re sure Donald Trump will congratulate Joe Biden, since Trump was always so very happy when Black unemployment numbers were low during his own administration.

But wait, what about all those big layoffs by tech companies we’ve been hearing about? The Washington Post notes that the

uptick in high-profile layoffs has not been reflected in payroll numbers or the unemployment rate, leading economists to posit that laid off workers are quickly finding new jobs or not immediately applying for unemployment benefits. These job losses are also being offset by hardy gains in other industries.

“The tech companies who went on a hiring spree and were thinking things look great as far as the eye can see are now thinking maybe we overdid this,” said Gerald Cohen, chief economist at the University of North Carolina’s Kenan Institute of Private Enterprise. “But other companies are seeing this as an opportunity to scoop up computer programmers and workers with other skills that are in demand.”

We haven’t yet seen how Republicans will spin all this as a terrible development, but frankly they’ve been such absolute shits everywhere so we aren’t even going to look, because Crom knows they’ll find some way to argue that the good economic news is all the more reason to default on the national debt to keep Biden from being reelected.

[BLS / CNBC / WaPo / Cato Institute]

Yr Wonkette is funded entirely by reader donations! If you can, please give $5 or $10 a month so we can keep finding the nicetimes as they turn up!

![What App Features Are People Willing to Pay For? [Infographic] What App Features Are People Willing to Pay For? [Infographic]](https://imgproxy.divecdn.com/mHJQ6ffz2lGDUuF649StZz5xtI56ORDL5z-Cjs9ZUw8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9hcHBzX3RoYXRfcGVvcGxlX3BheV9mb3JfMi5wbmc=.webp)