Oracle has announced the availability of 15 industry-specific AI models within the Oracle Unity CDP. These models will support customer data activation for brands in the automotive, CPG, communications, financial services, healthcare, high-tech, and utilities industries.

The AI models will process data to surface insights and next-step recommendations specific to the needs of those industries. Examples given by Oracle include:

- Automotive. A car brand can use Unity’s next-best-action models and next-best-offer models to recommend actions for customers based on sales and transaction patterns.

- CPG. An online cosmetic company can target campaigns for high-end skin care at customers tagged by Unity’s high lifetime value model.

- Utilities. A utility can understand whether to target customers, peak or off-peak, via email, SMS or Push using Unity’s channel recommendations model based on past interactions.

Industries care about different things

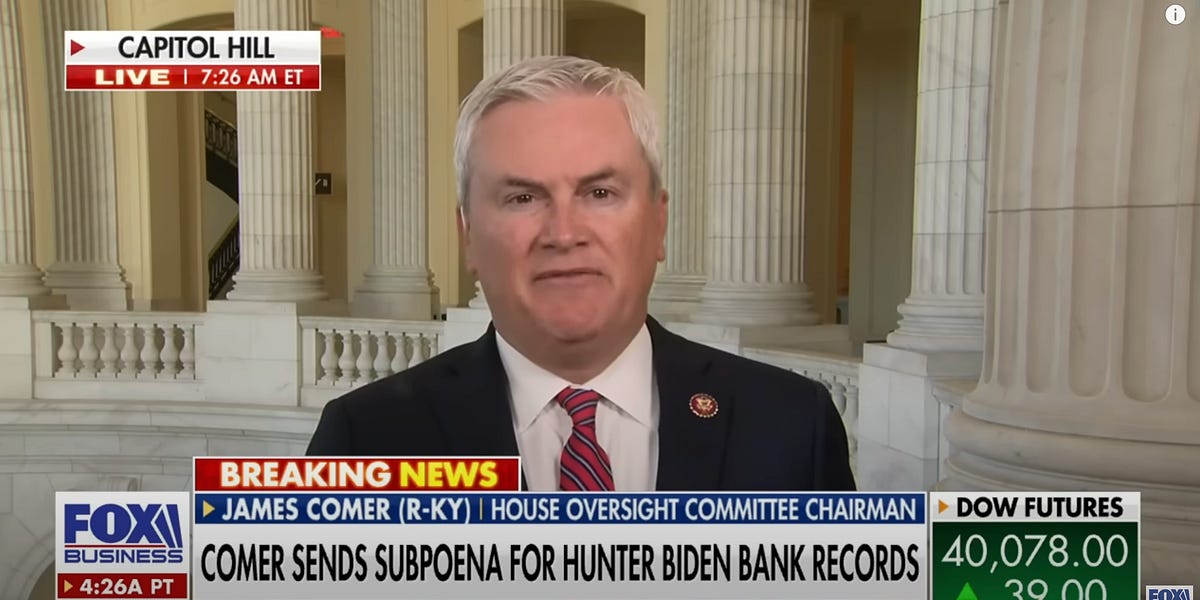

We spoke with Rob Tarkoff, EVP and GM of Oracle’s CX business, to understand the value of these new models.

“One of the things we really focused on doing was build models that could be easily configurable and extendable by non-technical users for every industry. So a lot of that was built into the way we represent attributes for each customer; we’re able to do that by focusing on both the ability to set your own attributes – if the customer was in retail and cared about average order value, I could do that, or I could do time since last purchase.”

Oracle Unity, said Tarkoff, took a lot of learnings from early customers and packaged models based on those learnings to show how flexible Unity’s model-building capabilities are. “We’re giving some industries really strong out-of-the-box models that they can use. We just think it’s going to increase time-to-value,” he explained. The models were built collaboratively with customers.

Dig deeper: What is a CDP and how does it give marketers the coveted ‘single view’ of their customers?

We had heard previously from Oracle that a common use case for Unity was to execute against selected audience segments using selected data rather than import all customer data and treat the CDP as a single source of truth. These developments seem to reflect that.

“Every company is trying to figure out what they have when it comes to first-party data; what’s truly useful and can replace a lot of my historical reliance on third-party audiences,” said Tarkoff. “For a lot of companies, they’ve either gathered a lot of superfluous data, or they haven’t really had a strategy about what they care about most. An example from Oracle: We care about first three days of product usage. When a customer goes live, what do the patterns of the first 30 days tell us, and how predictive is that of downstream success or problems?”

Tarkoff agreed that customers who were successful (with Unity) in the beginning had a pretty good sense of what data they cared about. “They didn’t try to boil the ocean. They just got very focused on those elements of behavior that could serve as indicators of next-best-action.”

One example he gave was ATT. Its customer base includes some 60 million small businesses and it wanted to cross-sell to them. It didn’t need to know everything about those businesses; it was primarily concerned to identify cross-sell triggers.

Marketing maintenance management

Oracle also announced Asset-Based Service for High Tech and Manufacturing, a new part of Oracle Fusion Service. It’s an automated system to help predict and prevent asset downtime, thus minimizing service interruptions. Not much there for marketers? Tarkoff disagreed. It does have relevance to marketing in some sectors.

“For marketers, the advantage is that a lot of companies want to market their expertise and proficiency at asset lifecycle management,” he said. “If you’re providing a service for an ATM provider, for example, part of what you want to be able to demonstrate and market is customer success stories on how you’ve tied preventative maintenance or IOT detection of asset downtime to parts and inventory. Marketers care about that because it’s a way of demonstrating the service levels your company can provide. In manufacturing, I think marketers care about that.”

Connecting the business to your customer

We asked what we should expect to see from Oracle CX down the road. “We’re thinking about CX as going beyond the front office,” Tarkoff said. “Our real focus is connecting CX to the back office so we can help companies traverse large business model changes – moving from transaction to subscription, or connecting sales to marketing in B2B – so we’re focused very much on CX as a part of the rest of your application estate. You need to know about creditworthiness, transactional history, SLA, those things in your supply chain systems and ERP systems – that’s an important part of it. That’s the story we’re trying to solidify.”

Oracle, of course, has much more skin in the back-office game than most of its competitors – SAP being an exception. Is that what’s driving this? “It does reflect the fact that the world is kind of running on Oracle. If you look at our position in ERP, the largest brands in the world are running on our platform. So we have a lot of data to optimize the customer experience. Rather than thinking about CX as marketing, sales and service, you should think about it as a business flow. I talk about it as connecting your business to your customer.”

Get MarTech! Daily. Free. In your inbox.