[ad_1]

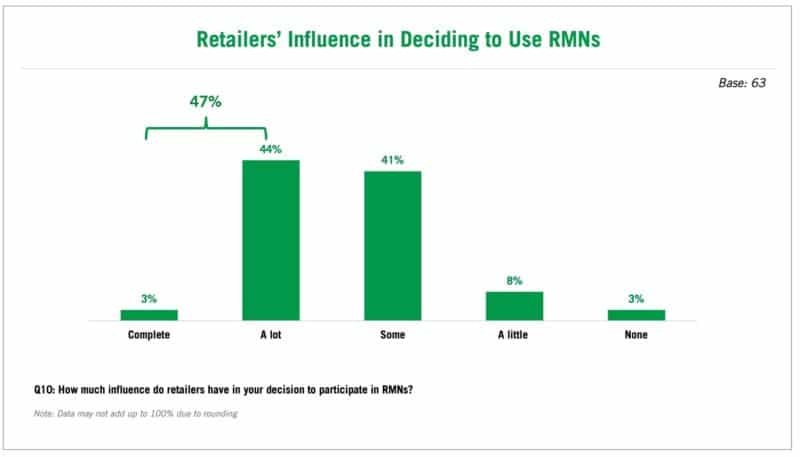

The growth in brands using retail media networks (RMNs) is being fueled by pressure from retailers, according to a new report. Eighty-eight percent of the companies surveyed by the Association of National Advertisers said they are somewhat or heavily influenced by retailers to buy advertising on their RMNs.

“It’s a power struggle right now,” according to an anonymous advertiser quoted in the report titled “Retail Media Networks: A Forced Marriage or A Perfect Partnership.” “For many brand marketers, RMNs are seen to be a ‘have to buy’ versus a ‘want to buy.’”

Dig deeper: Why we care about retail media networks

Further, one advertiser said they “play defense as much as offense with retail media networks.” Explaining that because of “economic uncertainty and rising inflation, consumers can switch to private label and the retailers own these. We use RMNs to protect our brands as much as build our brands.”

The survey also asked respondents to share how their organization views their investment with RMNs, using a five-point scale ranging from “Valuable marketing tool” to “Cost of doing business.” More than a quarter (28%) it was the former, while only 31% said the latter.

Some 42% placed RMNs exactly between those two extremes. “This should be concerning to RMNs and indicates that many brands are active but reluctant buyers,” the report said. “RMNs still have a job to do to prove their full value to marketers. This will be critical … if they expect to compete with and increase revenue from other non-RMN marketing platforms.”

Why we care. If RMNs are to continue growing it will be because of results not pressure. Retailers must clearly prove media networks’ value with useful, tangible data for metrics. They must demonstrate that these platforms can drive incrementality and positive ROAS for brands.

RMNs do hold real value. RMNs do provide ROI. Consider this: From May 1, 2021 to the end of the following January, more than 23,500 companies bought RMN ads, per MediaRadar. Retailer pressure alone can’t make that happen. Further proof of their value can be seen in the 56% of advertisers using five or more RMNs, with 40% using five to nine, and 16% using 10 or more.

More than half (52%) of companies expect that RMNs will be viewed more positively as a “valuable marketing tool” in the very near future. Both advertisers and retailers are already taking the steps needed to make this happen.

Brands say they are doing the testing and calibration needed to improve and optimize the activation and performance of RMNs against business objectives and KPIs. This will be greatly helped by measurement standardization and transparency from RMNs, something that companies expect to happen.

“RMNs check a lot of boxes for advertisers. They have become foundational to integrated marketing plans,” said one advertiser interviewed in the study.

Download the full ANA report here.

Get MarTech! Daily. Free. In your inbox.

[ad_2]

Original Source Link

![Chloe Cherry’s Gory New Slasher Revives ’80s Horror in New ‘Blood Barn’ Trailer [Exclusive] Chloe Cherry’s Gory New Slasher Revives ’80s Horror in New ‘Blood Barn’ Trailer [Exclusive]](https://static0.colliderimages.com/wordpress/wp-content/uploads/2026/01/blood-barn-1.jpg?w=1200&h=675&fit=crop)

![‘Stranger Things’ Star Reveals “There Wasn’t a Lot of Oversight” When Filming This Iconic Sci-Fi Crime Drama [Exclusive] ‘Stranger Things’ Star Reveals “There Wasn’t a Lot of Oversight” When Filming This Iconic Sci-Fi Crime Drama [Exclusive]](https://static0.colliderimages.com/wordpress/wp-content/uploads/sharedimages/2026/01/0392347_poster_w780.jpg?q=70&fit=contain&w=480&dpr=1)