Shifting Currents: How Geopolitics is Redefining Global Trade

Economic nationalism has gained serious momentum in recent years, with policies incentivizing domestic production and self-sufficiency. This trend reflects a reaction to vulnerabilities laid bare during COVID-19-related supply chain disruptions, pushing countries to prioritize resilience over cost-efficiency. Selective decoupling is reshaping trade relationships, particularly in essential sectors like semiconductors and technology.

A regional focus is also taking shape, with agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the African Continental Free Trade Area and the Regional Comprehensive Economic Partnership gaining prominence. These trade blocs underscore a shift towards localized collaboration over broader multilateral frameworks.

Furthermore, conflicts, such as those in the Middle East and Ukraine, exacerbate supply chain disruptions, impacting essential trading routes like the Red Sea and Suez Canal. Heightened tensions in regions like the Korean Peninsula and Taiwan Strait, as well as Europe and Russia, continue to threaten key trade corridors. Companies are increasingly nearshoring or reshoring operations to mitigate risks and improve resiliency, bringing supply chains closer to home markets. This realignment highlights “slowbalization,” a term first used by the Dutch trend-watcher Adjiedj Bakas in 2015, where trade growth is decelerating due to protectionism, geopolitical frictions and sustainability concerns.

Tariffs, Trade Wars and Power Plays: Trump’s Vision for a New Trade Order

What can we expect in January 2025 when Donald Trump takes power? He recently said, “Tariff is the most beautiful word in the dictionary.” The proposed trade policies suggest an aggressive realignment of the U.S.’s economic priorities. Central to this offensive vision is implementing universal minimum tariffs and strategic decoupling from China. Proposed tariffs as high as 60 percent on Chinese imports signal a direct challenge to Beijing. Furthermore, company-specific tariffs exceeding 200 percent aim to discourage firms from maintaining overseas production while targeting the U.S. market.

Closer to home in North America universal baseline tariffs of 10 percent–20 percent on all imports would significantly depart from conventional trade policy. The U.S.-Mexico-Canada Agreement (USMCA) remains a cornerstone, reflecting the administration’s approach to regional trade. The six-year review provision could see new restrictions to prevent indirect trade with China through Canada and Mexico.

Demystifying Tariffs: Balancing Protectionism and Economic Pitfalls

So, do tariffs make sense or not? Tariffs are taxes imposed on imported or exported goods that are powerful tools for governments to shape trade policies, build defense for domestic industries and generate revenue. Their implementation, however, remains a contentious issue.

According to the Council on Foreign Relations, one of the primary advantages of tariffs is their ability to protect domestic industries. By making imported goods more expensive, tariffs create a competitive edge for local producers, encouraging consumers to choose domestically produced items. This can benefit emerging industries or sectors struggling to compete with established foreign counterparts. The Brookings Institute also claims that tariffs can serve as a significant source of revenue for government. Furthermore, they also address unfair trade practices. For example, when foreign producers engage in dumping—selling goods below market value—tariffs can function as a countermeasure to safeguard domestic industries from economic harm.

Despite these advantages, tariffs do come with notable disadvantages. One major drawback is the increase in consumer prices. When tariffs raise the cost of imported goods, domestic producers often seize the opportunity to raise their prices, leaving consumers to bear higher costs. Moreover, protected industries may grow complacent instead of focusing on innovation and productivity. Lastly, imposing tariffs in industries where there is no suitable domestic substitution and which are neither mature enough to absorb the increased demand or sophisticated enough to service the demand, will further shift the burden of the tariff onto consumers.

However, proceed with caution as the potential for retaliation and trade wars further complicates the picture, according to a recent article in the Times. When one country imposes tariffs, its trading partners often respond with their own, escalating tensions and creating a cycle of increasing trade barriers, having the opposite affect of its intended policies.

High Stakes: The Vital Trade Ties Between Canada and the U.S.

So, what can we expect for Canada staring down the barrel of economic annihilation? It might not be as easy as the U.S. thinks to tariff its Northerly neighbour. The intricate economic relationship between Canada and the U.S. underscores the complexities involved. With deeply integrated web of supply chains and mutual benefits from free trade, tariffs between these two nations could result in significant disruptions. Higher costs, inefficiencies and retaliatory actions would outweigh any short-term gains, making tariffs an inadvisable strategy.

As John F Kennedy once said, “What unites us is far greater than what divides us.” According to the Office of the Chief Economist, Global Affairs Canada, the trade relationship between Canada and the United States isn’t just a partnership—it’s the lifeblood of the Canadian economy. In 2023, trade accounted for a staggering two-thirds of Canada’s GDP.

A lot is at stake and the numbers speak volumes. According to Statistics Canada, a remarkable 77 percent of Canada’s exports headed south of the border in 2023, amounting to an impressive $594.5 billion. On the other side, Canadian imports from the U.S. totalled $373.7 billion, representing half of all goods brought into the country. This symbiotic relationship, according to Ivey, translates into a dizzying $3.6 billion worth of goods and services crossing the border every single day. From bustling ports to seamless roadways, the U.S.-Canada border is a conduit for economic activity that fuels both nations.

Furthermore, trade with the U.S. supports a massive 3.3 million Canadian jobs—equivalent to one in every six workers—proving that this relationship is more than just numbers on a balance sheet. It’s a vital source of livelihood for millions of Canadians.

Tariff Tensions: Navigating the Economic Fallout of U.S.-Canada Trade Strains

The prospect of U.S. tariffs on Canadian imports looms like a marching army on the horizon. With Canada heavily reliant on trade with its southern neighbour, a potential 25 percent tariff would send shockwaves through the economy. The immediate impact of such tariffs would be a costly recalibration of trade flows, forcing Canadian businesses into a lose-lose scenario: absorb the increased costs and slash profits or pass them onto consumers through higher prices while seeking potential domestic alternatives, increasing search costs and potentially dampening sales. This economic squeeze would be compounded by potential retaliatory measures from U.S. trading partners, amplifying the pressure on businesses across sectors.

For Canada, the fallout could be immense, and we must take Trump seriously. Economic growth, already vulnerable to commodity price fluctuations, would stall dramatically. Oxford Economics forecasts suggest a grim GDP contraction of 2.5 percent by the end of 2026—down from a projected 2.2 percent growth—pushing the economy perilously close to recession. Exports to the U.S. could drop by 5 percent by early 2027, exacerbated by limited alternative markets and port inefficiencies.

The ripple effects wouldn’t stop there. Tariffs would likely weaken the Canadian dollar, with the USD-CAD exchange rate climbing to a projected 1.55 in 2025, according to ING. While this might offer a slight boost to exports, companies reliant on imports would face soaring costs, potentially leading to closures and job losses. To make matters worse unemployment could spike, according to Oxford Economics up to 8 percent by 2026, far above the forecasted 6 percent, leaving many Canadians grappling with economic uncertainty.

Inflation, too, would rear its ugly head, driven by retaliatory tariffs and rising import prices, potentially reaching 3 percent year-over-year. The Bank of Canada would face mounting pressure to act, raising interest rates by 75 basis points to 3 percent by 2026 to counter inflationary forces. However, higher borrowing costs could further strain consumers and businesses, creating a delicate balancing act for policymakers.

Lessons in Resilience: Leveraging Past Trade Disputes to Strengthen Canada’s Position

The past can be a key lesson for the future, as demonstrated by Canada’s response to U.S. trade actions in recent years. 2018, after the U.S. imposed tariffs on Canadian steel, aluminum and other goods, Canada swiftly enacted retaliatory measures under the Customs Tariff, targeting U.S. steel, aluminum and various products.

Persistent negotiations eventually led to lifting these tariffs, underscoring the importance of dialogue and diplomacy in resolving trade disputes. However, the unpredictability of trade policy became evident again in 2020 when President Trump reimposed a 10 percent tariff on Canadian aluminum, accusing Canada of exploiting the U.S. Although the tariffs were enacted, further discussions led to their removal just 15 days later, retroactively reversing the policy and reaffirming the significance of maintaining open communication to address and resolve trade tensions.

In all these instances, we learn that resilience, quick response and strategic negotiation are essential in navigating the volatile landscape of international trade. Past experiences serve as a reminder that, while economic pressures can often seem overwhelming, they can be transformed into opportunities for growth and collaboration, provided the right approach is taken.

Sector Showdown: How Tariffs Could Disrupt Canada’s Key Industries

The automotive sector stands on the brink of severe disruption as new tariffs threaten to undermine trade between the U.S. and Canada. According to TD Bank, by late 2025, nearly all automotive exports would be expected to flatline, with the sector suffering the most significant impacts for Canada. The reason lies in the complexity of the automotive supply chain, which, according to Real Economy, is deeply integrated across North America, making it challenging to diversify production sources.

For Canadian manufacturers heavily embedded in cross-border supply chains, this disruption could result in delays and higher costs for Canadian and U.S. companies. The uncertainty created by the looming threat of tariffs may also dampen investment, slowing economic growth as businesses hesitate to commit to projects in an unpredictable trade environment.

Oil and gas are the lifeblood of trade between the U.S. and Canada. Canadian exports comprise a third of the trade in energy products, including oil, natural gas and electricity. Despite potential tariffs, Canada’s energy exports are expected to remain exempt due to the critical nature of the trade and prior agreements. Energy is too crucial to U.S. economic infrastructure to be easily disrupted.

However, if the U.S. did impose a 25 percent tariff on Canadian oil and gas, it could raise the cost of refining for U.S. refineries that rely on Canadian crude. This would likely push gasoline and petroleum prices higher across the U.S. market, reducing the competitiveness of Canadian energy products. The interconnected nature of North American energy markets means tariffs could lead to inefficiencies and higher costs in the North and South. Fortunately, with new projects like the TransMountain pipeline and LNG Canada slated to come online in 2025, Canada will have access to international markets.

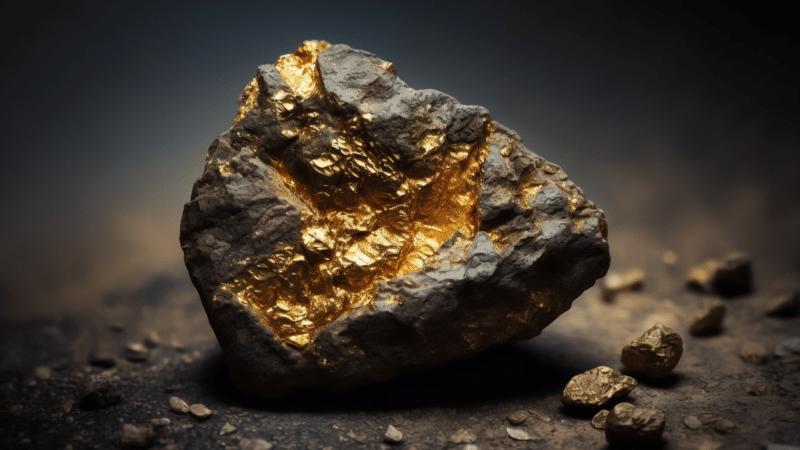

Canada’s mining and metals industry is also pivotal in U.S. trade, providing essential inputs critical to U.S. manufacturing. According to Mineral Trade in 2023 alone, the U.S. imported $83.8 billion worth of metals and minerals from Canada. Analysts believe this sector will remain unaffected. The U.S. has become highly reliant on Canadian steel, aluminum and rare minerals like nickel, cobalt and lithium, all essential for electric vehicle (EV) production and other high-tech industries.

The U.S. government’s focus on securing these critical minerals from Canada is part of a broader strategy to reduce dependency on China, especially as demand for EV-related materials soars. Tariffs on these essential minerals would increase production costs for U.S. manufacturers, potentially raising the price of goods across various industries.

Canada is also a major supplier of hydroelectric power to the U.S., particularly to states like New York and New England. Any tariffs on these energy exports could significantly disrupt the flow of electricity, leading to reduced demand and higher costs for U.S. consumers. Reducing demand could lead to lower revenues and potential job losses for provinces like Quebec and Ontario, which export substantial electricity. Furthermore, U.S. energy security could be jeopardized, as Canadian energy imports are vital in maintaining a stable and secure energy supply.

Boom or Bust: Canada’s Crucial Negotiation in the New Trade Era

As battlelines shift and global trade evolves, Canada stands at the crosshairs, facing the uncertainty of what Trump might do next. This unfolding dynamic underscores the need for Canada to prepare for any outcome, leveraging its deep economic ties while navigating the potential for significant disruption.

Thomas Friedman famously said, “geopolitics is all about leverage.” With tariffs looming, Canada must assess its strategic leverage, whether through critical industries like energy, manufacturing and mining or its role in deeply integrated supply chains. The stakes are immense: billions in trade, millions of jobs and the health of an interconnected economy hinge on the ability to respond decisively and strategically. In this high-stakes era of “slowbalization,” resilience, negotiation and innovation will determine who emerges stronger—or struggles to adapt in a tariff-fuelled era.

![Spider-Man Is Back in Black With the Green Goblin in New Funko Pop! Figures [Exclusive] Spider-Man Is Back in Black With the Green Goblin in New Funko Pop! Figures [Exclusive]](https://static1.colliderimages.com/wordpress/wp-content/uploads/2025/03/spider-man-the-animated-series-green-goblin.jpg)