SeungKyu “Sean” Yoon intends for Kia America to overcome its newest challenge just as the Korean-owned auto marque has clambered over previous obstacles on its way to its current status as the seventh-largest brand by sales in the crucial U.S. market.

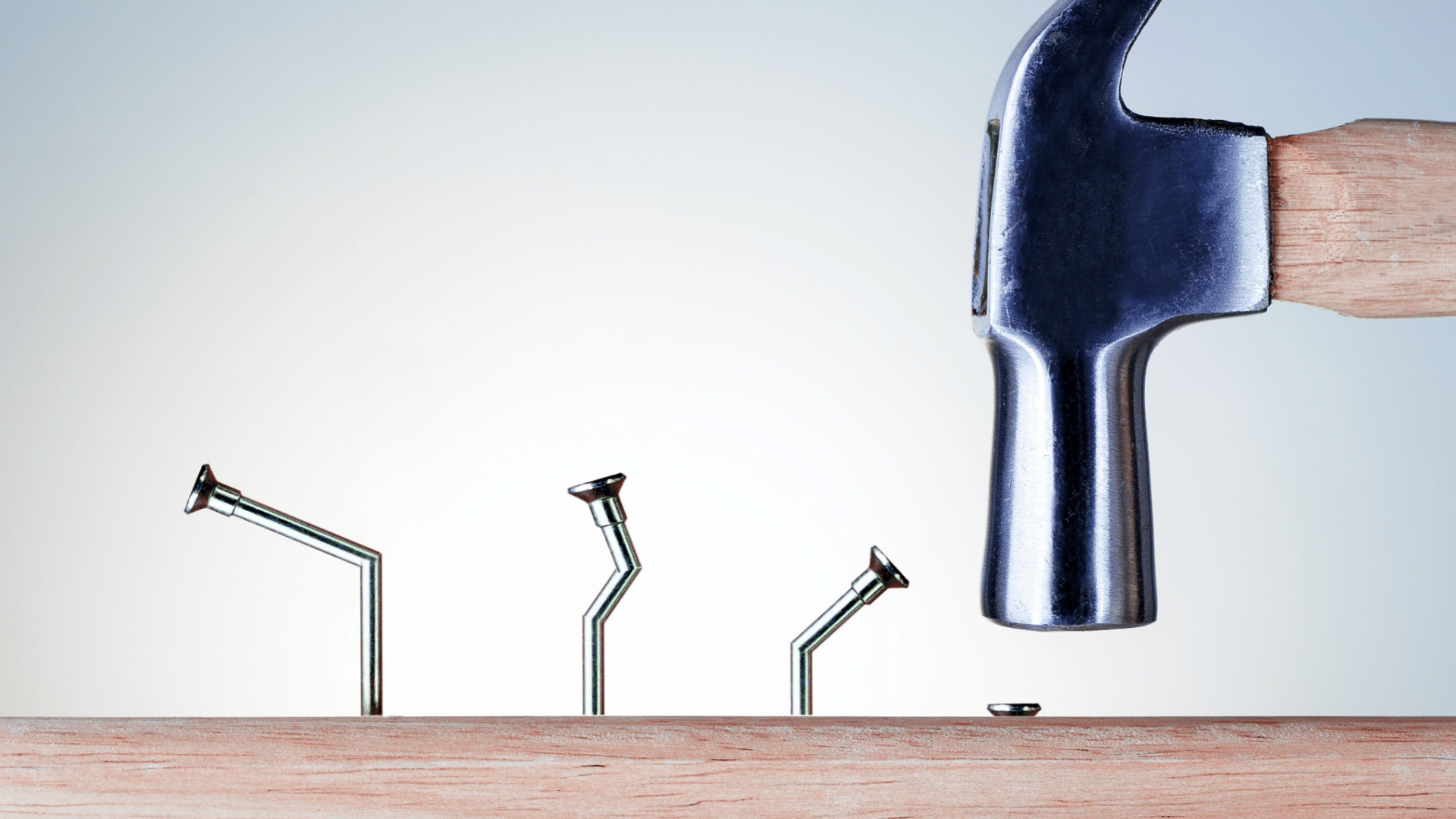

Kia America has been whacked by the Inflation Reduction Act (IRA), which dispenses up to $7,500 in tax credits per vehicle to domestically built EVs with U.S.-made batteries, because Kia doesn’t yet make all-electric vehicles in volume at its Georgia assembly plant — while many rivals already are making EVs domestically.

“We’ve been heavily damaged by the IRA,” Yoon told Chief Executive. “We weren’t ready for it, but I think that Kia is ready to manage the challenge. That’s because we are going to introduce our EV9 [all-electric SUV] at the end of this year and plan to start production of it in Georgia in the second quarter of next year.

“There are small-volume players” among Asian automakers producing EVs in the U.S., he allowed, “but we are going to challenge the market with the EV9 in high volume [and contribute] to the transformation of the industry. Our plan was set even before IRA, which is why we’re ready to produce so soon after IRA.”

Kia’s rise up through the hierarchy of the U.S. vehicle market took a bit of a pause in the last several months as vehicle buyers seeking to cash in on IRA tax drifted to other manufacturers, ranging from Ford to Volkswagen, whose domestically produced EVs qualified for the tax credits.

But the sibling brand to Hyundai and Genesis, all controlled by the Hyundai Motor Group chaebol, has been scrapping successfully ever since Kia entered the U.S. market about 30 years ago. First, Kia and Hyundai vehicles were regarded as poorly manufactured, similar in American perceptions and actual quality levels to how the first Japanese automotive imports to the United States were regarded a decade or so prior.

Yet over the last several years, Kia has improved its manufacturing quality tremendously, enough so that the brand repeatedly has ranked near the top of the highly regarded J.D. Power & Associates initial-quality index for the U.S. market, even beating out many luxury brands.

“We’ve been working very hard over the last five years on many aspects of the business, many of the basics,” Yoon said. “Quality-wise, there’s no question we are on top of it now. We weren’t in that position in the previous generation.”

Similarly, Kia executives smartly pivoted several years ago into the mainstream of the U.S. SUV market after initially fielding only sedans. That has proven a smart bet as well, given that utility vehicles and crossovers now comprise two-thirds to three-quarters of all vehicles sold in America.

How these decisions by his predecessors and mentors have turned out so well is one reason Yoon has confidence that Kia’s approach to the U.S. EV market — despite the reversal posed by IRA — will bear fruit.

“Our EV will be better regarded than the competition,” he vowed. “We planned the transformation of our brand [to EVs] earlier than others, and heading into the core of our transformation is the reason we’ll be ready to compete with IRA beneficiaries.”

The Kia brand nearly matched Hyundai, selling 184,136 vehicles in Q1, up almost 22%. Sportage sales almost doubled to 31,684 units. Forte was up a hefty 30% to more than 30,000 units. Telluride had a 23% hike. Sorento was up 13%. Sales of the K5 sedan were down nearly 20%. Kia sold 3,392 EV6 electric cars.

Hyundai Motor Co. and Kia Corp. kept their fifth place in sales in the U.S. market for the second consecutive year. Despite production setbacks due to semiconductor chip shortages, it succeeded in managing its supply chain well, closely chasing Stellantis, which was ranked fourth.

Hyundai and Kia said on Thursday that they sold 1,474,224 vehicles in the U.S. last year. Although the figure declined by 1.0% from 2021 (1,489,118), it did quite well given that the total sales volume of new cars across the world decreased by 8% compared to the previous year.

The post Kia Will Succeed Despite Initially Being Left Out Of U.S. Tax Credits appeared first on ChiefExecutive.net.