Developing a new publishing strategy in the media landscape is daunting. Content reigns supreme, followed by the heft of an established brand. But there’s more to thriving in the digital age. Much, much more. No one knows that better than the senior management team at The Arena Group, a conglomerate of traditional and digital media businesses.

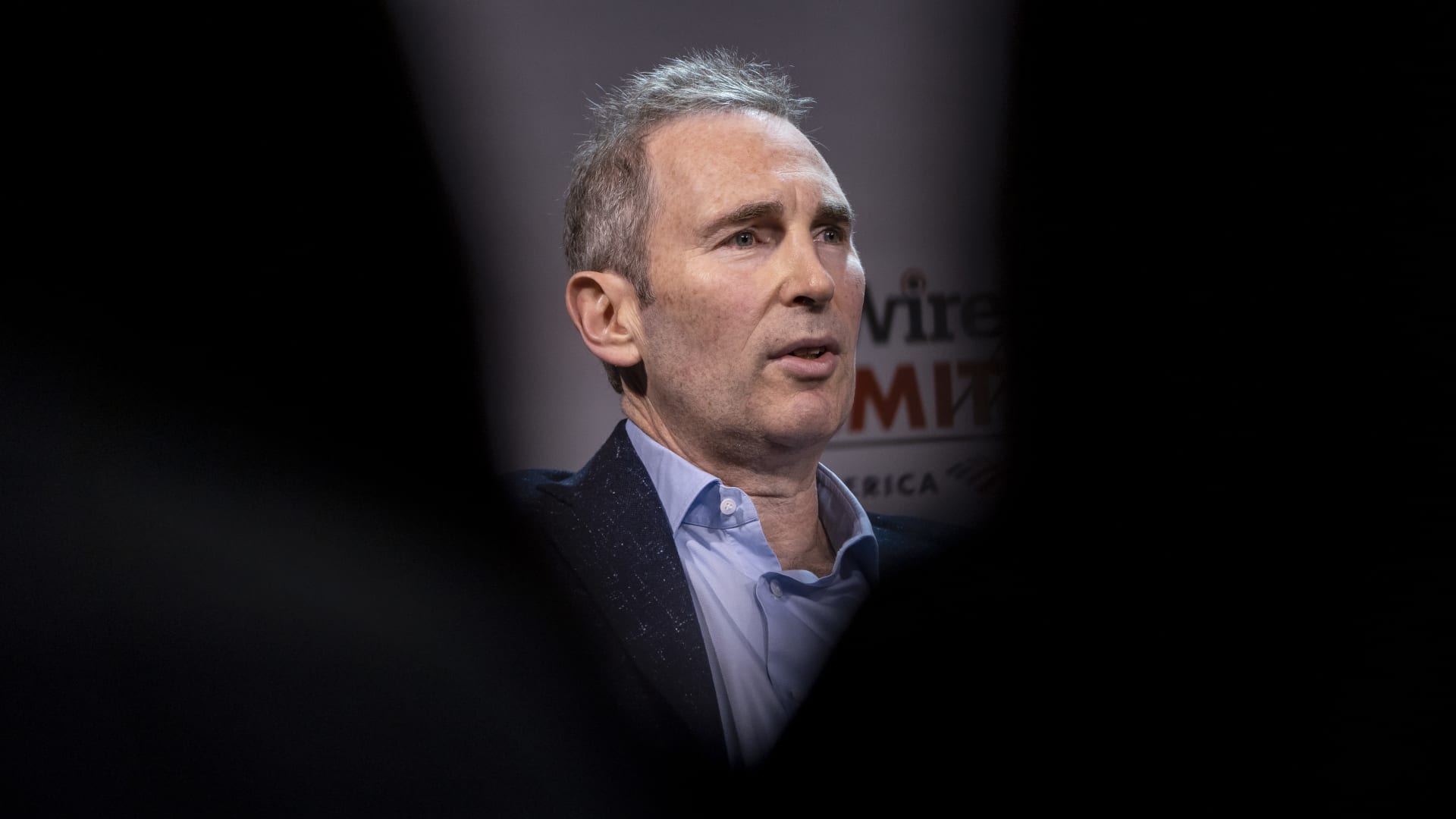

The Arena Group, led by CEO Ross Levinsohn (also the Sports Illustrated Media CEO), produces legacy publications such as Sports Illustrated and Parade magazines and online platforms such as HubPages, The Spun, and TheStreet.

Over the past 18 months, Levinsohn led an overhaul of The Arena Group’s publishing strategy. This move included retooling the technology stack, sunsetting some platforms, and optimizing partnership economics by eliminating partner guarantees.

“With the demise of the cookie looming on the digital side, and paper and transport costs increasing rapidly on the print side, we had to make a change,” Levinsohn says. “If our company was going to compete in this challenging landscape, we needed to get our technology, our go-to-market approach, and our positioning right.”

Ross Levinsohn Opens the Playbook

The Arena Group transforms media companies systematically via what Levinsohn dubs “the playbook.” It includes a scalable technology platform, monetization stack, and subscription infrastructure that management deploys across all its publications.

“In September 2020, when I took over as CEO of The Arena Group, we focused our resources, energy, and strategy on using technology to transform media brands,” Levinsohn says. “We invested in technology platforms, the strategic growth of our team, and designed a playbook for success that today drives phenomenal user and financial growth.

“The results have been spectacular: unprecedented audience growth, dramatic revenue increases, margin expansion through focused cost management, synergies, and operational excellence.”

Ross Levinsohn Explains the Strategy of Verticals

In a dramatic playbook move, The Arena Group shifted its strategic focus to a vertical model as Ross Levinsohn organized its media holdings. Currently, finance, sports, and lifestyle are the main verticals.

“We really look for assets that can fit into and expand an existing vertical for us — or start a new one,” Levinsohn says. “In this vertical partnership model, we share revenue with our partners without incurring costs, keeping our content costs low while showcasing some of the industry’s most dynamic and award-winning journalism from the top talents.”

For its acquisitions, The Arena Group seeks websites that have built loyal, engaged audiences. It owns popular niche publications and those with a broad following, like Sports Illustrated, where the editorial team delivers premium written content and professional-quality photographs. Targeted podcasts and videos round out the mix.

“Our unique vertical model starts with a powerful, owned-and-operated brand with a distinctive voice like Sports Illustrated, TheStreet, and Parade,” Levinsohn says. “We enhance and surround those brands with strategic partners and entrepreneurial publishers who add breadth and depth to our content through their specific expertise and audience. Whether it be about a particularsports team or a financial product, we expand content in a way that is both relevant and timely, driving traffic and increasing advertising inventory.”

The Arena Group differentiates its verticals online, grabbing the attention of targeted customers. The specificity of each vertical creates a loyal customer base with an appetite for newsletters, subscriptions, online engagement, and the creation of community.

The Importance of a Premium-Content Paywall

The New York Times, The Washington Post, and The Wall Street Journal stand out in a crowd for successfully converting readers into paying subscribers. In early 2021, the Sports Illustrated website put a content paywall in place, generating more revenue and delivering premium content to subscribers.

According to a recent earnings report, print revenue at The Arena Group increased 38% to $27.9 million for the fourth quarter of 2021, primarily driven by a 56% increase in print subscription revenue. This success reflects the drive to increase subscribers in the fourth quarter of 2020, and the diminishing effects of acquisition and accounting adjustments on the subscribers that existed when The Arena Group began operating the Sports Illustrated Media business.

When Jim Cramer, TheStreet’s founder and distinctive voice, left for a media deal in October 2021, The Arena Group buttressed TheStreet.

“We brought on a new leadership team and revamped our content strategy to develop TheStreet’s new voice while focusing on retaining subscribers,” Levinsohn says. “While we did lose some subscribers, we were able to retain 86% of subscriptions.”

The team rebuilt the funnel by applying the playbook to TheStreet. At the time of Cramer’s departure in October, the site had 5 million monthly unique users, according to ComScore.

“Just four short months later in February, TheStreet had over 16 million unique viewers, more than triple the viewers we had when Jim in his last month was with us,” Levinsohn says. “The resulting users’ page views and impressions have dramatically grown our advertising business. And we are optimistic that subscriptions will continue to stabilize and rebound as we continue to develop TheStreet’s new voice and reach a wider, more diverse audience.”

Ross Levinsohn Details More Revenue Drivers

The Arena Group reported that other revenue, primarily in digital licensing and e-commerce, increased by 39% to 2.7 million during the fourth quarter of 2021. The development of new revenue streams reveals another page from Ross Levinsohn’s playbook, where an iconic brand like Sports Illustrated magazine can realize substantial revenues through licensing deals, esports, and gambling contracts.

Through 888 Holdings, a leader in sports betting, the platform now hosts SI Sportsbook, a hub for online sports betting. Through a June 2021 partnership with Veritone, Sports Illustrated magazine monetized its video archives dating back to 1954. And in August 2021, a slate of podcasts was added through a partnership with iHeartMedia.

“We have repeatedly proven the effectiveness of our model across a wide array of properties,” Levinsohn says. “Today, we are a modern media company built on proprietary technological infrastructure, with rapidly expanding audiences, diversified revenue, and significant data assets, all working together to expand margins and generate profits.”

As the robust content model continues to drive traffic exceptionally well, Levinsohn is optimistic, noting, “Our business has reached the tipping point.”

Have you read?

Best Business Schools In The World For 2022.

Best Fashion Schools In The World For 2022.

Best Hospitality And Hotel Management Schools In The World For 2022.

Best Medical Schools In The World For 2022.

The World’s Best Universities For Doctor of Business Administration (DBA), 2022.

Track Latest News Live on CEOWORLD magazine and get news updates from the United States and around the world.

The views expressed are those of the author and are not necessarily those of the CEOWORLD magazine.

Follow CEOWORLD magazine headlines on Google News, Twitter, and Facebook. For media queries, please contact:

info@ceoworld.biz