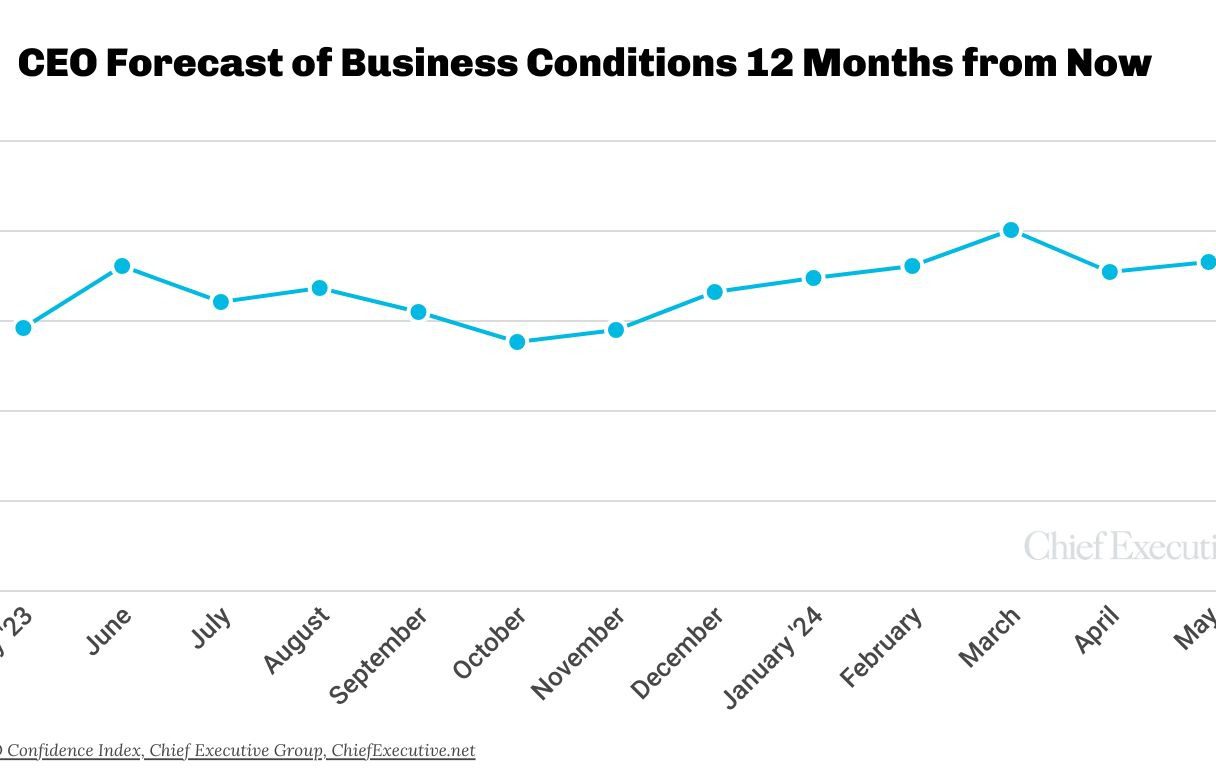

“It sounds like the Fed is going to lower interest rates, and the labor market could cool just slightly,” said Danny Gutknecht, CEO of Pathways.io, who forecasts conditions to improve from a 7 out of 10 today to a 9/10 by this time next year.

“We are seeing the Fed’s efforts beginning to take effect and the economy is slowing. Business will eventually benefit from a stabilization of inflationary issues,” said Michael Uffner, president and CEO of Auto Team Delaware, though he does not expect a rate cut this year.

Politics was also cited several times by those polled, with the majority saying the pre-election turmoil will have quieted by this time next year, which will tame uncertainty in the markets.

“The Fed will eventually bring inflation closer to 2 percent, and the uncertainty of the elections will be over in the next 6-7 months,” said Edward Gerner, president of Maryland-based insurance agency R.K. Tongue Co, echoing many others who believe getting past the elections will taper volatility and set the tone for business, regardless of who wins.

For now, however, CEOs continue to view current business environment as challenging, at best. When asked to rate them on that same 10-point scale, they gave an average of 6.2, down 2 percent since April and the lowest level of the year.

THE YEAR AHEAD

Overall, 49 percent of the CEOs we polled said they expect business conditions to improve over the next 12 months, up 5 points from 44 percent last month. Only 22 percent forecast a deterioration post-election—and 29 percent said they anticipate more of the same for some time still.

Against this backdrop, 71 percent of CEOs participating in the poll said they expect an increase in revenue over the coming year—up from 69 percent in April but still below the 75 percent proportion we found when we polled them in early January.

Among those forecasting revenue growth, our survey found a shift toward smaller increases compared to prior months. For instance, 18 percent expect revenue to grow by 20 percent or more, vs. 13 percent who said the same in April and 18 percent in March. Instead, 37 percent said, in May, that revenue should increase by less than 10 percent.

![Spider-Man Is Back in Black With the Green Goblin in New Funko Pop! Figures [Exclusive] Spider-Man Is Back in Black With the Green Goblin in New Funko Pop! Figures [Exclusive]](https://static1.colliderimages.com/wordpress/wp-content/uploads/2025/03/spider-man-the-animated-series-green-goblin.jpg)