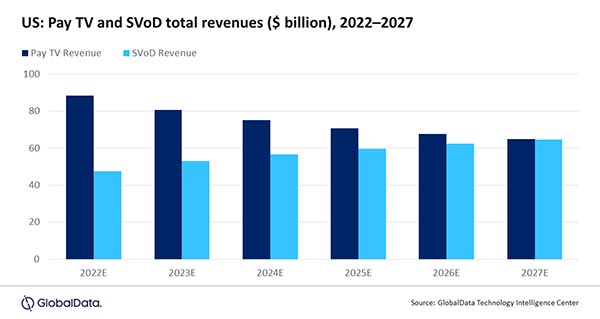

Per new research from GlobalData, annual SVOD revenues in the U.S. will nearly equal those from pay TV in 2027, rising to $64.4 billion, a 6.3 percent compound annual growth rate (CAGR).

Streaming will continue to cut into traditional pay-TV revenues in the U.S., GlobalData says. Pay-TV revenues are expected to slide from $88.5 billion in 2022 to less than $65 billion in 2027, reflecting a negative CAGR of 6 percent.

SVOD household penetration, which sat at 260 percent in 2022 thanks to homes having multiple services, will rise to 312 percent in 2027. Meanwhile, pay-TV penetration is expected to drop to 33 percent from 47 percent as cord-cutting and the number of cord-nevers increases.

Tammy Parker, principal analyst at GlobalData, noted: “SVOD was already on an impressive upward trajectory, but the addition of live sports programming is changing audience viewing habits even more, helping drive additional pay-TV cord-cutting and SVOD growth. Just this month, the National Football League and NBCUniversal announced that the Peacock streaming service will air the first-ever exclusive live-streamed NFL postseason game in January 2024, when it presents an NFL Wild Card Playoff. Even ESPN is reportedly eyeing a standalone direct-to-consumer (DTC) streaming version of its flagship channel.”

The good news for pay-TV operators is that ARPUs are expected to remain healthy, rising from $113.49 in 2022 to $118.34 in 2027. ARPUs are much lower for SVODs, remaining stable at about $12.79 by 2027.

“GlobalData expects Netflix to continue to dominate SVOD revenue market share, attracting about three times as much revenue as Amazon Prime, and twice as much as Hulu (SVOD only, without live TV) each year through 2027.” Parker added.