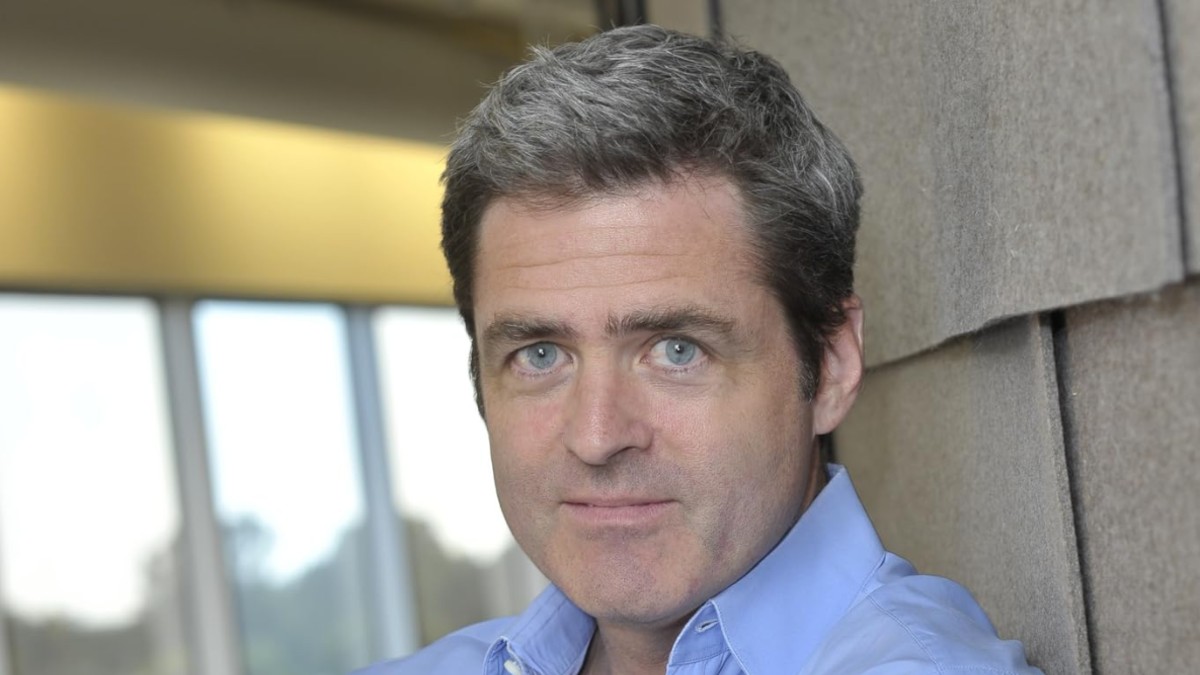

Elon Musk is the new CEO and owner of Twitter (Patrick Pleul/Pool via AP File).

If new Twitter owner and CEO Elon Musk wants to move Twitter off of ad revenue entirely, he’d need just over 64 million subscribers at $8/month to make that happen. On a platform with just 238 million monetizable users according to Twitter’s most recent public earnings filings, that would be quite a feat. It would require that one fifth of all Twitter users subscribe to it.

Contrast that with YouTube’s 80 million subscribers on 2.6 billion users — and a strong value proposition in terms of music and videos — and it looks even tougher.

Twitter’s most recent earnings release states that the company had $1.2 billion in revenue for Q2 2022. The company requires almost 50 million customers to cover this revenue at $8/month, which is $24/quarter. Musk stated however that they are losing $4 million every single day. That adds to the $360million expense.

Total it all up — and you can see my math here — that shortfall requires 15 million more subscribers, for a total of just over 64 million.

The most probable scenario for Twitter is to keep as many ad revenues as possible and also add as much subscription income as possible. This would mean that Twitter dumps as much salary as it can, including the salaries of the 3,700 employees who were fired last week and the 4,400 contract workers that were reportedly laid off today.

Twitter needs just a little less than 24 million users to purchase its $8/month plan. If Twitter is able to keep the ad revenue per person at $5/user/quarter it’s been for years, Twitter will only need one in ten of those subscribers. That’s not a given, of course, with various ad agencies pulling back from Twitter recently.

However, it’s likely that they’ll return as the dust settles, and if the new Twitter can stabilize somewhat.

A Twitter subscription and ad revenue scenario

Note that I’m assuming in this model that subscribers, who Elon Musk has said will see half the ads, are still worth the $5/month of non-subscribers in ad revenue. That’s both due to the fact that they’d be more valuable people for advertisers to target — known spenders with money — and heavy users of the site so that even at a 50% ad load, they’d probably still see more ads than non-subscribers.

If Twitter could pull this model off, it’d be a huge win, with 40% higher revenue.

(This is all based off Q2 revenue data, Twitter’s last public earnings filing. Quarters with holiday ads will see higher revenue numbers.

It’s important to remember, however, that getting a 10% subscription rate is like winning the lottery. Many Twitter users, some even the biggest stars, deny the idea, insisting that Twitter should pay them to have their content.

The goal of 5% is a more realistic, but still very ambitious target. That would actually would also work out in Twitter’s favor, increasing revenue on a quarterly basis by about 20%.

We will see if Musk achieves that feat at Twitter. According to Q2 earnings, Twitter made less than 10% from subscriptions and other sources. This includes a now-defunct adtech company, MoPub. MoPub probably accounted for most of the $101 million in non-advertising revenue, which means that getting to even around $600 million level in subscriber revenue — 5% of users subscribing — would be a major challenge.

Musk however has certain advantages.

He’s reducing costs at Twitter via mass layoffs and terminations, and self-reported usage of the platform has increased, potentially bringing in more passionate and likely-to-subscribe people.

Lower costs reduce the need for revenue, though they may also reduce Twitter’s ability to innovate, grow, and serve both advertising customers as well as users. A second challenge is that Musk, in his deal to take Twitter private has placed the company on more than $22.5 billion in debt. This will mean the company must pay interest payments of $845 million per year.

One thing is for sure: Musk’s acquisition of Twitter has shaken up a fairly stable and boring social media landscape and made it one of the hottest topics in tech.