[ad_1]

Snapchat has published a new report which highlights its unique reach to younger audiences, which also underlines the platform’s value as a messaging and interaction app, with the majority of Snapchat users primarily relying on the app to keep in touch, over other key messaging platforms.

Snapchat partnered with GWI for the new study, which looks at how often Snapchat users open other apps, and which apps they rely on, on a daily basis, for their social and engagement activity.

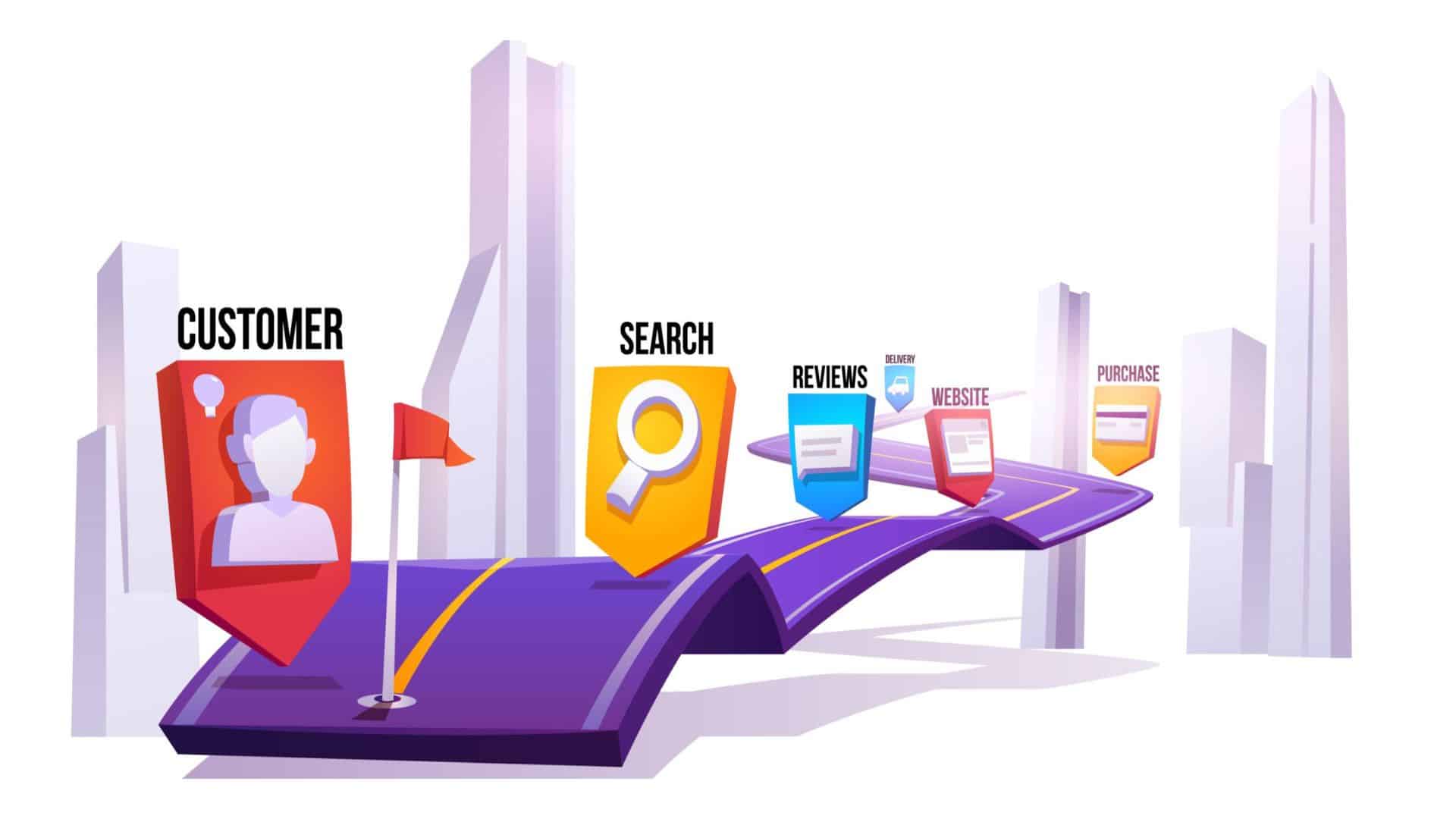

The data shows that 51% of daily Snapchatters aged 16 and over don’t use TikTok every day, while 67% don’t log onto Twitter at the same rate.

That’s interesting, especially considering TikTok’s rise, and its popularity among younger audiences. You would think that there would be a strong crossover here, but the data shows that Snapchat users remain aligned to the app – which could also be a vote of confidence in its own Spotlight short-form video feed.

If people are getting their TikTok-type fix on Snap (or indeed any other app), that justifies this type of replication – so even if you think it’s a cheap tactic to copy a competitor, if it works…

As you can see in this chart, Instagram is the most closely aligned app, with 70% of active Snapchat users indicating that they also log onto Instagram each day. But around half of Snapchat’s audience is not logging on to YouTube, TikTok or Facebook at the same rate, which underlines the app’s unique reach potential, and the value it holds for those that regularly use the app to keep in touch with friends.

And those results shift again when the age bracket is increased:

As explained by Snap:

“When we look specifically at 16-24 year old daily Snapchatters, the results are fascinating. While TikTok’s reach increases slightly, Facebook and Twitter both see a further decline among this key Gen Z demographic. 70% of daily Snapchatters ages 16-24 do not use Twitter every day, 63% of daily Snapchatters ages 16-24 do not use Facebook every day, and 42% of daily Snapchatters ages 16-24 do not use TikTok every day.”

Also interesting to note the comparative difference between Messenger and WhatsApp users and Snapchatters, with most Snap users not opening these messaging apps at anywhere near the same rate. That would suggest that for active Snap users, it’s now the messaging app of choice, which is an important trend to keep in mind for marketers looking to establish connection via DMs.

Of course, that’s not to say that Snapchat users would be open to messages from brands, necessarily. But still, it’s worth considering how Snapchat facilitates more intimate connection in this way, and how that changes the dynamic for Snapchat users in regards to how they keep in touch.

Snapchat has long-touted its unique audience reach, with a similar study published back in 2019 showing that Snap users are strongly aligned to the app.

The hope is that this data highlights Snapchat’s niche audience reach, and helps to differentiate the app from others, encouraging more ad spend from brands looking for alternative avenues of promotion to its audience.

And it is an effective overview of Snap’s potential, which could help to underline its unique value in the space, as opposed to being viewed as a directly comparative platform.

Worth considering in your plans.

[ad_2]

Original Source Link