It has been a wild ride, and it’s not over yet. Elon Musk offered to buy the social media firm. There was outrage, pushback, and much more. Finally, the Tesla deal was reached.

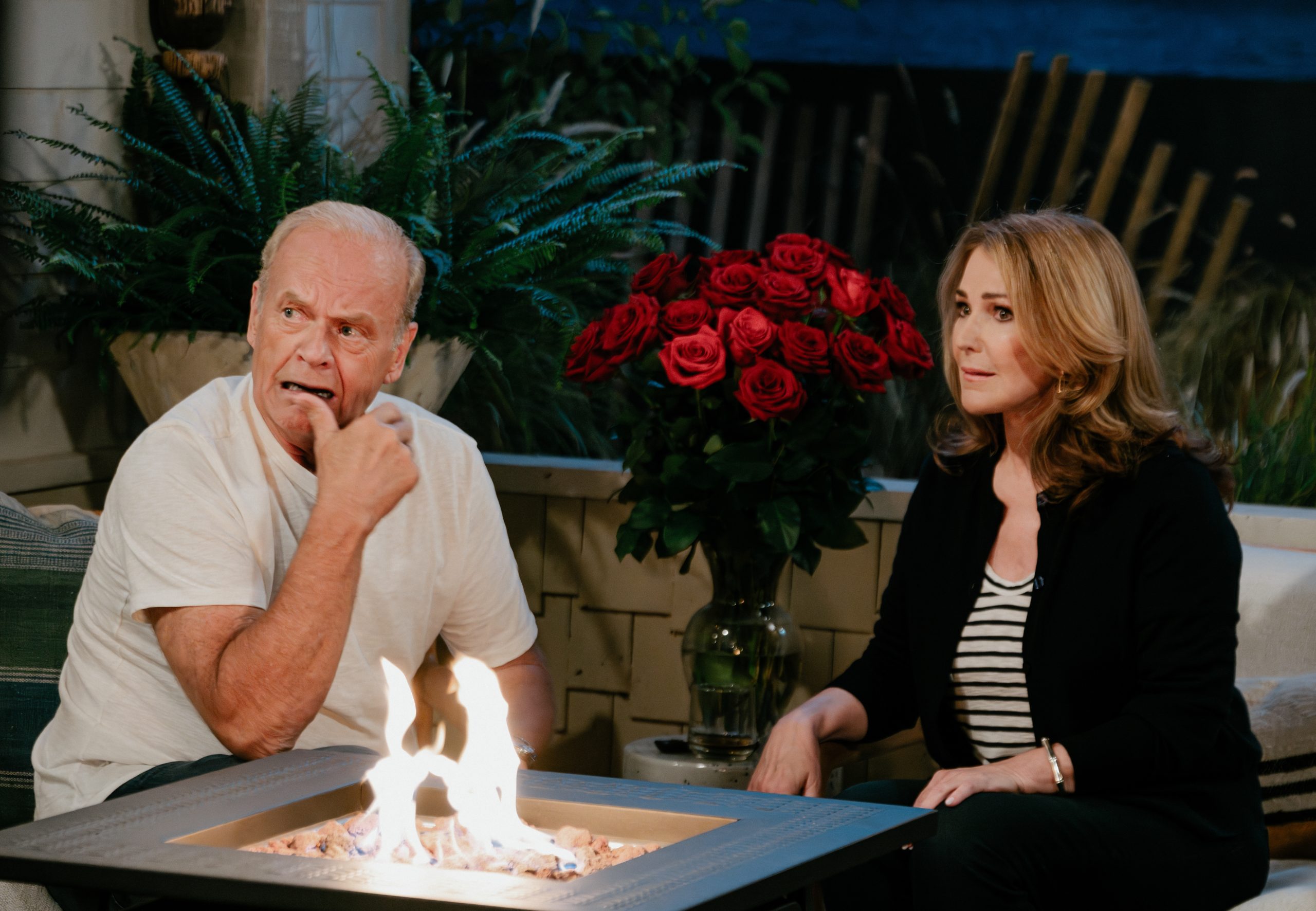

A screen showing Elon Musk’s tweet and a logo for Twitter on a mobile phone screen is seen. … [+]

Musk said that Twitter didn’t provide enough information, despite the price. This should allow him to get away with it without any payment. It’s been the deal of the year, with many for and against votes and a media firestorm from throngs who were horrified or delighted that Elon was plopping down billions to take on Twitter. However, that was before. How could the economic downturn and the constant mudslinging have any impact on taxes? Musk enjoys talking taxes. He talks about everything from the price he should sell Tesla stock to California’s high taxes to why Tesla and he relocated to Texas. Are taxes part of the commotion surrounding Musk’s bid to become a Twitter CEO? Did he get a tax deduction in the $44 billion deal?

You have a basis for purchasing something. However, there is no deduction. Even legal fees must be added to purchase price in order to capitalize them. Even though most legal costs can be claimed as business expenses in business, this is still true. However, what happens if Musk decides to back out? According to tax law, Musk can deduct the $1 million fee from his taxes if necessary. Additionally, he can deduct all legal fees that he incurs in the large lawsuit Twitter has just filed. He can also write off all the legal fees and deal costs he may have incurred. Not Deductible while the Twitter deal was in effect, but now they are deductible. The IRS requires that these costs be capitalized as soon as the deal has been negotiated, closed and documented. If the deal falls through, you cannot capitalize expenses. You can, however, write them off.

Musk probably isn’t thinking about taxes in this Twitter war. However, a payor can deduct the breakup fee as an expense or business loss. If a deal fails, termination fees are charged. Capitalization is often irrelevant. A court may block a merger proposal if the potential acquirer loses a few hundred million. In these cases, the IRS can usually deduct the amount of the termination cost. In some instances, the IRS may consider fees paid for terminating a deal to be part of the cost of executing a merger. Second transaction. Tax rules may be triggered by this. Capitalization is required to cover costs that are involved in the acquisition or modification of more than 50 percent of an interest in a business.