Could you see yourself relying on X for your all of your financial needs?

This remains the core vision of Elon Musk’s X project, the fundamental element that has powered his dreams for what Twitter could become, now that it’s moving into the next stage of its existence.

In fact, Musk has held onto this dream since 2008, when he was working at PayPal, where he’d pushed the board of that company to change its name to “X.com”, and facilitate a broader range of financial services.

Musk was eventually ousted from the company due to these insistences. But even so, he remains solely dedicated to this focus, and to making his X vision a reality.

Why? Because as with all things Elon, he believes that he knows a better way, and he’s determined to test his theory with his latest project.

So will it work?

Well, there’s a lot to consider.

Payment licensing

Before Elon can do anything, he needs to get regulatory approval to facilitate payments in the X app, which has thus far proven more complicated than he had hoped.

According to a new report from Bloomberg, Musk had initially hoped to launch payments on X globally by the end of this year, but he’s since had to scale that ambition back to U.S. only payments, due to initial pushback from U.S. state authorities.

X Payments has secured money transmitter licenses in 28 states, the first stage of facilitating transactions in the app, but it still has a way to go in getting full approval. And that’s only for the U.S., with the company set to face even more significant challenges in other nations.

Indeed, Musk’s own antagonism of certain governments could slow the approval process even more, with Musk has repeatedly criticizing the Australian Government, Brazilian authorities, the German government, and others over various issues. Each of these conflicts could weigh against him and his companies as they look to extend into new areas.

And that’s before you consider the historic skepticism that regions like India have displayed in relation to payments and online payment options.

Basically, X is still a long way off from even this first step, though the plan, at present, is for X to have secured full transmitter licenses in the U.S. by the end of 2024. From there, it will also need to secure payment processor licensing, though money transmitter licenses will enable it to at least begin the first stage of its payments plan in the U.S.

New opportunity

Musk’s broader vision with payments is that this will enable X to explore new revenue streams, though seemingly not directly, via payment processing fees and the like.

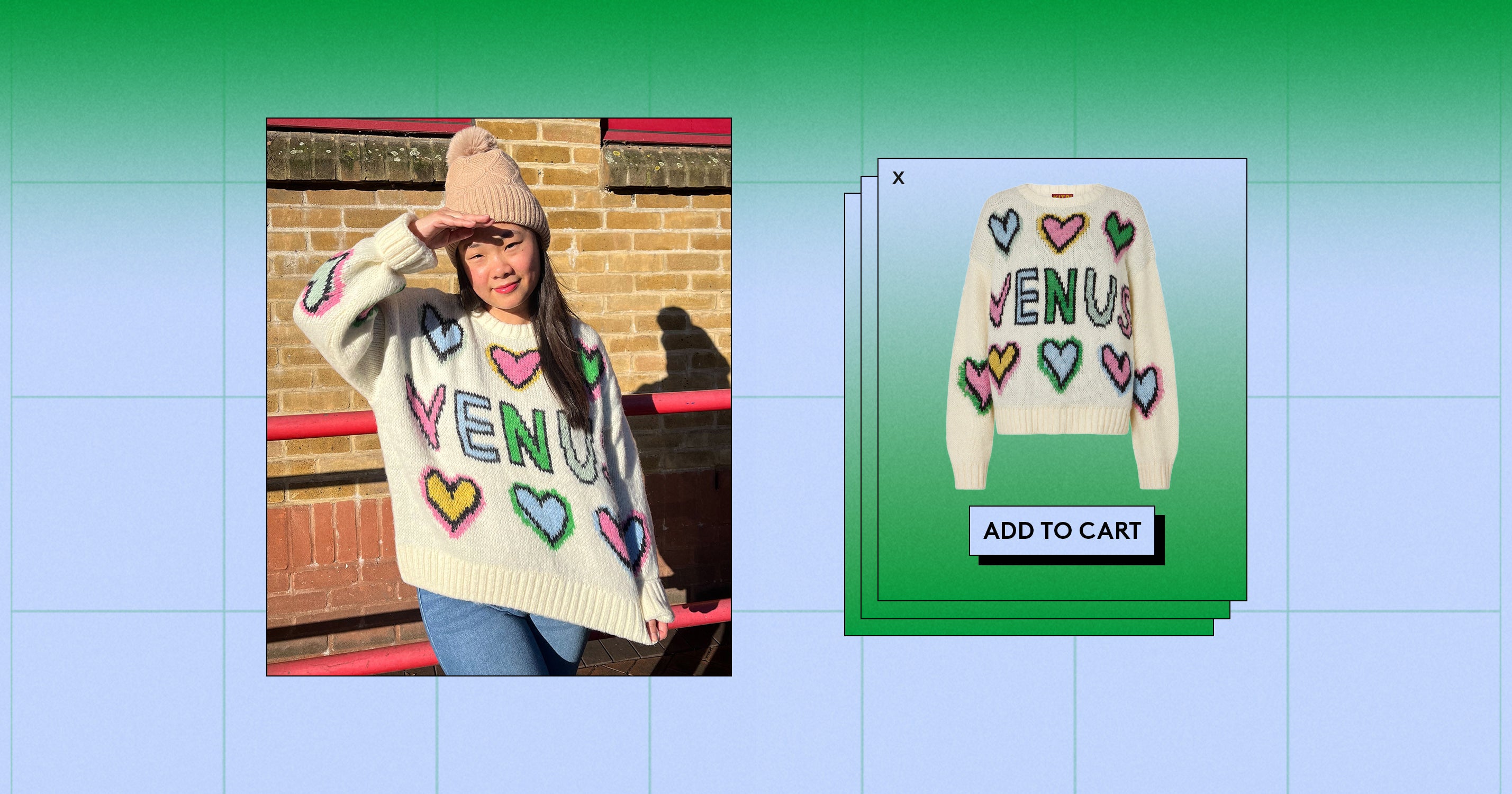

According to Bloomberg’s report, Elon’s vision is for X to host a digital payments dashboard that will “serve as a centralized hub for all payments activity” online. So when you want to pay for something in another app, or on another website, the concept is that X will appear as a payment option, similar to PayPal or Venmo, but X doesn’t plan to charge users for this.

Instead, the documents suggest that payments will broaden X’s business opportunities by increasing X users’ “participation and engagement.” Eventually, X may also look to charge merchant fees for product sales in the app, but again, that’s based on the next stage of regulatory approval.

Right now, X is simply looking to get people storing money within their X account, and it sees that as a means to facilitate the first stage of the broader plan.

X could also look to offer high yield savings accounts and other incentives to keep people adding money to their profiles, with a view to shifting habitual behaviors.

It’s hard to see how this will work as an incentive, with limited usage for payments in the app, but this would be the first step towards facilitating this expansion.

And ultimately, Elon believes that this is the pathway to completing the original vision for what PayPal would have been, using X’s reach to bring this new payment model to more users.

Future marketplace

In the past, Elon has noted that, in his view, PayPal is “a half-baked version of what it could be.”

Musk believes that the very process that PayPal, and indeed the entire financial system, is built upon is flawed, in that it’s reliant on multiple stacks of databases interacting, primarily via batch processing.

Musk’s view is that web-based payments can and should be processed in real-time, which is where X, ideally, would fit in. Whether that’s true or not, I don’t know, and Musk, presumably, has a better perspective on this than most, given his work on PayPal. But the question remains as to whether people actually want this, and whether X can actually offer enough value to make people want to host their financial lives in the app, in all aspects.

Because Twitter tried, with payments and in-stream shops, and they never caught on in any significant way. Virtually every other social app has also tried, with less than impressive results.

And then there’s also the question of Musk himself, and his ongoing insistence on sharing his thoughts on every news event and political story, which, as noted, has pitted him against various governments and regulatory groups, while also tarnishing his reputation as a trusted “genius.”

These days, more people are likely to have a negative view of Elon, and his future plans, and that will also play a part in whether X Payments actually works out.

Because if they don’t trust him, they won’t trust their money with him either, and really, Musk would be better served by resisting the urge to weigh into every subject with his thoughts and opinions.

But that, seemingly, isn’t going to happen. And with the ongoing delays in regulatory approvals, combined with X’s declining revenue intake, it’s hard to see Musk’s payments vision ever becoming a significant shift.

But then again, maybe Elon sees something I don’t, and maybe, history will prove him right in his broader vision for online transactions.

![5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic] 5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic]](https://imgproxy.divecdn.com/Hv-m77iIkXSAtB3IEwA3XAuouMwkZApIeDGDnLy5Yhs/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9saW5rZWRpbl9zdHJhdGVneV9pbmZvMi5wbmc=.webp)