The US Supreme Court ruled today that the funding mechanism for the federal consumer watchdog agency is perfectly cromulent, putting a stop to the Right’s latest attempt to dismantle the Consumer Financial Protection Bureau (CFPB) and potentially “government” and “society” and “other living things.”

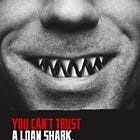

A lawsuit by one of the agency’s perennial enemies, the loan shark payday loan industry, claimed that because the CFPB isn’t funded by an annual congressional appropriation, it is therefore unconstitutional. In a 7-2 decision, the Court said get out of here with that, because Congress set up the agency’s funding, which comes from the Federal Reserve, and that’s fine, actually.

In something of a surprise, the majority opinion was written by Justice Clarence Thomas, who apparently doesn’t have any billionaire friends who got rich from payday loan operations. Far-right fuckwads Sam Alito and Neil Gorsuch, who never met a federal regulation on business he ever liked, dissented.

The CFPB was created during the Obama administration, as part of the Dodd-Frank financial reform package. It was the passion project of Sen. Elizabeth Warren (D-Massachusetts), who cut her law-prof teeth on consumer law and used to perplex her Harvard Law students by making them read disclosure statements in credit card agreements and identify all the ways they could bamboozle consumers. It brings lawsuits against all sorts of corporate baddies who try to take advantage of people, like car loan companies that target military members with terrible loan terms, or banks that arbitrarily change the rules for credit cards and cheat customers. The bureau says it has so far returned more than $19 billion to consumers since 2010. Republicans HAAAATE it, and set out during the Trump “presidency” to try and destroy it. Nevertheless, it persisted.

As the New York Times ‘splains, this case was brought

by two trade groups representing payday lenders. They challenged a regulation limiting the number of times lenders can try to withdraw funds from borrowers’ bank accounts. The Fifth Circuit struck down the regulation, saying it was “wholly drawn through the agency’s unconstitutional funding scheme.”

Y’see, funding for the CFPB was intentionally designed to be protected from Congress’s annual funding fights, to make it harder for a Republican-held Congress to just make consumer protection go away by zeroing out its budget. Talk about prescient!

Instead, the CFPB gets its funding from the Federal Reserve, with a formula designed to keep its spending in order, as Politico very sexily explains (yes, sexily. Agency financing gets some policy nerds very hot, don’t kink-shame):

The funding mechanism allows the bureau to request the amount of money it needs each year from the Fed, which in turn is funded by fees it levies on financial institutions and interest on the securities it holds. The CFPB automatically receives the requested amount, subject to a cap set by Congress.

Republicans and financial industry critics, many of whom have opposed the bureau since its inception, have long argued that the funding scheme allows the agency to escape accountability. They see the agency as as a rogue regulator with too broad a purview and too few checks on its power.

Translation: It’s too hard to make the mean consumer financial watchdog lie down and snooze while financial “services” companies rip people off.

Happily, the Court didn’t buy the claim that the funding mechanism makes the agency untouchable. During last fall’s oral arguments, Justice Kegstand pointed out that “Congress could change it tomorrow. […] There’s nothing perpetual or permanent about this.”

In the opinion, Thomas wrote that it was fine that the CFPB’s funding was designed by Congress to protect the agency from, well, Congress:

In addition to vesting the Bureau with sweeping authority, Congress shielded the Bureau from the influence of the political branches. […]

Under the Appropriations Clause, an appropriation is simply a law that authorizes expenditures from a specified source of public money for designated purposes. […] The statute that provides the Bureau’s funding meets these requirements.

We agree with Clarence Thomas here, so could someone please acquire a feather, over with which we might be knocked?

Also, here’s a fun trivia fact: Politico notes that Sam Alito’s dissent is actually three pages longer than the majority opinion. He griped that there is no historical precedent for the CFPB’s particular funding mechanism, not even in the writings of 17th Century witchfinders general, so that means it’s bad.

Also too, Justice Ketanji Brown Jackson, who just keeps making us say “hell yeah,” wrote a brief concurring opinion that sounded to us like a not-at-all subtle defense of the “Chevron Doctrine,” which holds that courts should generally defer to agencies because they know what they’re doing. Why, yes, the Court seems likely to gut Chevron soon.

Said Jackson,

An essential aspect of the Constitution’s endurance is that it empowers the political branches to address new challenges by enacting new laws and policies—without undue interference by courts. […] Put another way, the principle of separation of powers manifested in the Constitution’s text applies with just as much force to the Judiciary as it does to Congress and the Executive.

Ahem, my esteemed colleagues, you shits.

PREVIOUSLY!

[AP / Politico / NYT / CFPB v. Community Financial Services decision / Photo (cropped): Adam Fagen, Creative Commons License 2.0]

Yr Wonkette is funded entirely by reader donations. If you can, please become a paid subscriber, or if a one-time donation is more your speed, we have this speedy link for you.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)