[ad_1]

Ed Sheeran would make any business manager proud.

The advisers who guide the finances of artists and executives often struggle to get clients to focus on the long term, including estate planning and exactly what their heirs should do when they’re gone.

That’s not a problem for Sheeran.

The singer recently told GQ that he has built a chapel on the grounds of his estate in England, where he has hosted friends’ weddings — and has found a spot for his cremated remains.

“It’s a hole that’s dug in the ground with a bit of stone over it, so whenever the day comes and I pass away, I get to go in there,” Sheeran said in the October interview. “People think it’s really weird and really morbid, but I’ve had friends die without wills and no one knows what to do.”

Artists and executives always know what to do when they work with any of Billboard’s 2023 class of top business managers. Nominated by their firms and peers and chosen by our editors, these advisers handle not only estate planning but also spending, saving, investing, royalty tracking, asset sales, tax compliance and more — all well before clients meet their final reward.

Each year, Billboard asks our top business managers for examples of their clients’ most unusual investments. Their answers this year include such colorful ventures as comic books, a longhorn bucking bull, a roller-skating rink and Pokémon cards.

But FBMM chairman Duane Clark offers a more sober response for a challenging time: “Our clients have become vastly more sophisticated in investing,” he says, “so the unusual is now being replaced, thankfully with our assistance, with discussion of fee structures, allocations and long-term goals — investing in quality businesses, not the latest unconventional scheme.”

What concerns today’s top business managers? Mark Pariser, co-founder of Dunn Pariser & Peyrot, provides a short list: “inflation, war, high taxes, unstable financial markets, higher interest rates on the macroeconomic level. On the industry side, new business models resulting from streaming, [artificial intelligence] and significantly higher touring costs,” he says.

The increases in interest rates imposed by the Federal Reserve since the spring of 2022 to address inflation have had a wide impact on “a number of client decisions from buying a home to investment opportunities, as well as the cost of business acquisitions and sales,” says Tyson Beem, CEO of Gelfand Rennert & Feldman.

Tina Fasbender, president of Fasbender Financial Management, continues to highlight the role business managers play as emotional advisers. “Money versus long-term health and emotional stability is an incredibly underrated and underdiscussed element of the industry,” she says. “If we want the clients to survive and succeed for the long run, this needs to be a priority.”

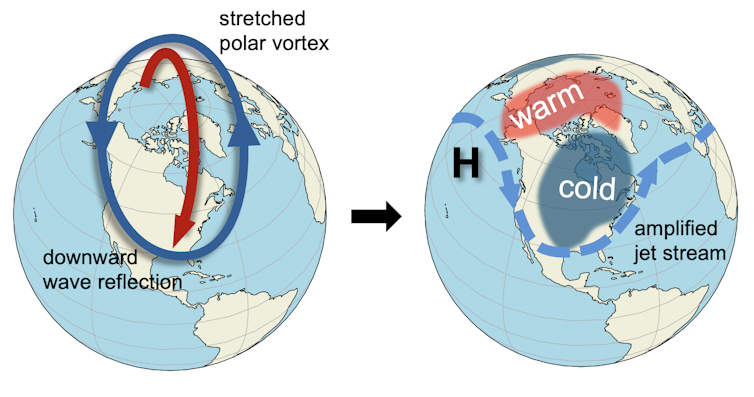

Rit Venerus, founder of Cal Financial Group, raises another fundamental concern that smart advisers are watching: “We have continued to see climate change impacting the business more and more,” he says. “From when and how clients tour to the predictability of travel, weather around live events or insurance companies pulling out of certain markets, climate change will continue to be an evolving challenge for our business.”

Iván Alarcón

Co-founder/CEO, Vibras Lab

Alarcón was a key member of the team that closed a deal that brought Karol G to Interscope Records, solidifying Vibras Lab’s cachet only five years after its 2018 founding. Alarcón, who now employs over 40 professionals and serves clients from Latin America, Puerto Rico and Spain, has had roles in some of the biggest tours in the world, including two by Bad Bunny. As a business manager, he helped structure Karol G’s recent stadium tour. The future for Latin artists is bright, he says, adding, “The music business will have new avenues of income that we don’t know yet.”

Notable clients: Karol G, J Balvin, Eladio Carrión, Grupo Firme, Natalia Jiménez, Carin León

Vibras Lab co-founder/CEO Iván Alarcón was a key member of the team that closed a deal that brought Karol G to Interscope Records.

Gerardo Mora/Getty Images

Michelle Amos-Richburg

President/CEO, Richburg Entertainment

Amos-Richburg successfully launched a 30-plus-date North American arena tour for A Boogie Wit Da Hoodie, overseeing all production budgets, managing salaries and handling travel costs, insurance requirements, tax withholding and other logistical aspects of the tour. She was the business manager of record for the production company behind Mary J. Blige’s Strength of a Woman Festival in Atlanta and oversaw brand partnerships for the three-day May event. In a music catalog sale for one client, “we were able to negotiate and secure an offer that was 40% higher than the original valuation, benefiting the client significantly,” she says. Her firm has developed financial literacy courses “with a particular focus on women of color and young Black and brown men.”

Pressing issue: “Lifestyle management. Helping clients create the right mindset to create wealth, maintain wealth and leave a legacy. Making responsible decisions and avoiding extravagant expenses that may not be sustainable in the long run.”

Belva Anakwenze

Business manager, Abacus Financial Business Management

Anakwenze offers tried-and-true advice to clients: “Live below your means, save enough to survive a world disaster, and always account for taxes.” As the rise of artificial intelligence (AI) changes the financial landscape for creatives, Abacus Financial ensures that contracts reflect protective clauses or perpetual royalties on name, image and likeness, and intellectual property. Anakwenze’s firm recently increased its staff by 20% to help it continue to meet the ever-changing needs of clients whom it advises “to dive deep to ensure contracts are written for longevity.”

Pressing issue: “The surge of social media financial educators or influencers creates a generation of creatives who rely on general financial tips that only apply to some situations. Clients often send social media clips with financial advice, suggesting we use those tactics for them. Unfortunately, not every tip works for everybody.”

José Aristizabal

Founder/CEO, Camaleon

Aristizabal highlights his firm’s work with “two of our valued clients in diversifying their portfolios, while simultaneously helping them establish robust teams and organizational structures for business expansion.” These clients, he says, “operate as record labels, publishers and managers [and] engage and sign talented producers, songwriters and artists, offering a wide range of professional services” — and turn to Camaleon’s business guidance to support all of these efforts. The firm’s clients include Juanes, and Bomba Estéreo.

Pressing issue: “Maintaining a great service and a consistent and transparent line of communication with the artists we represent, as this is integral to nurturing their trust in us as their business managers.”

Angie Barajas

Louis Barajas

Co-founders/business managers, Business Management LAB

Working with a roster of artists that includes Nicky Jam, Yandel, Edgar Barrera, Elena Rose and Yahritza y Su Esencia, Angie and Louis Barajas help their clients create investment plans for multimillion-dollar catalog deals, while saving them millions of dollars in taxes in the process. “Catalog sales have been most affecting our clients” in terms of income, Louis says. “Having a sound investment plan has proved to be more difficult with the uncertainty in the private equity markets.”

Most unusual client investment: “A chain of boutique meat markets [and] an international baby product.”

Harrison Bauman

Senior vp/financial adviser, Bauman Wealth Management of Raymond James

Bauman Wealth Management takes a personal approach with its clients, which include The Monsters & Strangerz, Rare Behavior and Gregory “Aldae” Hein. Whether it’s the sale of a music catalog or the renovation of a house, the company advises on matters to allow clients to focus on their work, not their finances. The music catalog market is cooling off, Bauman says, “which means clients need to choose if they want to go to market for liquidity now or face uncertainty [and] rely on existing cash flow.” In addition to inflation in 2023, “the cost of living and borrowing costs have gone up over the past two years,” he says, which “is affecting the daily living for many.”

Most unusual client investment: “One client wanted to put a 5,000-gallon fish tank in a house.”

Tyson Beem

CEO, Gelfand Rennert & Feldman

Chris Fazzolari

Todd Kamelhar

John Menneci

Melissa Morton

Rick Mozenter

Anton Pamer

Mike Skeet

Managing directors, Gelfand Rennert & Feldman

Gelfand Rennert & Feldman remains a leader in domestic and international touring and business management as well as royalty and valuation services. “The depth of knowledge necessary to best service global entertainers can only be accomplished with the resources and talent we are fortunate to share, with our U.S. and U.K. colleagues having expertise in touring, taxes, business management, royalty services, publishing and music label services,” Beem says. As music industry revenue models evolve, “an understanding of how to register for, advocate for and collect on the various revenue streams available to musicians requires expertise and diligence,” he adds. “Because of this expertise — including an expertise in the valuation of music catalog sales and purchases — we have a unique perspective to advise our clients on how to best operate in the current environment and plan for the future.”

Pressing issue: “Interest rate increases have an impact on a number of client decisions, from buying a home to investment opportunities,” Beem says, “as well as the cost of business acquisitions and sales.”

Marius Bercovici

Justin Kobay

Venicia Mestey

Bruce Seckendorf

Partners, LL Business Management

The firm, which Seckendorf founded in 1994, has had substantial growth in the Latin American music market with “our international tax expertise [allowing] our clients to effectively navigate the complex tax issues encountered by U.S. artists touring abroad and foreign artists touring in the U.S.,” Mestey says. Additionally, as catalog sales remain strong, LL Business Management continues to guide clients through the process. “When done at the right time,” Mestey says, a catalog sale “can provide financial security for them [and] can help set them up for the next 10 years, if not more, of their career if the money is managed properly.”

Most unusual client investment: “A roller-skating rink.”

Charles Bradbrook

Janice Lloyd

Steven Wren

Partners, SRLV

With 35 years in business and a reach across more than 50 countries, the U.K.-based SRLV has recently expanded by 30% to 180 partners and staff. “Much of this has been driven by our clients who’ve been busier than ever with major international tours, album releases and other projects,” Lloyd says, “while our royalties team has seen a marked increase in the number of catalog valuations over this period.” With an expertise in international tax and U.K./U.S. tax matters, the company takes pride in “always” supporting new talent and early startups over the years.

Pressing issue: “Clients are seeing their name and likeness being used via artificial intelligence without their consent in different forms of media,” Lloyd says. “Without taking the necessary steps to protect their rights and provide these under license, AI has the potential to erode a client’s brands and income streams.”

Joseph Callaghan

Mark Carter

Thomas F. Smith

Simon Winters

Partners, Prager Metis

Prager Metis, a 10-year-old firm with 600 employees that represents what Smith describes as “musicians, music publishers, record labels, fashion designers, TV and film stars, influencers, sports figures and creatives,” has spent the last couple of years focusing on concerts. “It has been a busy touring season,” Smith says. “We look at keeping costs down, location of tours domestic versus foreign, central tax withholdings and forecasting the rising vendor costs.”

Pressing issue: “The rising interest rate environment,” Smith says.

Adam Caswell

Director of business management, Fineman West and Co.

Caswell’s firm added a royalty department over the past year that “resulted in successfully capturing typically missed revenue opportunities,” he says. What are Fineman West’s “ultra-high-net-worth” pop star clients buying these days? Private planes, according to Caswell: “The tax law currently allows for a full write-off of the cost. We have extensive knowledge in helping our clients maximize a broad range of tax-saving opportunities available to them.”

Notable clients: Kim Petras, Tyga, Steven Tyler, producers Tank God and J.R. Rotem

Duane Clark

Owner/chairman/president/business manager, FBMM

Julie Boos

Owner/vice chairman/vp/business manager, FBMM

David Boyer

Jamie Cheek

Carmen Romano

Erica Rosa

Owners/vps/business managers, FBMM

Jen Conger

Owner/business manager, FBMM

Paul Barnabee

Director of West Coast operations, FBMM

Chris Hughes

Dan Killian

Betsy Lee

Business managers, FBMM

Three years after the height of the pandemic, touring artists are still facing challenging headwinds when it comes to touring logistics, including rising transportation costs. Meanwhile, Clark notes that for many artists, “ticket prices, guarantees and walkouts are not rising at the same level. There are storm clouds on the horizon if one or the other doesn’t change.” He also says that ongoing gains in consumption of music through streaming and social platforms is offering “material transformation in both current income and asset values into the future.”

Most unusual client investment: “Our clients have become vastly more sophisticated in investing,” Clark says, “so the unusual is now being replaced, thankfully with our assistance, with discussion of fee structures, allocations and long-term goals — investing in quality businesses, not the latest unconventional scheme.”

Lauren Cooper

Maria del Pilar Lopez

Wayne Kamemoto

Sharon Sullivan

Errol Wander

Partners, Citrin Cooperman

Citrin Cooperman was founded in 1979 with seed money from two iconic rock bands, and the firm “continues to focus significant resources to our music practice,” says Kamemoto, who was recently named the music subindustry leader of the company’s entertainment, music and sports practice. “We continue to expand our practice by signing world-class royalty guru Jon Payne to our royalty inspection, contract compliance and consulting practice and establishing the preeminent music economics and valuation services practice with the addition of Barry Massarsky and Nari Matsuura last year,” Kamemoto says. “To have these resources within our music practice and to have the greater firm’s expertise in other areas our clients are involved with — cannabis, digital assets, international taxation, not-for-profits, real estate, restaurants — has been extremely beneficial.”

Notable clients: The Black Eyed Peas, Jack Antonoff, Bleachers, Alejandra Guzmán, Redfoo, The Strokes

Jack Antonoff, seen with Taylor Swift at the 65th annual Grammy Awards, is a client of Citrin Cooperman.

Kevin Mazur/Getty Images

Lester Dales

Founding director, Dales Evans & Co.

“The business environment clients operate in moves much faster,” Dales says. “Providing a supportive and proactive business management team service is fundamental.” Despite increasing touring costs and “reduced capacity in insurance markets for nonappearance insurance,” over the past 18 months, Dales and his team “have worked on a number of successful tours with domestic clients.” He has also advised a number of U.S. artists on their withholding taxes in Europe and South America. Going forward, Dales adds, “the effect of artificial intelligence and other new technologies have to be carefully considered as new streams of income develop.”

Notable clients: Dua Lipa, Queen, Coldplay

Kella Farris

Stephanie Self

Catherine Moore

Stephanie Alderman

Partners, Farris Self & Moore

This year has been full of steps forward for the firm’s leaders as Farris assumed the role of Country Music Association board president, Self was named the 2022 CMA Touring Awards business manager of the year and Alderman was named partner. Plus, the company moved to a new, 10,000-square-foot office in Nashville. But it has also been a year of navigating challenges for clients, particularly in touring, which has grown economically tougher “due to higher borrowing costs, escalating touring expenses and persistent inflation,” Alderman says. “The silver lining is new artists with any degree of bargaining power are now receiving label offers that enable them to keep ownership of their masters and exclude the 360 component. This transforms the artist-label relationship into more of a partnership than we’ve seen in the past.”

Most unusual client investment: “Unconventional or high-risk investments should only constitute a small portion of a client’s portfolio,” Alderman says. “Our clients have been presented with a broad array of investment opportunities, including cannabis stocks, med spas, car dealerships, beverages, utilities, the metaverse and licensing deals that now often incorporate equity participation.”

Tina Fasbender

Founder/president, Fasbender Financial Management

After more than 36 years in the industry, Fasbender says the most pressing issue now facing business managers as they guide the finances of their clients is mental health. “Money versus long-term health and emotional stability is an incredibly underrated and underdiscussed element of the industry,” she says. “If we want the clients to survive and succeed for the long run, this needs to be a priority.” Fasbender says some of her most “gratifying” recent work has been managing the estate of late songwriter Allee Willis, who co-wrote legendary songs like “September” by Earth, Wind & Fire: “She was a client, friend and larger-than-life personality who knew no boundaries in life or the arts.”

Most unusual client investment: “A minor league baseball team.”

Tina Fasbender, president of Fasbender Financial Management, represents the estate of songwriter Allee Willis, a 2018 Songwriters Hall of Fame inductee who co-wrote legendary songs like “September” by Earth, Wind & Fire.

Stephen Lovekin/Variety

W. Shane Glass

President, Colony Business Management, The Colony Group

“The music industry is in a constant state of transformation, and we continue to adapt along with it,” Glass says. “Music catalog sales have created opportunities for our clients to diversify their income streams and portfolios. The prominence of the newer streaming models and quicker payments has helped our clients put money in their pockets quicker.” Protecting his clients, Glass says, “involves not only managing their income and expenses but also assessing potential risks in contracts, investments and their overall financial portfolio,” as well as guiding clients to make “prudent decisions in an ever-changing industry.”

Most unusual client investment: “Ice cream trucks, or cryptocurrency that I have never heard of.”

Reggie Gooden

Co-founder/managing partner, 360 Business Management

The challenge for a modern business manager, Gooden says, is to “not only be able to effectively communicate to a younger client base but add value beyond basic accounting and tax services. They also need to stay well informed of rapid changes in tech as well as culture so that they can be trusted advisers and partners with their clients.” Just over a year since opening, 360 Business Management has expanded from four employees to a staff of nearly 25 and added investment and wealth advisory services to its business management model. The firm represents creators like Cedric the Entertainer, Grammy Award-nominated producer HARV and Grammy-winning songwriter Cory Henry, as well as media executives.

Most unusual client investment: “Digital real estate investing has been a conversation that has raised my eyebrow and blood pressure in the last 12 months.”

Sean Granat

Partner, CohnReznik

During the past 18 months, CohnReznik has “significantly expanded its presence in South Florida, recently opened an office in Denver and has broadened its team and capabilities in Asia,” Granat says. “As more of our music and entertainment clients look to generate revenue by licensing their names and images for consumer products, our entertainment practice has begun collaborating with our consumer industry practice to support their efforts from tax planning and financial advisory perspectives.” Touring remains the primary source of income for CohnReznik clients and, as costs and inflation have stabilized, the company can better assess the profitability of a tour when advising clients. Catalog sales continue to be an income stream for artists, Granat says, but the era of large premiums has declined.

Most unusual client investment: “While I have been asked to opine on numerous ideas — from buying football teams and exotic real estate to purchasing foreign currencies — I tend to steer them toward the tried and true unless the unusual investment offers superior tax or business advantages.”

Becky Harris

President, Huskins-Harris Business Management

Huskins-Harris is constantly trying to find ways to “save our clients money” on the one hand and help “them to grow their financial portfolio” on the other, according to Harris. At the same time, she adds, it’s crucial to keep up with “the constant influx of new social media platforms and ways to monetize them” while protecting her clients’ privacy. Harris is also watching new streaming payment models, which “will continue to affect income as the royalty rates change and policies evolve.” She adds: “Keeping up with this aspect of the business can be a full-time focus of its own.”

Most unusual client investment: “A longhorn bucking bull.”

Nicholas Judd

Co-founder/CEO, Leftbrain

Nicholas Brema

Business manager, Leftbrain

Leftbrain recently launched a vendor tracking database that allows its business managers “to monitor market trends [and] compare vendor and independent contractor rates,” Brema says. “Our clients sleep easier knowing that their business management team is monitoring all their vendor relationships to ensure appropriate and fair compensation.”

Pressing issue: “Firm culture. Given the behind-the-scenes, and often thankless, nature of our roles, it is easy for a firm to develop an apathetic culture,” Brema says. “At Leftbrain, we talk about culture — a lot. We encourage members of our team to develop a strong rapport with their clients, and we highlight those employees who exemplify our culture through their actions. While our technology may help differentiate us from the competition, it is our culture that our clients fall in love with.”

Kevin Kanegai

Partner, NKSFBGO, a division of NKSFB

Kanegai says that his firm has played “a critical role in helping our clientele surpass $1 billion-plus in strategic asset sales and successful venture exits.” While helping to identify and vet potential buyers for those assets or partners for business ventures, the firm has “assisted with valuations and aided in negotiating best terms,” he says. Although catalog deals may often result in “immediate generational wealth, it is not always the right decision to sell,” Kanegai says. “Our ultimate advice is based on many factors not limited to high multiples, tax benefits and subsequent investment opportunities. Every client has a unique life experience and expectation. Our advice is personally curated to address each specific story.” His firm’s clients include Steve Aoki, Slipknot, Becky G, Lil Tjay and Julia Michaels.

Most unusual client investment: “From the incredibly ingenious to the absolute ridiculous, we have seen it all. Mining asteroids?”

Michael Kaplan

Managing partner, Miller Kaplan

Michael Kane

Partner, Miller Kaplan

According to Kaplan and Kane, who count Mariah Carey, Britney Spears and the Michael Jackson estate among their star-studded roster of clients, a concern for many business managers in 2023 is the “unfortunate short-term decisions” some artists made during the pandemic. “They sold assets or requested advances due to cash flow issues that resulted in compromising certain rights — often only to service their lifestyle during the COVID-19 years,” Kane says. The duo predicts better days ahead for many of its clients: “With COVID largely in the rearview mirror, we’ve experienced a return to the touring aspect of our musical artists,” Kane says. “We currently have artists on world tours, Broadway and performing in Las Vegas.”

Most unusual client investment: “One client wanted to pursue buying a bison farm,” Kane says. “However, once she realized the bison on those farms are slaughtered, she no longer had an interest in bison farming.”

Michael Karlin

Founding partner, NKSFB

Wallace Fortune

Matt Segal

Larry Tyler

Partners, NKSFB

The achievement by NKSFB in the past year that Karlin highlights has been “navigating our film and television clients through the strikes” by writers and actors. “This means managing spending and providing regular input. Streaming is the game-changer for theatrical, television and music,” he says. “The sheer number of streams continues to increase. The goal is to attempt to monetize that increase for our clients.”

Pressing issue: “Uncertain economic conditions, rising interest rates, political instability,” Karlin says. “We need to be aware of macro issues and able to pivot as necessary. Being conservative with advice always pays off in the long run.”

Matt Klarberg

Managing director, MAI Capital Management

MAI has “strategically expanded every division of our sports and entertainment group,” Klarberg says, noting that he can provide clients access to an “entire suite of services” including financial and retirement planning and investment management. He has seen music catalog sales affect the lattermost sector, noting that “it can be a helpful tool to pull cash out and then reinvest it in other ventures.” Some clients have also invested in new AI technology as it pertains to the music industry, which Klarberg says “has the potential … to shape the way the next generation operates creatively.”

Notable clients: Kaskade, Tokischa, John Summit

Josh Klein

Managing partner/CEO, TKG Business Management

Since its founding in 2020, TKG has offered its services to clients such as The Chainsmokers, Anitta, Big Sean and Charlie Puth. Klein reports that TKG has doubled in size in the last year, bringing in more clients and employees to help manage its growing aspirations as a company. Such aspirations include the creation of a new royalty group within the firm to focus on helping clients collect “their fair and equitable share of the profits they’re due from the creation of their art,” Klein says.

Most unusual client investment: “Professional pickleball teams have been a hot topic lately.”

Kristin Lee

Founder/managing director, KLBM

Lee has been expanding the business management firm she launched in 2014, with growth in its Nashville office — which opened in 2021 — that “has spawned major opportunities that have changed the face of this firm,” she says. The top issue her team has been managing for clients in 2023 has been the economics of touring. “Even top-earning tours are not necessarily ending as profitable as they would have been pre-pandemic,” Lee says. “Rising costs coupled with unchanged guarantees are hitting some of our clients pretty hard.”

Pressing issue: “The urgency to protect our clients’ artistry and likeness are at an all-time high. It’s imperative that we are working closely with our clients’ legal teams and industry guilds to ensure such safeguards. While there may be practical use of new technologies, without any assurance, all of our livelihoods are at stake.

David Levin

Managing director, DLBM, a division of Adeptus Partners

Levin — whose clients include John Legend, Chrissy Teigen, Wyclef Jean, Estelle and Madison Beer — was promoted to managing director of Adeptus Partners’ DLBM business management division in a year when the company added four new business management music and entertainment firms to its portfolio, representing a variety of musicians, producers, film/TV/theatrical clients and influencers. He oversaw the roster additions of Journey, producer-performer Raphael Saadiq and, with associates Mike Nelson and Ellis Beber, Indigo Girls and BoyWithUke, while helping to structure and bring to market Hailey Bieber’s Rhode skin care line. Levin also notes his role in helping to “orchestrate the resurgence and re-formation” of the multiplatinum band Live fronted by Ed Kowalczyk.

Pressing issue: “Same as it ever was: Live within your relative means, save because you never know what tomorrow brings, and pay your bills and taxes timely.”

Matt Lichtenberg

Partner/business manager, Level Four Business Management

Paul Ta

Business manager, Level Four Business Management

While the pandemic and strikes by Hollywood’s writers and actors have affected entertainers’ income streams, Level Four Business Management has been helping clients navigate “these challenging times and assisting with assessing their needs as opposed to ‘wants’ so they can make informed financial decisions,” says Ta, who adds that the firm’s advice to clients is always, “Live within your means.” But with touring resuming after the pandemic and consumers “spending more on VIP experiences and new pricing models,” he adds, touring has become “more profitable for the acts than ever.”

Most unusual client investment: “Solar farms, a laundromat, individually owned ATM machines, to name a few,” Ta says.

Mike Merriman

President, PARR3

Bryan Gott

Director of business development, PARR3

“We’ve spent a lot of time working on ourselves this past year,” Merriman says. “Our job is busy and demanding, but we’ve deliberately made time for leadership training, off-site retreats, volunteer days and frequent employee reviews. Our big focus over the past year has been on empathy, which accountants often forget. If we’re always thinking about the quality of our reporting and also how it feels to be on the receiving end of financial information, then we can truly serve our clients at the highest level.”

Pressing issue: “We’re still pushing for more transparency and accuracy in the way royalties are accounted to artists, producers and songwriters,” Merriman says. “We’re encouraged by the potential for AI to mend the gap, but the industry still needs the major players to take action. Meanwhile, we’ll continue our royalty hunting every quarter and keep finding more money for our clients.”

Enrique Narciso

President, ERN Advisors

During the past year, ERN has worked closely with its clients and their attorneys to “define the right valuation for intellectual property rights as an intrinsic part of their net worth, based on the monetizing of said assets,” Narciso says. That monetization can happen “either by selling their catalogs or determining the right value of future advances.” As catalog sales for artists and songwriters become more common, “reinvesting the proceeds,” he says, is “now a very important part” in an artist’s “overall financial planning.” On top of that, he adds, “some endorsement deals are transforming into private equity and venture capital opportunities.”

Notable clients: Shakira, Maluma, WK Entertainment’s Walter Kolm

Harley Neuman

Founding partner, Neuman & Associates, a division of NKSFB

“As we continue to add music clients, we have integrated our Neuman & Associates division with our parent firm [NKSFB] more than ever before,” Neuman says. “Working with other partners and staff, with touring specialists, with royalty specialists and with tax specialists, all of whom have added value to our practice.” The firm’s clients include Melissa Etheridge, Alicia Keys, Pete Yorn, Cee Lo Green, Dave Koz, Brian Culbertson, A Great Big World and Good Charlotte’s Joel Madden.

Pressing issue: “Security in the face of increasingly sophisticated parties who are constantly coming up with new ways to attempt to access people’s accounts and assets.”

Melissa Etheridge, whose biographical Broadway production, “Melissa Etheridge: My Window,” opened in September, is a client of Neuman & Associates, a division of NKSFB.

Arturo Holmes/Getty Images

Glenn Nordlinger

Business manager, The Nordlinger Group

A longtime member of the Jonas Brothers’ team, Nordlinger leads one of the top business management firms in the music industry and says he’s constantly looking for pain points his clients might face and areas of new opportunities. One ongoing concern, he says, is “the cost for artists to tour,” citing increases of 1.5 to 2.5 times over the past few years for various production costs, buses, trucking, hotels, flights and other expenses. “As this is the primary income source for most artists,” he says, “maintaining high profit margins without sacrificing the quality of a performance has been extremely challenging.”

Kerry O’Neil

Alvin Hagaman Jr.

Legina Chaudoin

Cheryl Harris

Sam Powers

Lynda Ragsdale

Lillian Williams

Partners, O’Neil Hagaman

The increased attention to catalog sales “has prompted meaningful conversations among our artist and songwriter clients,” Powers says. “These clients trust us to help them understand the catalog sale process and discover their work’s potential value.” The firm’s intellectual property group works with both catalog buyers and sellers, Powers says, “so we bring comprehensive experience to the negotiating table. It’s very rewarding to put that expertise to work for our clients.”

Pressing issue: “On the touring front, we continue to face challenges with market saturation, supply chain and employment issues,” Williams says. “Our touring artists have always been sensitive to the fans’ ability to afford attending concerts and thus, the increasing costs present a challenge between the show people can afford versus the show that artists want to give their fans.”

Mark Pariser

Tony Peyrot

Partners, Dunn Pariser & Peyrot

Pariser highlights the firm’s work submitting claims for clients under the Employee Retention Credit — a payroll tax credit that was created as part of the 2020 CARES Act — in the six- and seven-figure range, as well as ensuring clients complied with Small Business Administration spending requirements for the pandemic-era Shuttered Venue Operators Grant program. Though Pariser has not yet seen a huge impact from AI, he says that low streaming rates have definitely hit his nonperformer songwriting clients “dramatically,” with some finding new income streams by working on TV projects.

Most unusual client investment: “One of my clients has a son who will be playing lacrosse at a Division 1 college,” Pariser says. “He invested in a company called Q Collar, which is a device worn around the neck of an athlete while playing contact sports.”

Murray Richman

Nathan Richman

Partners, Richman Business Management

As artists return to international touring in a post-pandemic world, Nathan says his firm is ensuring “we minimize the international tax liability the artist has to pay in different countries.” Part of maintaining that is the royalty tracking system that Richman Business Management has instituted, which he says ensures “every dollar is being collected accurately and timely.” RBM is also working to create an interactive, real-time reporting and budgeting system to “allow the artist to see the profitability of a tour and make adjustments as required.”

Pressing issue: “The rise of fraudulent activity is prevalent and a major concern,” Nathan says. “This is in the form of unauthorized credit card transactions, fraudulent check writing and email and phone hacking, to name a few.”

Phil Sarna

Founder/senior managing director, PS Business Management

Amy Gittleman Blom

Tara Moore

Patrick Templeman

Managing directors/partners, PS Business Management

Andrew Britton

Managing director, PS Business Management

Abner Monegro

Director, PS Business Management

Amy Hertz

Senior manager, PS Business Management

Sarna, who founded PS Business Management in 2002, has since expanded the company’s expertise to include business management, accounting, financial advisory, financial planning, and royalty and licensing services and broadened its reach to Los Angeles, Nashville and New Orleans. And for all of the difficulties surrounding the pandemic, Sarna says the firm has encountered a trend since “many artists learned the lessons that business managers have always preached: Be smart with your money.” As a result, he adds, artists are asking for more information and are more comfortable having bigger conversations about their finances.

John Shaheen

Partner, Business Wealth & Tax Management

“For us, this year has been about maximizing revenue through earned and unearned income opportunities and simultaneously helping to minimize taxes and expenses via short-term and long-term planning,” says Shaheen, whose firm works with Afrofusion superstar Burna Boy, rapper Rico Nasty, director Gibson Hazard and management firm The Revels Group. In the last year, Burna Boy became the first Nigerian artist to headline New York’s Madison Square Garden and Citi Field, while Hazard directed the music video for Lil Uzi Vert’s Billboard Hot 100 top 10 hit, “Just Wanna Rock,” and the short film for Metro Boomin’s Billboard 200-topping album, Heroes & Villains. “We’ve been working more closely with investment advisers,” Shaheen says, “and continue to support the community through our affiliations with various charitable organizations and foundations.”

Most unusual client investment: “A Dolce & Gabbana two-slice toaster.”

Burna Boy, who is the first Nigerian artist to have headlined New York venues Madison Square Garden and Citi Field, is a client of John Shaheen’s firm, Business Wealth & Tax Management.

Aaron J. Thornton/Getty Images

José A. Silva

Managing partner, Grupo Silva

For Rauw Alejandro’s 2023 Saturno world tour — which grossed over $50 million in revenue across the United States, Canada, Mexico and Europe, according to Silva — his firm structured the financial process, bookkeeping, vendor relationships, venue settlements and taxes. Additionally, Silva says the firm “has been working on helping independent labels along with label management to provide them with the preparation and reporting of royalty statements, mechanical licenses and analysis of income ledgers.”

Notable clients: Wisin, Cosculluela, Zion, Paco López, La Base, Duars Entertainment

Alex Smith

Partner-in-charge of business management, Mann Gelon Glodney Gumerove Yee

Justin Sroka

Partner, Mann Gelon Glodney Gumerove Yee

The addition of new staff specializing in royalties, touring and insurance has helped Mann Gelon Glodney Gumerove Yee better serve its music clients. Today’s tempestuous financial landscape — namely soaring costs and rising interest rates — puts a premium on sound guidance. “The general health of the economy is requiring business managers to plan further ahead and manage client expectations about their finances,” Sroka says. He adds that one current challenge is rising interest rates, which have affected once-soaring catalog valuations and clients’ ability to access liquidity from their music assets.

Most unusual client investment: “Single-edition musical recordings from iconic artists,” Smith says.

Thomas St. John

CEO, Thomas St. John

Krister Axner

Head of legal, Thomas St. John

Pieter Dunselman

Director, Thomas St. John

Luke Henning

Nina Nguyen

Business managers, Thomas St. John

The managers at Thomas St. John are proud of their newly revamped procedures that provide clients with best-in-class accounting, which includes the development of a platform for real-time financial reporting for performers and their teams far beyond current industry standards, according to St. John. They’ve also added AI auditing and process automation, which has resulted in music clients coming in “under budget with a typical 20% improvement in net profits,” he says. He adds that the cutting-edge technology is “unshackling our people from keypads and allowing us to focus on what clients really want: deep insight, objectivity and frictionless service.”

Pressing issue: “The exodus of qualified [certified public accountants] not just from business management but the accounting industry in general,” St. John says. “Long hours, lackluster wages and increasing client demands have driven prospects into other fields and industries.”

Charles Sussman

President, Sussman & Associates

Sussman is watching the “escalation in the mechanical and streaming rates, which will impact the long-term value of catalogs,” he says. Sussman notes that inflation is a particularly pressing issue for touring in addition to securing both equipment and personnel to put on shows. The stock market’s instability is concerning as well, as it can potentially have a negative effect on his clients’ retirement plans, he adds.

Notable clients: Bon Jovi, Jessica Simpson, Bette Midler, Megadeth, Miley Cyrus, Noah Cyrus, Cheap Trick

Lou Taylor

Founder/CEO, Tri Star Sports & Entertainment Group

Tri Star recently took a technological leap with the creation of its own computer operating system, Star Lynx, to serve business management firms and financial advisers for high-net-worth families. “We also developed our own app, which allows clients to see their account balances, transactions and financial information in real time,” Taylor says. “We are really proud of what we have accomplished by developing our own tech in order to serve our clients better.” One trend that concerns Taylor is the recent drop in venture capital investments. “That is important because the creative community are true entrepreneurs with no lack of ideas, so the tightening and accessibility to capital has certainly caused everyone to work harder.” In addition, she notes, “the general impact of inflation, rising interest rates and market volatility requires a constant realignment of goals, wants and necessities.”

Notable clients: While Tri Star keeps its roster confidential, current music clients who have been linked to the firm include Justin Bieber, Reba McEntire, Cardi B, Mary J. Blige, Sean “Diddy” Combs and Meghan Trainor.

José Juan Torres

Founder, Torres

With a client roster that includes Bad Bunny, Residente, Camilo, Villano Antillano and record label La Buena Fortuna, Torres is focused on reshifting priorities to maintain financial health. “It has been a shift of financial assets into cash-related products. We’ve seen plenty of investment opportunities for those clients with healthy cash flows due to rising interest rates,” says Torres, who has also had growth in real estate assets. It’s all part of a “take ownership of your business” approach that Torres espouses for artists, given the “somewhat low royalty rates offered by streaming services.”

Pressing issue: “Keeping track of all content monetization. There are many revenue streams and being able to maintain visibility across all of them is extremely challenging.”

Sally Velazquez

Founder/president, Empower Business Management

As marquee clients at Empower, 21 Savage is planning his first European tour (after getting his green card) and Tinashe has secured a new label deal with Nice Life Recording Company, where she “maintained creative control over her brand and music,” says Velazquez, who also counts iann dior, jxdn, Dinah Jane and Amber Rose among her clients. Creative control and her clients’ income are top of mind for the executive, especially with the rise of AI. “While AI can assist with adding value to the production processes,” she says, “our artists may find competition in AI-generated content, potentially influencing their income streams.”

Most unusual client investment: “Pokémon cards. Oh, the conversations that were had about this one.”

21 Savage, who is a client of Sally Velazquez, founder and president of Empower Business Management, has gained permanent resident status in the United States after years of immigration issues, according to the lyrics of a new song that his collaborator Drake released in October.

Prince Williams/WireImage

Rit Venerus

Founder/senior managing director, Cal Financial Group

Butch Gage

Dan Goscombe

Managing directors, Cal Financial Group

Sarah Dellimore

Amy Self

Directors, Cal Financial Group

Cal Financial’s clients, which include Dave Matthews Band, The Lumineers, ODESZA, Goose, Grupo Frontera, John Mayer and Dead & Company (which concluded its final tour in July), all successfully returned to the road following the pandemic. But now the firm is grappling with how unstable weather conditions are affecting outings. “We have continued to see climate change impacting the business more and more,” Venerus says. “From when and how clients tour to the predictability of travel, weather around live events or insurance companies pulling out of certain markets, climate change will continue to be an evolving challenge for our business.”

Most unusual client investment: “If I had to say, maybe U.S. Treasury bills? While that doesn’t sound unusual, we haven’t seen rates [of return] this high in 20 years. So the amount of activity around Treasurys in the last year has at least felt very unusual.”

Bill Vuylsteke

Scott Adair

Managing partners, Provident Financial Management

Vuylsteke and Adair are particularly proud of merging their respective Provident Financial Management and London & Co. companies to create “the perfect-size firm… big enough to matter and small enough to care,” Vuylsteke says. Looking ahead, he cites the touring industry as a renewed source of income for clients, but he warns of “tight resources and rising costs” affecting transportation and personnel. He says, “Our shared expertise and synergy are a great benefit for existing and new clients as well.”

Pressing issue: “Taxes — domestic and foreign,” Vuylsteke says. “Increased rates, complexity, reduced deductions and inconsistency in foreign territories.”

David Weise

Founding partner, David Weise & Associates, a division of NKSFB

Jaime Masuda

Beth Sabbagh

Rob Salzman

Partners, David Weise & Associates, a division of NKSFB

Weise has been offering financial guidance to three major international tours by clients whose identities he has kept confidential. He has also closed catalog deals for clients including “an iconic producer,” according to the company. Masuda notes the importance of focusing on retention and development of staff “that truly care about their clients’ financial well-being.” Sabbagh says that the “security of our clients’ assets has always been a primary focus, but never more so than with the recent issues in the banking industry.” Adds Salzman: “It’s a race combating inflationary pressures, and being interest rate-conscious whenever assisting clients with financial decisions or managing liquidity is beyond important.”

Dan Weisman

Principal, Bernstein’s Sports and Entertainment Group

Adam Sansiveri

Senior managing director of Nashville/co-head, Bernstein’s Sports and Entertainment Group

Stacie Jacobsen

National director/co-head, Bernstein’s Sports and Entertainment Group

Bernstein’s Sports and Entertainment Group oversees more than $4 billion in assets under management for its U.S. artist and athlete clients. Its investment platform and proprietary analytics also offer clients exclusive alternative investments and help them predict the outcomes of major financial decisions. “We have a seat at the table to advise around complex financial decisions and work with each artist to customize a road map to reach their definition of success,” Sansiveri says. “There is a massive shift in artists wanting to invest in more alternatives, like private equity, but getting them access to the opportunities where the most sophisticated institutions are also investing is something that has set Bernstein apart in recent years.”

Pressing issue: “A lot of artists are making more money now than they could have a decade ago, but for the most part, there is a smaller ‘middle class’ left in the music business,” Sansiveri says. “Macroeconomic factors such as high interest rates and inflation are impacting the music industry in a way they never have before.”

Kris Wiatr

President, Wiatr & Associates

Sarah Hamner

Kim Olson

Valerie Shelton

Partners/senior vps, Wiatr & Associates

“The mental health of the entertainment industry as a whole post-pandemic” is one of the big issues business managers are facing right now, according to Hamner. “The pandemic and cease of work and income not only created an uptick of individuals’ anxiety and fear of financial instability, but it also brought to light other mental health issues that previously may have been ignored.” To help combat financial instability, says Wiatr — whose clients include Mick Fleetwood and HARDY — it’s important to stress “teaching clients to be the CEOs of their businesses” and being “intentional with their spending so that the money lasts.”

Pressing issue: “One of the things our firm makes a priority is establishing employee benefit packages for band and crew when the artist’s company is in a place to offer them,” Hamner says. “When our artists can offer their employees health insurance and/or a 401(k) plan, it not only benefits the employees but also gives the client a tangible way to take care of their staff, which benefits them as a boss and leader.”

Wiatr & Associates counts country star HARDY among its clients.

Monica Murray for Variety

Dwight Wiles

President, Wiles + Taylor & Co.

Robert Taylor

Vp, Wiles + Taylor & Co.

Kevin Dalton

Steve Eggart

Business managers, Wiles + Taylor & Co.

In a year largely defined by getting back to business post-pandemic, the team at Wiles + Taylor & Co. looked toward the future more than the past. Whether examining the rise of successful independent artists or questioning the business strategy of selling an act’s catalog, Eggart says the company has focused in recent months on finding new sources of financial success for its roster. “We are bullish on streaming rates and other revenue sources increasing,” he says. “[We] believe the value of our clients’ assets will continue to grow as well.”

Pressing issue: “The rising costs of touring in all production/transportation areas is very challenging,” Eggart says. “Even though ticket revenues are on the rise, attaining pre-pandemic profit margins is difficult without significant changes in an artist’s touring configuration.”

Colin Young

Founder, C.C. Young

Young has kept growing his firm — which now counts a staff of 38, up from 25 last year — as touring has continued to awake from “its COVID slumber,” with C.C. Young providing “business management, tax mitigation and tax utilization for the very largest tours in the world,” he says. But the firm has also been dedicated to providing its clients with the most transparent royalty accounts in the business, particularly in the digital realm as YouTube, TikTok and digital service providers continue to grow. “We need to source DSP data and not be pushed back with the generic, ‘Sorry, not available under our [nondisclosure agreement],’ ” he says. “We audited $53 million of royalty income and conducted our first audit that reached 100% sample size — the industry standard is 7%.”

Most unusual client investment: “Gold bullion — buried in the garden.”

Bill Zysblat

Co-founder/managing partner, RZO

Tom Cyrana

Lila Sweet

Partners/managing directors, RZO

RZO has distinguished itself among the top tier of business management firms with its sole focus on the financial needs of artists — “no managers, agents, executives, labels, merchandisers or publishers,” Zysblat says — and it stands apart, given the stature of those artists.

Client U2 helped launch a state-of-the-art venue with its residency at Sphere in Las Vegas that began in September. Another client, The Rolling Stones, released its first album of new songs in 18 years with the arrival of Hackney Diamonds in October. A third client, Lady Gaga, guested onstage with both bands.

Steely Dan, David Byrne, Luis Miguel, Shania Twain, Sting, Yoko Ono and the estates of John Lennon and David Bowie, among others, also work with RZO. And the firm recently added the estate of Tom Petty to its roster.

“Anytime you’ve got an artist that defines a particular lane in music, it’s wonderful to be a part of it — to get the next generation to know what the music is,” says Zysblat, who notes he has been a Petty fan since seeing him at The Bottom Line in New York in 1977.

Tom Petty onstage in 2017.

Mark Horton/Getty Images

Two years earlier, in 1975, Zysblat and his late business partner, Joe Rascoff, began advising the Stones — on what was then said to be the group’s last tour — and they formed RZO in 1988. Zysblat is recognized among Billboard’s top business managers this year along with RZO partners/managing directors Cyrana and Sweet. (Former partner and fellow honoree John Gula has retired since last year’s list.)

With four decades of expertise in the economics of touring, Zysblat says: “The last year can be defined by two words — dynamic pricing.” Adjusting concert ticket prices based on demand has resulted in performers, not scalpers, earning top dollars, and “I think it’s perfectly acceptable now to charge market value on a limited number of tickets,” he says.

And the demand for live music? “Never higher,” he says. “Everyone’s on the road. Our clients are doing the best business they’ve done in their careers.” That’s despite touring costs that are higher than ever.

While RZO’s clients include some of the most enduring acts in popular music, Zysblat acknowledges not all artists will have such long careers.

“My message is always the same,” he says. “Except for a handful of artists, it doesn’t go on forever. So save some money. Seriously, put some money away so that when it doesn’t go on forever, you can have a decent life. Save enough money so that it throws off enough [investment] income that you can live. And then if you want to piss away the rest, knock yourself out.”

Contributors: Nefertiti Austin, Starr Bowenbank, Anna Chan, Leila Cobo, Stephen Daw, Elizabeth Dilts Marshall, Bill Donahue, Thom Duffy, Griselda Flores, Lyndsey Havens, Gil Kaufman, Steve Knopper, Elias Leight, Heran Mamo, Taylor Mims, Melinda Newman, Jessica Nicholson, Glenn Peoples, Ronda Racha Penrice, Sigal Ratner-Arias, Isabela Raygoza, Kristin Robinson, Jessica Roiz, Dan Rys, Crystal Shepeard

Methodology: Nominations for Billboard’s executive lists open no less than 150 days in advance of publication, and a link is sent to press representatives by request before the nomination period. (Please email thom.duffy@billboard.com for inclusion on the email list for nomination links and for how to obtain an editorial calendar.) Billboard’s Top Business Managers for 2023 were chosen by editors based on factors including, but not limited to, nominations by peers, colleagues and superiors, as well as music industry impact of cited clients. That impact is measured by metrics including, but not limited to, chart, sales and streaming performance as measured by Luminate and social media impressions using data available as of Oct. 3.

This story originally appeared in the Nov. 18, 2023, issue of Billboard.

[ad_2]

Original Source Link

![ENHYPEN’s ‘[WALK THE LINE SUMMER EDITION] IN CINEMAS’ Concert Film Sets March Release Date ENHYPEN’s ‘[WALK THE LINE SUMMER EDITION] IN CINEMAS’ Concert Film Sets March Release Date](https://charts-static.billboard.com/img/2020/12/enhypen-z2c-344x344.jpg)