This is the third article in a three-part series. The first, on composable CDPs, is here; the second, on composable customer engagement platforms, is here.

In the CDP space, all the talk recently has been about the composable CDP. Not only are there CDPs designed primarily to be composable, like Simon Data, built on Snowflake, but traditional packaged CDPs like ActionIQ are now offering a composable option. In this context, composable means a strong integration with a data warehouse (or “lakehouse”) allowing the CDP to activate data in the warehouse rather than ingest data from the warehouse (and other sources) to create its own, independent, persistent database.

The same trend is seen in the customer engagement space, where platforms like MessageGears, Iterable and Braze pull appropriate data from the warehouse to support personalized, omnichannel customer messaging. It seems clear that these platforms do maintain copies of data from the data warehouse in order to be ready to respond to customer actions in real-time; where swift retargeting in response to customer actions is a perceived need, that data may be stored for a year or two.

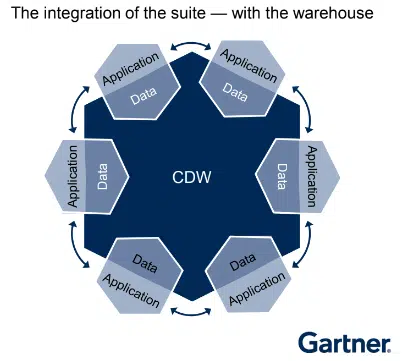

What happens when more and more applications adopt this composable structure — marketing automation, for example? In the view of Gartner analyst Ben Bloom, we might see the “unbundling” of apps and data across the board.

Dig deeper: What the composability revolution means for customer engagement

The unbundled martech stack

What does that mean? Martech stacks have traditionally been composed of a series of more or less well-integrated applications, mostly maintaining their own native datasets. DAM has its data, marketing automation has its data, CRM, social media and so on. In a sense, the traditional packaged CDP was intended to ease this problem, acting as a single source of truth for customer data.

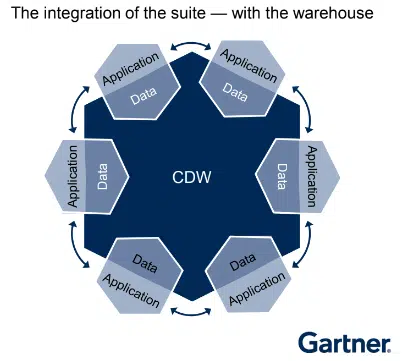

If the trend towards centralizing both customer and other business data in a data warehouse (Amazon Redshift, Google Big Query, Databricks, Snowflake, etc.) continues, we can imagine a stack in which there is one data repository and a series of apps, unbundled from the data, forming a layer “where we do the work,” as Bloom says.

But is this vision of the future (oversimplified, admittedly, but made clear by the representation from Gartner) actually realistic?

Dig deeper: Cloud data warehouses set to disrupt the martech stack

Composable CDPs don’t yet dominate the space

First, it’s worth noting that, for all the widespread discussion of the composable CDP, it doesn’t yet dominate the CDP space. So much was made clear in some recent research from David Raab at the CDP Institute. Just looking at Google search volumes, the term “CDP” is still much more searched than the term “composable CDP.”

“While the CDP industry has definitely stalled, the reason is far from clear,” the Institute says. Composable CDPs may be growing at a slightly faster rate (based on number of employees) than traditional, packaged CDPs, but not enough to explain the slowing down in the traditional CDP market.

The numbers speak for themselves, but don’t demonstrate that composable CDPs won’t dominate the space in the future. They might still be climbing towards the peak on the Gartner hype cycle.

Dig deeper: What the composability revolution means for CDPs

A reality check on ‘unbundling’

Kevin Wang, chief product officer at Braze, a customer engagement platform that can pull data from data warehouses, finds the “unbundled” stack model plausible for some applications — for example, for analytics apps that just need to scrutinize data that previously came from a range of different sources without taking any action. “I don’t think that’s going to be applicable to Braze at all. We do activate data that comes from a data warehouse, but we are ourselves generators of first-party and zero-party data. Also, we need to have data in order to have that real-time responsiveness that is key to the use cases that we make possible.”

Raab’s reaction to the unbundling of apps and data bordered on the incredulous. “Are they really not going to have their own data?” Even if an app plugs into the warehouse, it’s still going to make its own copy of some of the data. “The more interesting thing is whether you have a central platform or not,” he said. “It could be a data warehouse or the Salesforce Data Cloud, or the data platform Adobe has, and then you have applications that sit on top of that platform. But that’s an architecture we’ve been dealing with for a long time. That has nothing to do with composability per se. I don’t think everything is going to access the warehouse directly; I’m sure not.”

What we’re dealing with then, yet again, may not be so much a complete overhaul of the martech stack but a swinging pendulum. For years, the martech pendulum swung between all-in-one marketing technology suites and collections of point solutions somehow bolted together (what Pega’s Alan Trefler 10 years ago called the Frankenstack).

Recently, the pendulum became somewhat stable over the middle ground of a central hub (often one of the big suites) with select point solutions plugged in — a situation acknowledged by the growth, for example, of HubSpot’s and Salesforce’s app marketplaces.

What we now have, however, is a new dimension for the pendulum to swing in. Between the app-plus-data world and the utopia, Ben Bloom suggests, of apps and data uncoupled.