2022 saw notably less funding for marketing technology than previous years, but there were significantly more new product announcements, feature updates and M&A activity throughout the year.

At CabinetM, we’ve built a marketing technology directory of 15,000+ products to drive our marketing technology management tools. Managing a directory of this size means keeping track of new products, new categories, acquisitions and their associated name changes, as well as unfortunate company and product implosions.

For the last six years, we’ve published this information weekly in our Friday newsletter to help marketing teams stay abreast of shifts and changes. In late 2020, we decided to take a quarterly view to look at trends in product and category direction. Since then, we’ve been publishing our MarTech Innovation Report every quarter. What follows are the key findings from our 2022 year-end report.

New product launches

In 2022 there were 376 new product announcements reflecting the output of the investment made in marketing technology companies in the previous two years. This was a significant jump from 225 in 2021.

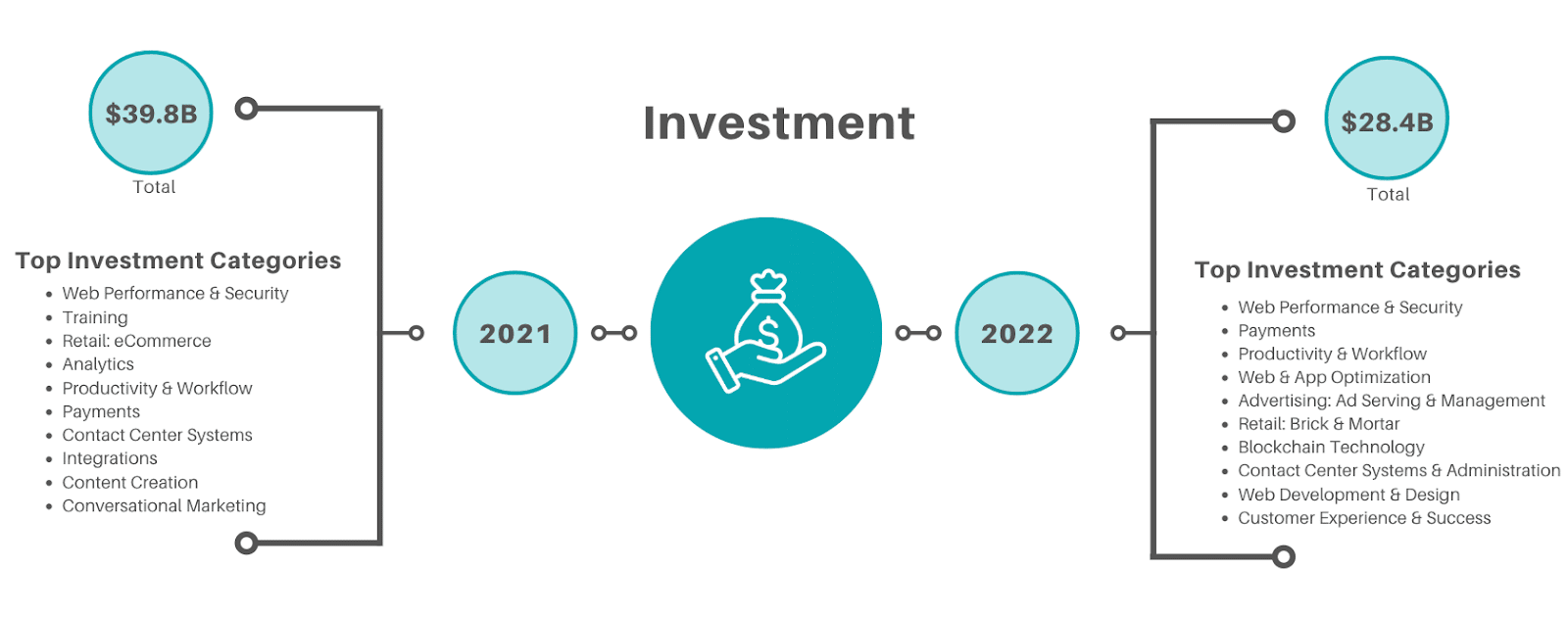

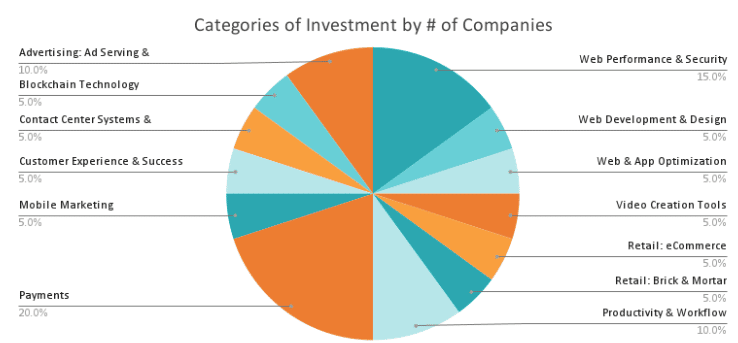

Investment

In contrast, investment in martech companies dropped from $39.8B in 2021 to $28.4B in 2022. It’s important to note that these numbers do not include investment in AI content creation startups which we did not start to track until late Q4.

This would certainly have increased the overall numbers for 2021 and 2022 but may not have impacted the relationship between the two years.

We believe that economic uncertainty and martech “investment fatigue” were key factors in the downturn in investment.

Mergers and acquisitions

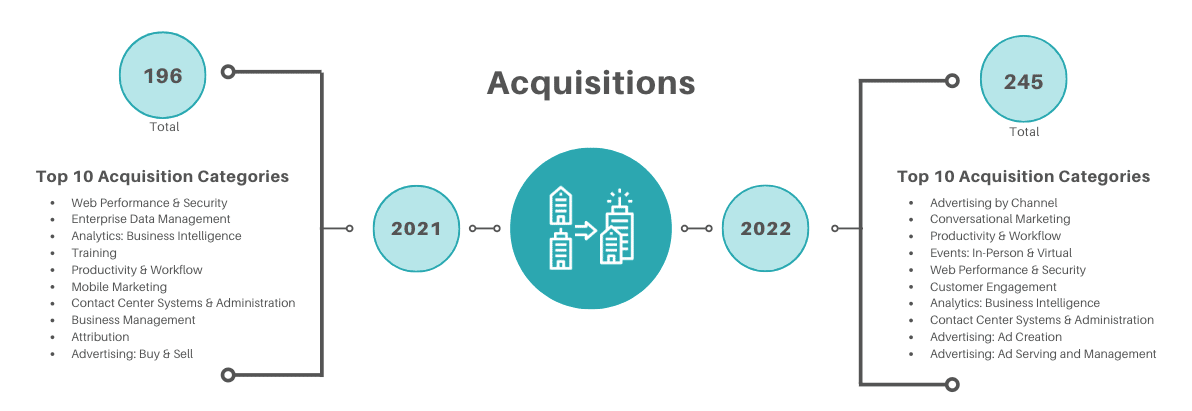

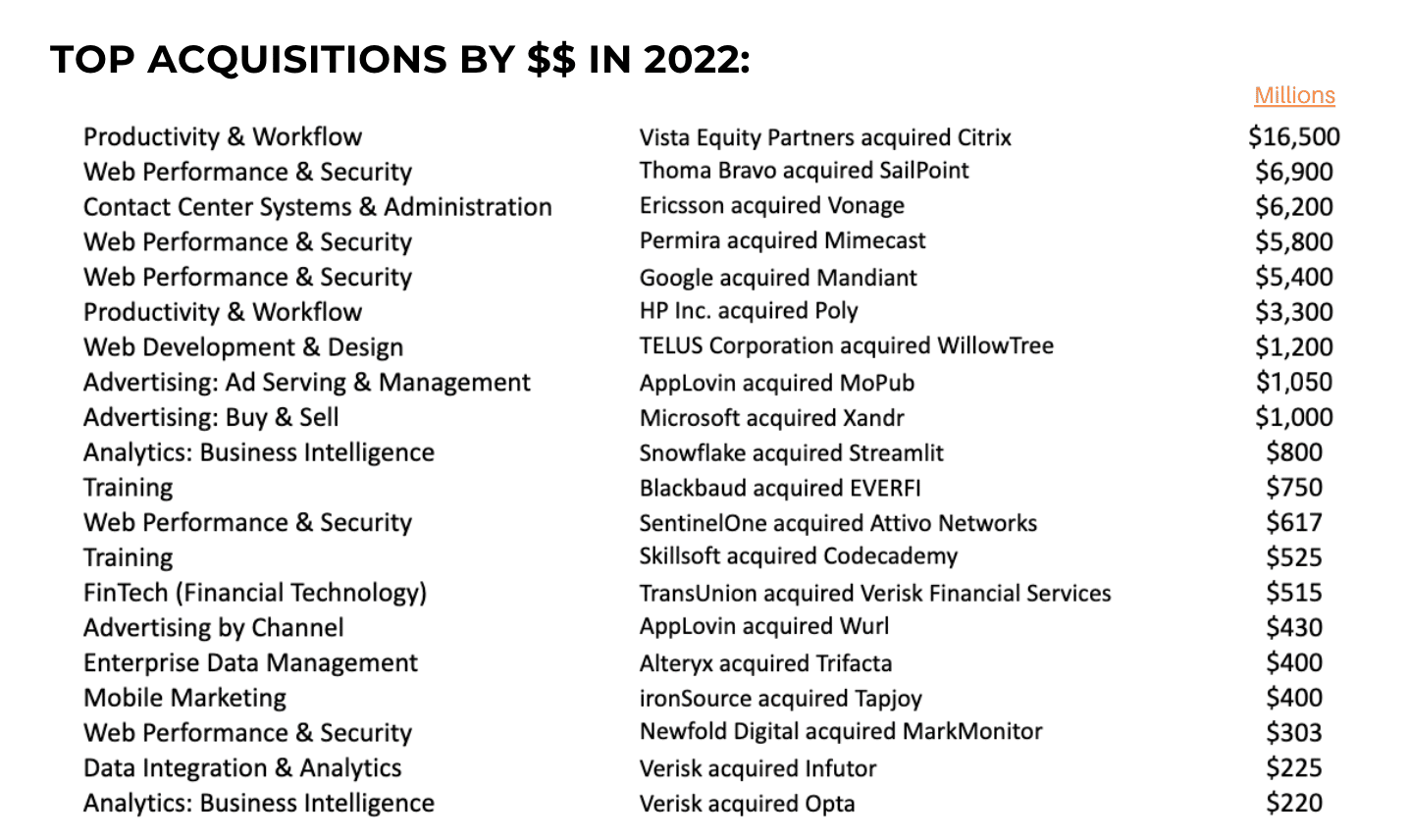

Looking at M&A activity in 2022, there were 246 acquisitions for a total value of $54.9B in disclosed purchase amounts compared to 196 in 2021 for a higher total value of $101B in disclosed purchase amounts.

Martech in 2023 and beyond

So where does this leave martech as we move into 2023?

With so much uncertainty about the global economy, most companies are taking a more conservative approach to marketing, marketing spend and technology. Budgets are tightening and the pressure to meet revenue objectives will be intense.

Against this backdrop, there continues to be a steady drumbeat about the need to consolidate the number of tools in the industry and individual martech stacks. With more than 15,000 products on offer, it does not appear that the industry is consolidating as a whole.

Reducing the number of products in individual martech stacks continues to be a topic of conversation. This is a simple and unrealistic answer to budget constraints.

If reducing the number of products negatively impacts revenue, what have you accomplished? Technology expenses may shrink but the cost of customer acquisition will rise and revenue goals will be missed.

Rather than focus on reducing the number of tools to reduce expenses, marketing teams should rationalize their stacks to eliminate contract, product and functional redundancies and discard products that no one is using.

At the same time, there should be an ongoing evaluation of stacks to ensure that tools are fully utilized, contributing to marketing and corporate objectives and performing as expected.

It continues to astonish me how few companies know what’s actually in their stack or how well those products are performing. Sooner or later there will be a reckoning and hopefully, it will be because of budget overruns and not because of data privacy or security issues which is a real risk when flying blind.

If it were up to me, I’d anoint 2023 as the “year of stack rationalization.”

Dig deeper: 5 strategies B2B marketing and sales teams can bank on as markets tighten

You ain’t seen nothin’ yet

Despite economic concerns and what may be a difficult year for the industry, the outlook for martech looks great. There’s a tendency to say that the technology landscape is too big and over-invested, to which I say “ridiculous.”

Martech is not one homogenous industry it is made up of more than 500 different categories some of which have been over-invested (how many more CRMs do we need?), while others are brand new and generating a ton of excitement (i.e., AI-driven content).

Innovation in our industry is driven by changing consumer behavior, new channels to market, an increasingly fragmented prospect base, regulations and technology innovation.

Scott Brinker captures this in his article, “2023 will be a chaotic year for martech, yet the start of a massive wave of growth” — a must-read for anyone in and around the industry.

Brinker predicts that growth in the next seven years will dwarf anything that we’ve seen to date driven by what he refers to as new technology S-curves which he defines as:

I’d add data to this list (collection, compliance, compilation and enabling personalization).

I’m with him… there’s so much innovation ahead. In the meantime, use this year to rationalize, review and refine your stack.

You may download CabinetM’s full 2022 year-end MarTech Innovation report here. (Note: The report is not gated and downloading will not result in annoying emails and phone calls.)

Get MarTech! Daily. Free. In your inbox.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)