[ad_1]

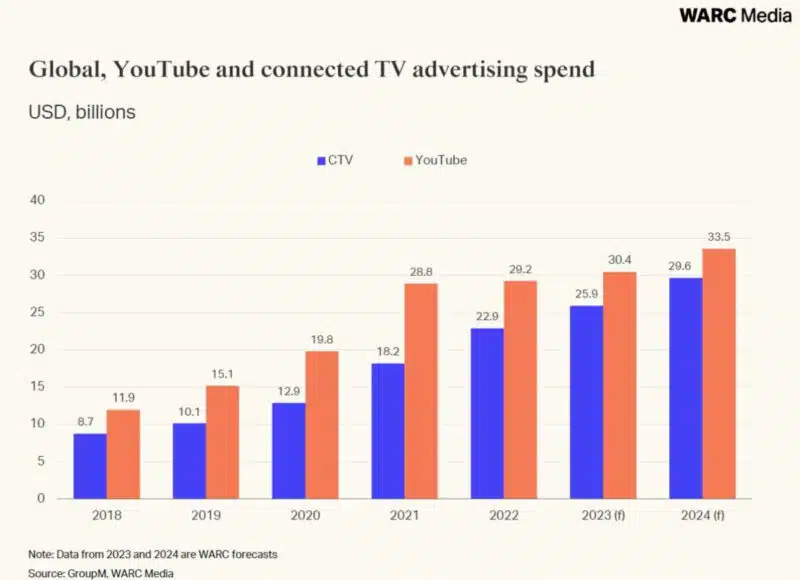

Connected TV (CTV) ad spend is expected to reach $25.9 billion globally this year, up 13.2% year-over-year, a new study from WARC Media found. Although it’s a promising sign for CTV, it falls short of the growth seen in retail media networks (RMNs) and YouTube.

“The market is fragmented, and CTV ad investment is mainly being drawn from existing budgets,” said Alex Brownsell, WARC Media’s head of content, in a release. “More work must be done to help CTV to realize its full potential and ensure that media owners are able to attract ad dollars from beyond the current confines of the TV market.”

Another recent study projected 21.2% growth for CTV this year.

CTV vs. retail media. CTV is growing at a three-times slower rate than retail media at a similar point in its development, the report found.

Here’s a chart showing the growth of both markets after reaching $10 billion in revenue. CTV hit this mark in 2019, while retail media did so in 2015.

CTV vs. YouTube. YouTube wasn’t included in the CTV numbers even though it provides a subscription streaming service. That’s because YouTube’s projected revenue is 17.4% greater than the entire CTV ecosphere.

Dig deeper: Why video is the marketing channel you can’t afford to miss.

Why we care. We’ve seen a number of retailers build out their RMNs in the last two years. The market is larger, and has been around longer, than some might realize. CTV (OTT and smart TVs included) offer different experiences to customers than traditional linear TV. Yet, advertisers are largely taking money from the linear TV budget to spend in CTV, which doesn’t match the new value CTV can potentially create for advertisers.

[ad_2]

Original Source Link