When looking at martech vendors and marketplaces, we’ve gotten used to quadrants. They provide a simple visual to plot key players in an industry — almost like a horse race.

At a time when most technology marketplaces have hundreds of products — each claiming to be a leader — such a graphic can help simplify creating a shortlist of vendors to explore when you start your evaluation journey.

However, there are several problems with the popular quadrant-based shortlisting approaches, and I’ve seen many large enterprises make poor decisions based on them.

Different requirements but single quadrant?

Every enterprise is different. For martech especially, we’ve found that customer maturity, needs, emphasis, capabilities, budgets, architectures, incumbent environments and priorities will differ, including across enterprises within a single industry.

Over the years, we have noticed that — regardless of what vendors claim — they are not always equally good at addressing all business use cases. Moreover, each organization wants to solve different use cases. Therefore, what’s a good fit for one organization may not be a good fit for another.

However, vendors and their industry analysts often disregard these differences and tend to think that most or even all customer requirements resemble each other. Due to this misperception, vendors often claim their platforms can solve different types of requirements equally well. Analysts develop two-dimensional quadrants with generic winners and losers as if it were a horse race.

But martech decisions are not a race; the reality is much different. Consider the following:

- Traditional analyst quadrants tend to hide more than they show. For example, a customer may never know why one vendor got placed at (x, y) and another one at (x1, y1).

- Static quadrants often include only a small subset of an overall marketplace and often miss out on highly suitable candidates. Many mature marketplaces, such as WCM and DAM, have many vendors. You can often find solid regional vendors and functionally specialized vendors. If you use a static Quadrant with 8-10 vendors, you are likely to miss out on vendors who may offer a better fit for you.

- At least some of the vendors on the quadrants are also customers of quadrant-makers. So there’s a clear conflict of interest there.

- Static quadrants assume generic winners and losers when the key consideration here is vendor fit for your specific circumstances.

That last problem is perhaps the most pernicious, and I’ve seen many enterprises overbuy or otherwise look at the wrong vendors as a result. Let’s explore an alternative approach where your specific requirements and sense for strategic trade-offs really matter.

Dig deeper: 6 things martech vendors don’t want you to know

Shortlisting based on vendor fit

For illustration purposes, let’s look at the marketing attribution marketplace, where we critically evaluate ten vendors.

For marketing attribution, most enterprise needs fall within five archetypal scenarios:

- Marketing mix modeling.

- Multi-touch attribution.

- TV attribution.

- B2B attribution.

- Omnichannel attribution.

Almost every one of those ten vendors will claim they can handle all of these scenarios. In reality, though, we have found that most vendors are good at only one or two of the above.

In addition, several strategic factors about vendors are equally, if not more, important than the product itself. These include channels and vendor professional services, their strategy, what’s on the roadmap, technical support, etc.

As an example, Product X has all the features that you require, but it doesn’t provide any professional services in your geography. Does it even make sense to have it on your shortlist? Perhaps so, but you should understand the implications.

Let’s then look at how these factors come into play using two examples.

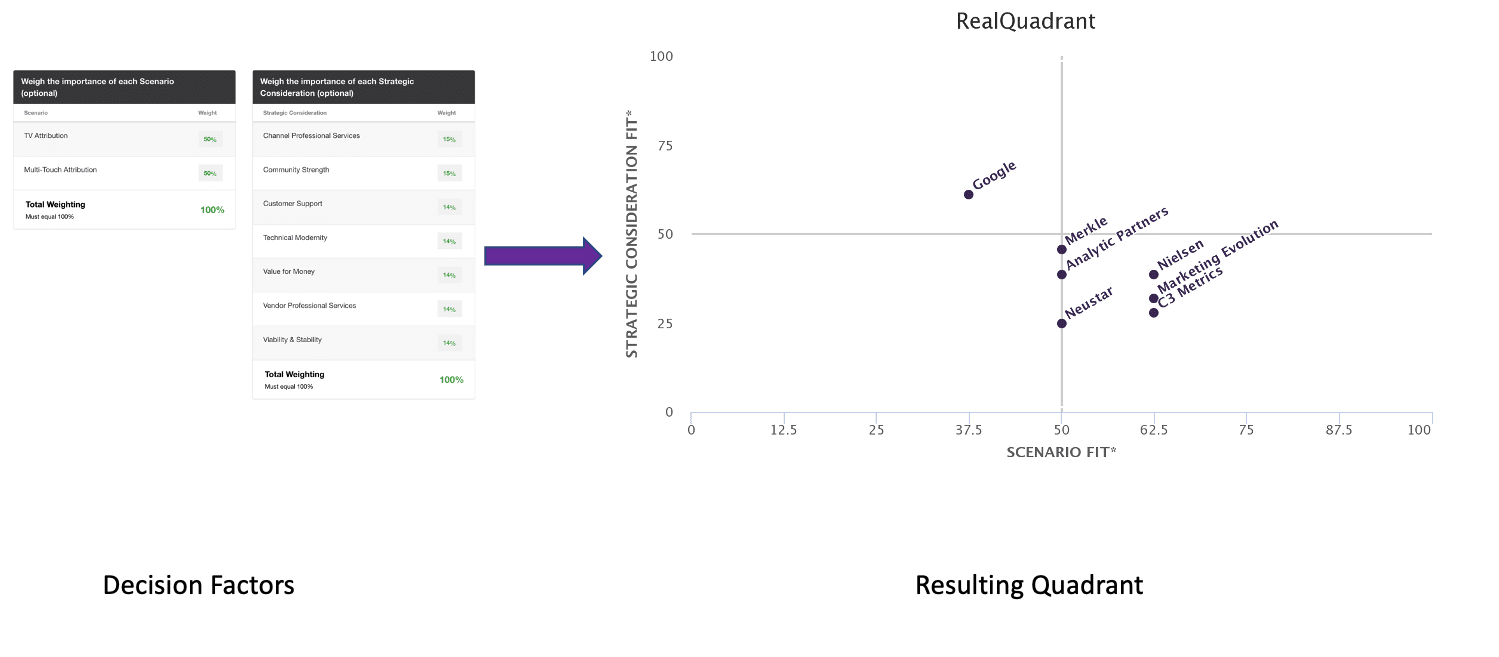

Case 1: An FMCG firm

This hypothetical fast-moving consumer goods (FMCG) firm wants to address the following two scenarios. They think both these scenarios are equally important to them:

- TV attribution.

- Multi-touch attribution (MTA).

They have also listed the following strategic factors important (all equally important) to them:

- Channel professional services.

- Community strength.

- Customer support.

- Technical modernity.

- Value for money.

- Vendor professional services.

- Viability and stability.

Based on these inputs, their shortlist looks as below:

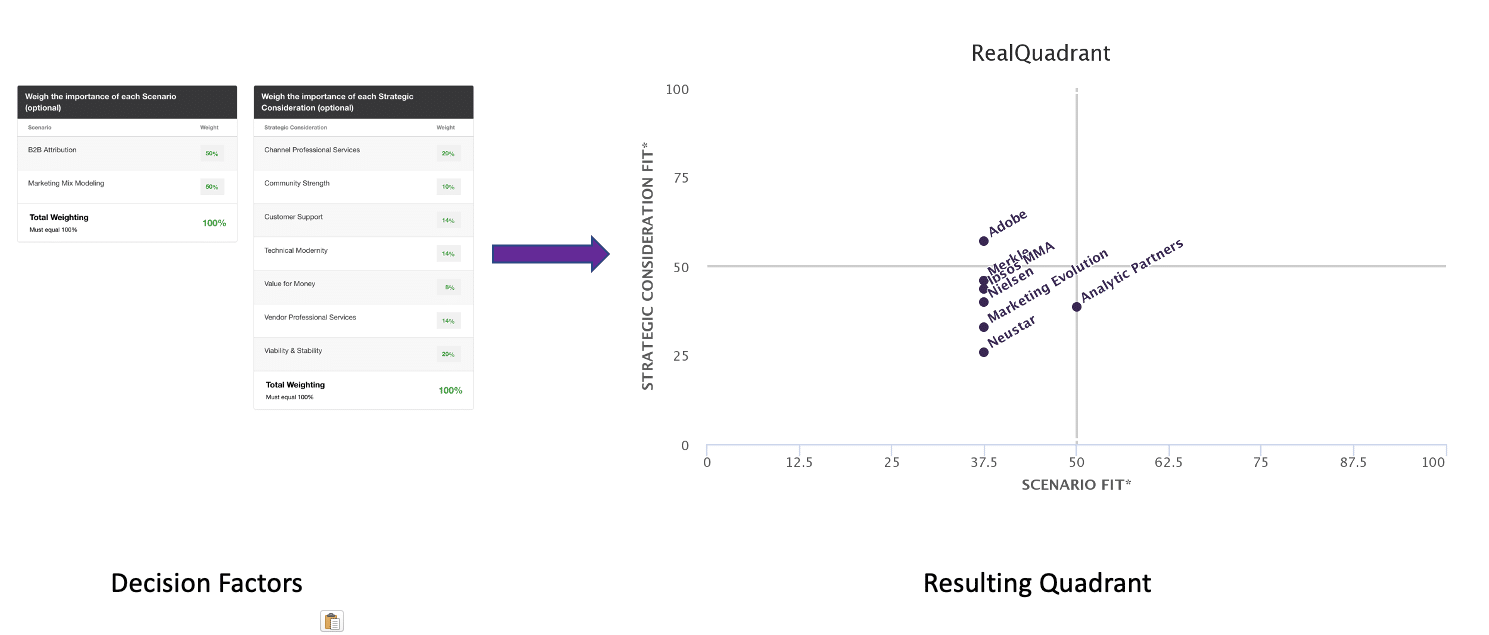

Case 2: A B2B equipment manufacturing firm

This hypothetical B2B firm wants to address the following two scenarios:

- B2B attribution.

- Marketing mix modeling.

They consider both of these scenarios as equally important to them. Notice that they don’t consider the other scenarios relevant to them.

They have also listed the following strategic factors important to them. While factors are similar, they’ve given different weights to “viability and stability” and “channel professional services.”

- Channel professional services.

- Community strength.

- Customer support.

- Technical modernity.

- Value for money.

- Vendor professional services.

- Viability and stability.

Based on these inputs, their shortlist looks as follows:

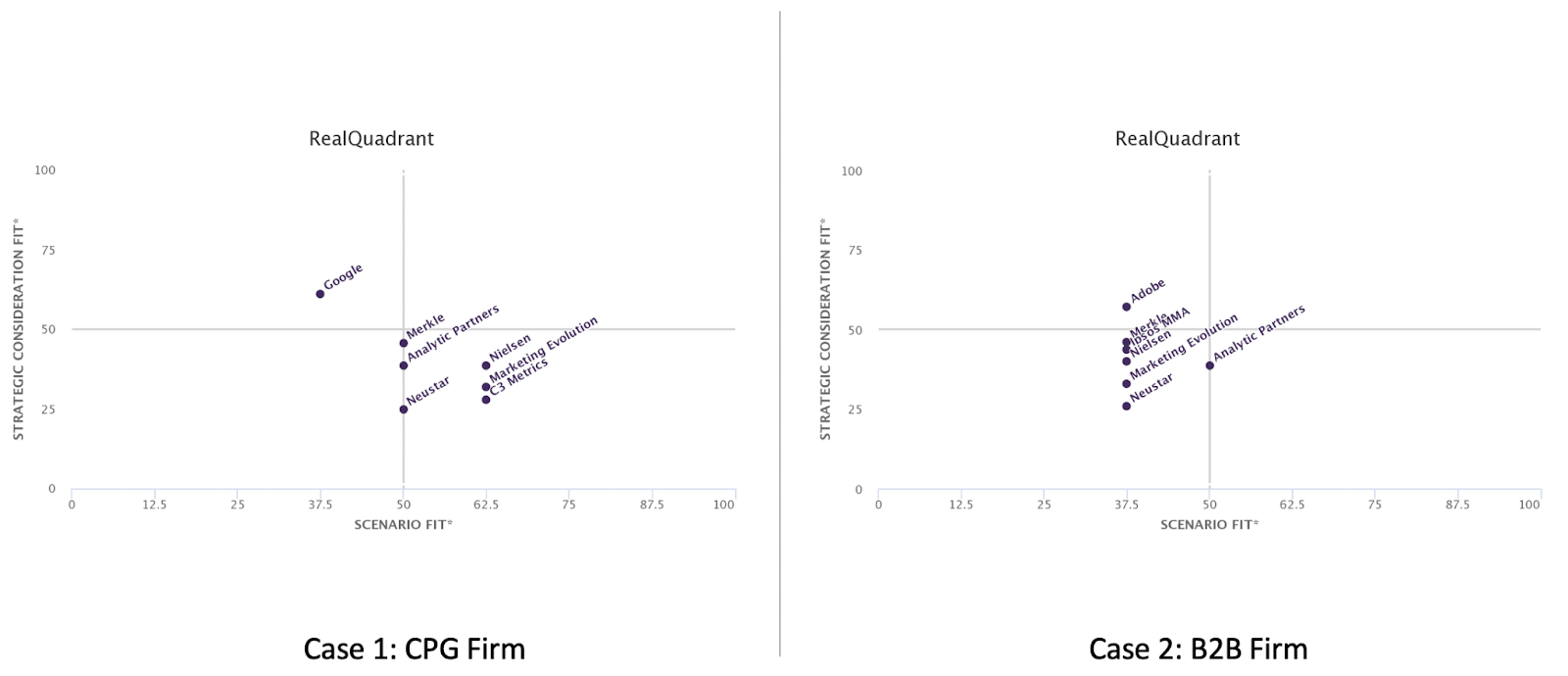

Notice that the quadrants generated due to specific requirements and strategic considerations are very different. Not only will you find different vendors on the quadrants (Google and C2 Metrics in case 1 vs. Adobe and Ipsos MMA in case 2), but their relative positions also differ based on their relative strengths.

Dig deeper: How to choose the right martech partner: 6 practical tips

What should you do?

Vendors will always claim broad applicability for their platforms. However, since software development is all about trade-offs, each platform (and vendor) will inevitably bring certain strengths in terms of what they can do best.

For example, in the marketing attribution marketplace, some platforms can do media-mix modeling better than others, while others can be better at B2B attribution.

Therefore, the key is to:

- Align around and prioritize canonical scenarios.

- Prioritize strategic considerations.

Remember, your requirements or combination of requirements will almost always differ. You may seek a similar set of functionality, but there are always differences in how you will deploy that functionality. That’s why you need to get out of a horserace mentality and step up a level to focus on business use cases rather than a laundry list of checklist requirements.

Dig deeper: A practical guide to building a marketing technology stack

function getCookie(cname) {

let name = cname + “=”;

let decodedCookie = decodeURIComponent(document.cookie);

let ca = decodedCookie.split(‘;’);

for(let i = 0; i <ca.length; i++) {

let c = ca[i];

while (c.charAt(0) == ' ') {

c = c.substring(1);

}

if (c.indexOf(name) == 0) {

return c.substring(name.length, c.length);

}

}

return "";

}

document.getElementById('munchkinCookieInline').value = getCookie('_mkto_trk');

The post Beyond quadrants: An alternative approach to martech selection appeared first on MarTech.