A pair of influencer marketing platforms were acquired by agencies this week, in a sign the advertising industry sees a future in influencer-led strategies that’s bright enough to attract investments in the technology behind them.

The larger of the two acquisitions was announced on Thursday, when Publicis Groupe said it entered into a definitive agreement to acquire Influential, the largest influencer marketing platform in the world in terms of revenue.

On Wednesday, Stagwell announced it acquired LEADERS, a digital agency specializing in influencer marketing and its InfluencerMarketing.AI (IMAI) SaaS platform. Stagwell is adding the influencer capabilities to its Stagwell Marketing Cloud’s PRophet Comms Tech Suite of tools for PR and marketing professionals.

Publicis Groupe acquires Influential

Publicis and Influential is a combination of two of the biggest players in their sectors. Publicis is one of the major advertising agency holding companies and Influential is the largest player in the relatively young influencer market platform space.

Marketers and agencies use Influential to connect brands with creators, much like marketers use online platforms to find freelance designers or writers. But Influential operates more like a dating site of sorts, relying on data to help match the right creator with the right brand.

According to Influential, its AI-powered platform has 100 billion data points and includes 3.5 million creators, including 90 percent of influencers around the world with more than 1 million social media followers. Creators on Influential currently work with more than 300 brands around the world, the company said.

Bringing the market leader in influencer marketing into the fold will bring a boost to Publicis and its agencies. A centralized platform for finding creators certainly beats reaching out via social platforms and email to find the right fit. But make no mistake, this marriage — like many in marketing today — is built on data.

Publicis put Epsilon, its data-tech platform, at the center of its business, where it delivers a wealth of information about consumers. It is betting on the combination of the data in Epsilon and the data points in Influential to create stronger bonds between brands, creators and consumers.

Dig deeper: Influencer marketing: The bridge between B2B brands and genuine connections

Stagwell adds LEADERS and InfluencerMarketing.AI

Stagwell’s acquisition of LEADERS and IMAI is aimed at increasing the capabilities Stagwell provides marketers through its Stagwell Marketing Cloud. By integrating influencer marketing into its platform, which already includes tools for PR and media, it’s putting influencer tactics at the fingertips of its users.

IMAI also relies on AI, which it says helps connect marketers and creators worldwide. Notable users of the SaaS platform on the brand side include Coca-Cola, Estée Lauder and Superdry.

Why we care: Influencer marketing is now big business. According to Publicis, influencer marketing is the fastest-growing segment of social media marketing. By next year, Publicis expects $186 billion will be spent on social media marketing. If that happens, it will mark the first time social media surpasses global linear TV ad spend.

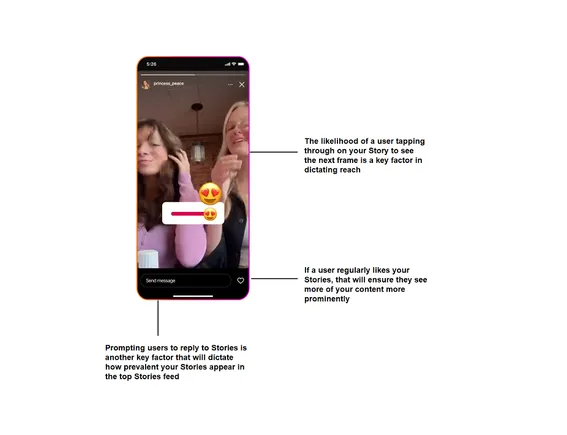

Social and influencer spending can’t reach such lofty heights if marketers can’t scale their efforts. Finding and engaging with creators and then agreeing on terms takes time. Influencer marketing platforms are the shortcut that makes it faster to find creators and then plan, launch and monitor campaigns.

Influential and IMAI aren’t the first influencer platforms to be acquired. In 2023, Meltwater acquired Klear and Triller acquired Julius. MarkNtel Advisors values the global influencer marketing platform market at $14.1 billion in 2024 and expects it to grow at a compound annual growth rate of 38% from 2024 to 2030.