It is not often that a thoughtful newspaper like the Financial Times gets it backwards. In a recent editorial, the FT examined the trend for outflows from ESG funds. It stated that ‘the lustre of ESG has largely been dimmed by politicisation.’ This is what has it exactly backwards.

ESG is not a financial issue that has been politicized. Rather it embodies a set purely political issues that have been inappropriately financialized.

‘ESG’ is about what we see as the role of business in our society. How we view environmental, climate and other externalities. How we think about the social benefits and harms brought about by business behaviours. Whether we want to keep accepting things like child and slave labour in the supply chains of the products we purchase. How we evaluate globalized business activity in an era of heightened concerns about national security. And more.

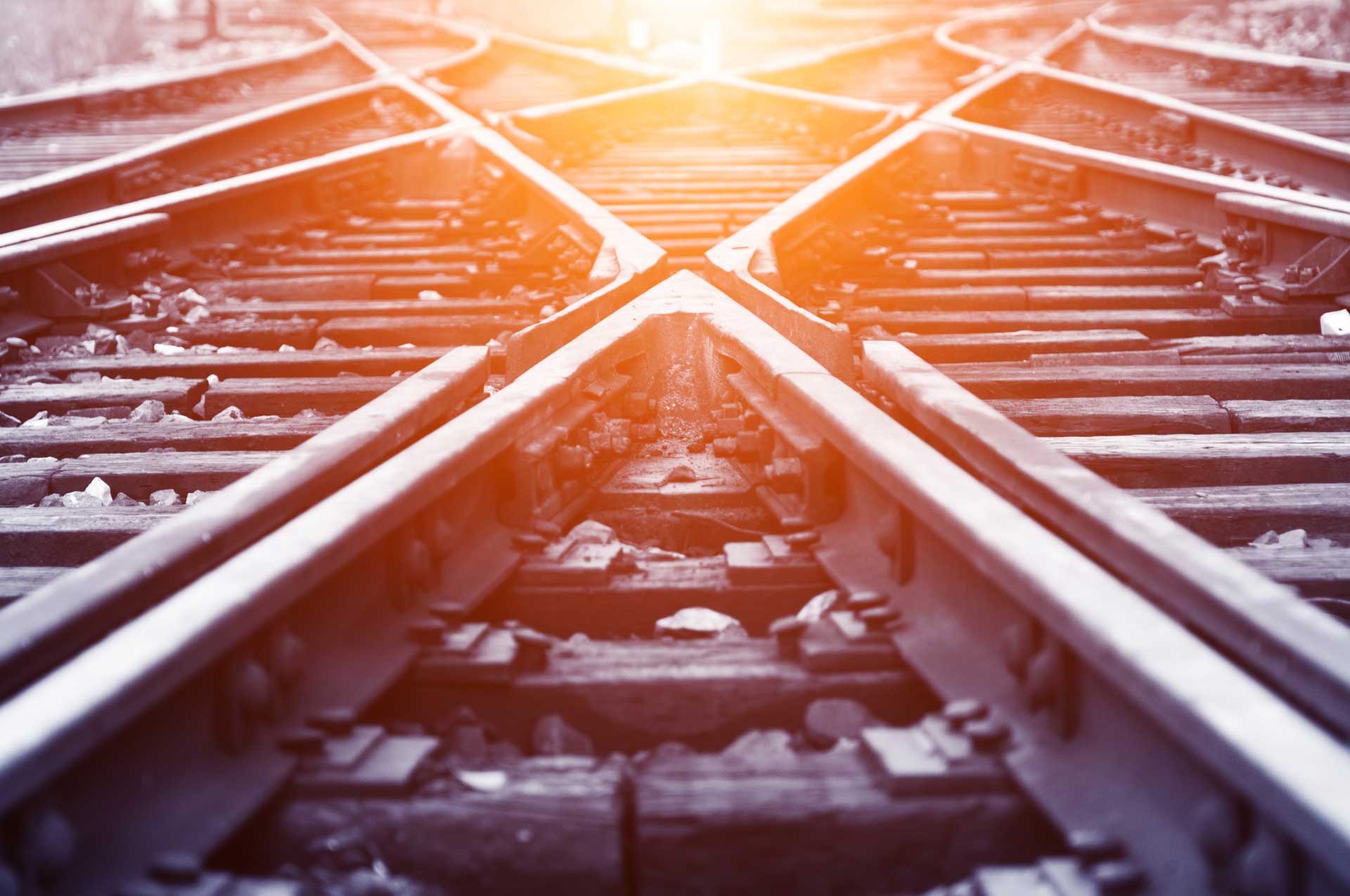

All these are purely political issues. They will be discussed in public debate and our social mores and moral intuitions will change as that debate progresses. As in all political debates, there will, rightly, be different views clamouring to be heard; each trying to prevail. There will be different perspectives on what should be considered ‘progress.’ The process of change will not be neatly linear. It will tack this way and that as we seek to explore that which will end up having the broadest level of public support.

Lost in financialization

Yet, the purely political nature of ESG discussion has been lost in a discreditable process of financialization. The narrative that ESG was the route to increased profitability for all gained traction – though it has always been a mystery to me how internalizing externalities would improve short-term profitability.

Consequently, the belief was that shareholders were the route to driving change. A muddled and inconsistent set of metrics has emerged that has cast a fiendish spell on the whole process. Corporations went along with ticking the boxes thereby effectively allowing external rating agencies to define their business approach rather than doing it for themselves in ways that are appropriate for their own business. Generic ESG compliance programmes were sold and eagerly bought.

Stock pickers welcomed the opportunity to take shortcuts. They swallowed both the delusion of a direct financial link between ESG and short-term profit performance, and the idea that using generic metrics of ESG performance served up by outside agencies was the way to go. Much more convenient than doing one’s own analysis in much the same way as they would analyse for themselves companies’ financials, R&D pipelines and future prospects. The launch of ‘ESG funds’ further embedded tokenism and financialization. As one executive in a private equity owned business said to me when I asked why they had an ESG programme ’It’s so that we can access the monies in ESG funds when we flip the business.’ Financialization complete.

Companies, wanting to see short-term financial gains from their ESG efforts, tried to gain advantage by shouting from the rooftops about the most minor changes that were in line with ‘ESG’ metrics. None of that could possibly last.

It was only a matter of time before the attempt to reduce the complex, fuzzy and ever-evolving politics around the role of business in our societies to simplistic technical, measurement and compliance exercises would collapse. As was the idea that investors (if one can call ‘investors’ those that hold company shares for, in the US, an average of 5.5 months) were the route to driving what are challenging and long horizon changes in what society expects from the business community.

The FT editorial, as expected, got much of it right: ‘The principles underlying the ESG boom are also becoming entrenched.’ There is little doubt that societal expectations around how businesses do business in the 21st century has changed and will continue to change. Corporations would do better to ignore all the hype around meeting and reporting short-term metrics as an end in itself, instead focusing on whether some of those metrics may be helpful as they determine the future strategic direction of their business.

We’re still a way away from that. Research shows that some 70% of companies have not incorporated ‘ESG’ concepts into their strategic decision-making. Instead, they remain enveloped in the financialized and mechanistic concept of ESG – a route to nowhere. The 30% who seem to have moved in a more strategic direction will have a head start.

ESG is dead. Long live ESG (or whatever we will choose to call it tomorrow).

The era of financialized ESG is, hopefully, drawing to an end. I suggest that in a few years’ time ESG funds will no longer exist. Instead, we will become focused on what we should have always been focused on: which companies are positioning themselves to remain successful as the politics surrounding business activity continues to change? As social mores evolve and expectations shift?

Opposition to change is inevitable and to be expected. But the direction of travel is clear even if the end destination and the route to getting there remain hazy. Despite short-term volatility of opinion as part of the political debate, there will be no sustained turning of the tide (and another four years of a Trump White House – if that were to happen – will not change that). After all, let’s remember that the slave traders and plantation owners objected vehemently to the abolition of slavery because of its impact on their profitable business model.

Think of those political forces that still seem to believe that, in business, anything goes so long as it makes more money right now as the rightful heirs to those slave traders and plantation owners. They will screech, squeal and squeak, but they’re on the wrong side of history.

Written by Dr. Joe Zammit-Lucia.

Have you read?

How Senior Leaders Can Elevate Employee Performance and Accelerate Retention.

R U OK Day: How CEOs Can Build Emotional Resilience in Their Teams.

The 3 Secret Ingredients for Making Big Bet Decisions.

Building a culture of commitment.

Corporate Social Responsibility (CSR): A CEO’s Perspective on Integrating ESG for Sustainable Growth.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine’ prior written consent. For media queries, please contact: info@ceoworld.biz

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)