After a long stretch of undershooting investors’ expectations for Economic Profit (EP) growth and Total Shareholder Returns (TSRs), OEMs find themselves in an unfamiliar role: high performers.

Automotive OEMs have historically struggled to deliver the typical profit growth expectations set for most industries. The automotive industry’s high capital intensity, narrow margins and long product cycles challenged companies’ ability to consistently grow EP.

However, as new-vehicle supply tightened, expectations for battery-electric vehicles (BEV) rose, vehicle pricing increased and investor expectations began to rise.

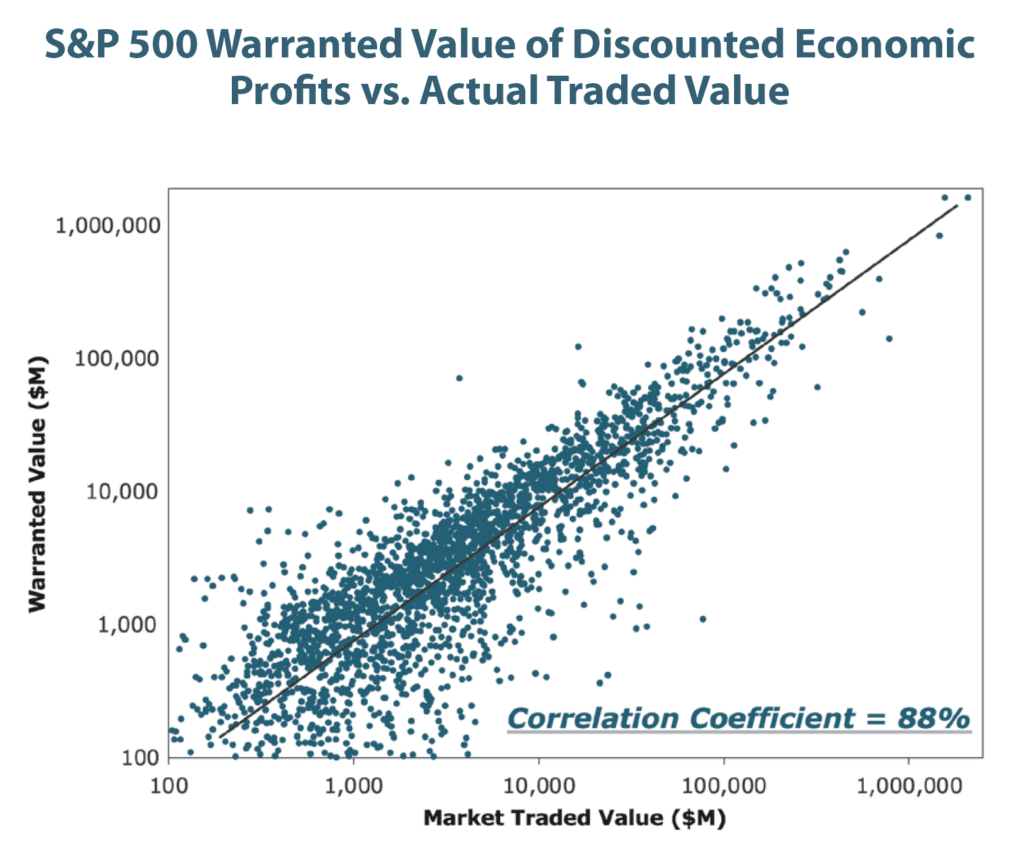

The best measure of a company’s success is delivering superior shareholder returns compared to its industry peers. Since shareholder value is driven by investor expectations of future cash flow and EP growth (See S&P 500 Warranted Value of Discounted Economic Profits vs. Actual Traded Value chart, below), EP has been used as the profitability metric for AlixPartners’ Automotive Value Creation study.

To sustain the recent increase in their TSRs, OEMs, like any other public company, will need to exceed investors’ already-high expectations for EP growth.

CHARTING THE MOMENTUM

To understand the backdrop, consider the three-year period leading up to January 2020. During this time, the industry’s EP growth was challenged as margins were squeezed by declining global volumes and high fixed costs. As a result, OEM TSRs underperformed the S&P 500, delivering 5 percent TSRs versus 15 percent for the broader market.

However, from December 2020 to December 2021, investors raised their outlook for OEM EP growth as supply tightened and pricing firmed, reflecting an expected rebound in U.S. auto demand, including increasing demand for BEVs, greater OEM pricing power and emerging growth in higher-margin and recurring subscription-based software and service revenues.

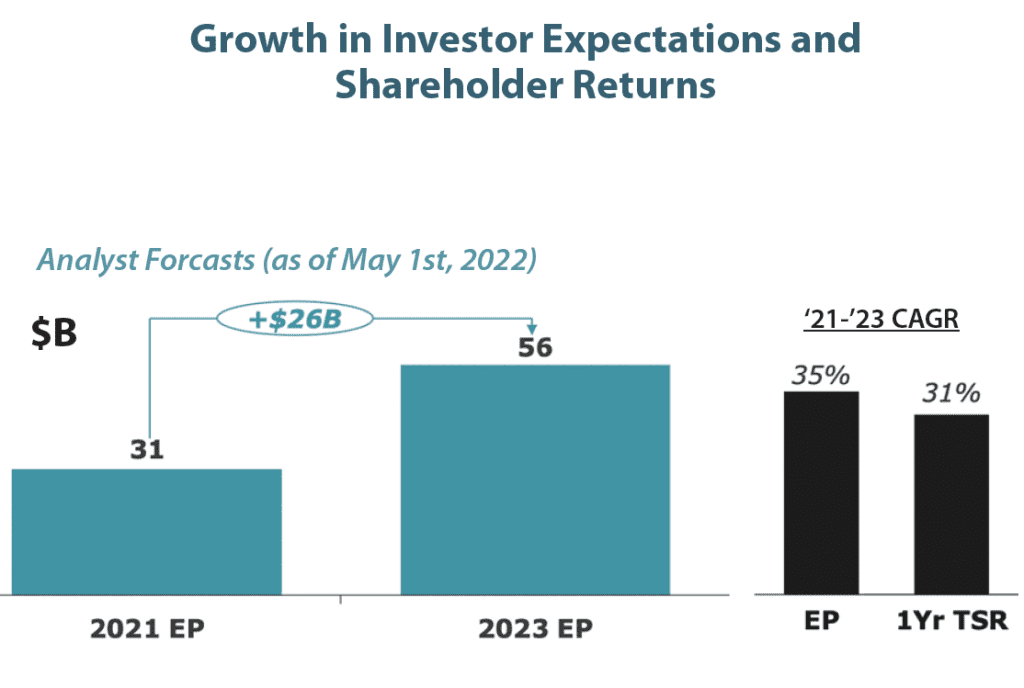

With this improving outlook, investors have priced in roughly $25 billion in EP growth from $31 billion in 2021 to $56 billion in 2023. The result: 31 percent TSR for OEMs (versus 29 percent for S&P 500), more than quadruple the TSRs delivered from 2016 to 2019.

ACHIEVING AND SUSTAINING TOP-QUARTILE PERFORMANCE

To sustain the recent capital market momentum, OEMs will need to not only meet but exceed these rising investor expectations for future EP growth.

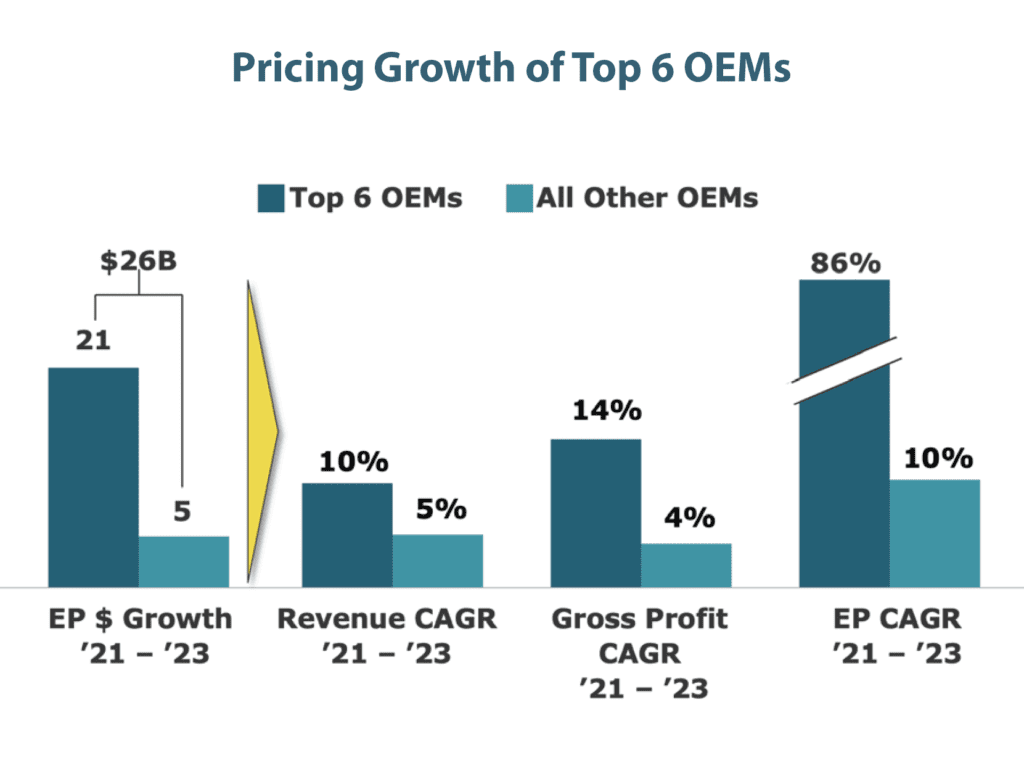

A deeper look into the 2021 to 2023 growth expectations highlights potential opportunities for OEMs. Out of nearly 40 OEMs analyzed, the top six OEMs are expected to drive ~$21 billion or ~80 percent of the total EP growth from 2021 to 2023. The forecasted EP improvement is highly reliant on sustaining increased pricing power, which for new vehicles rose ~30 percent in Q2 2022 versus Q1 2019 levels.

OEMs will also need to navigate emerging headwinds. Raw materials costs are volatile; the relative appreciation of the dollar versus the yen and euro; continued supply chain issues complicate procurement and operations; and consumer sentiments may be waning amid escalation in sticker prices, inflation and recession fears.

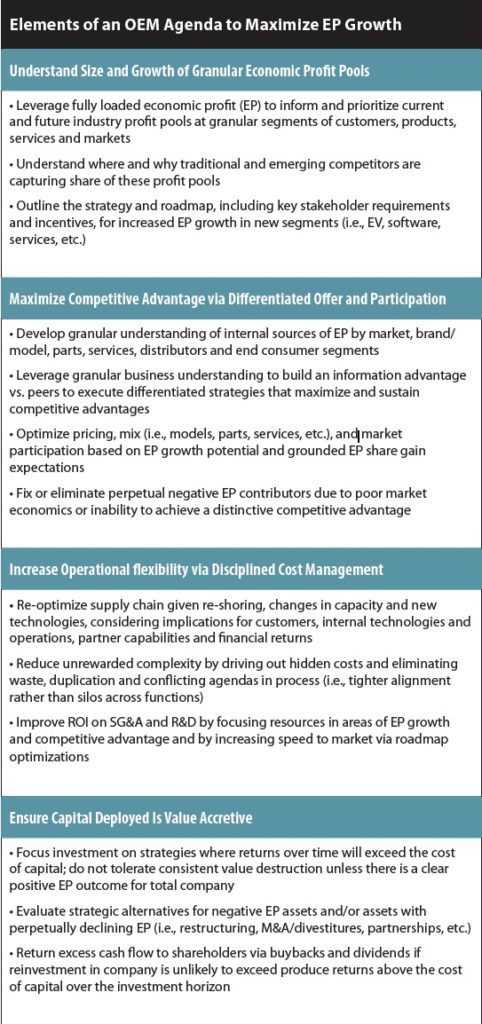

These headwinds will lead to even further concentration of market profit pools and OEMs’ EP growth opportunities. Understanding where and why these concentrations exist and how they might shift in the future is the key to proactively addressing the headwinds and fully focusing resources—time, talent and treasure—on an agenda of the best opportunities for sustaining and accelerating OEMs’ recent profit growth (see table below).

These steps require disciplined leadership from CEOs and top management to ensure a cross-functional focus on maximizing EP growth and long-term shareholder value. The OEMs that succeed will not only sustain top-quartile TSRs but will also build a reinvestment advantage that will be difficult for competitors to overcome.

![Social Media Spring Cleaning [Infographic] Social Media Spring Cleaning [Infographic]](https://imgproxy.divecdn.com/9e7sW3TubFHM00yvXe5zvvbhAVriJiGqS8xmVFLPC6s/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zb2NpYWxfc3ByaW5nX2NsZWFuaW5nMi5wbmc=.webp)

![5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic] 5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic]](https://imgproxy.divecdn.com/Hv-m77iIkXSAtB3IEwA3XAuouMwkZApIeDGDnLy5Yhs/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9saW5rZWRpbl9zdHJhdGVneV9pbmZvMi5wbmc=.webp)