[ad_1]

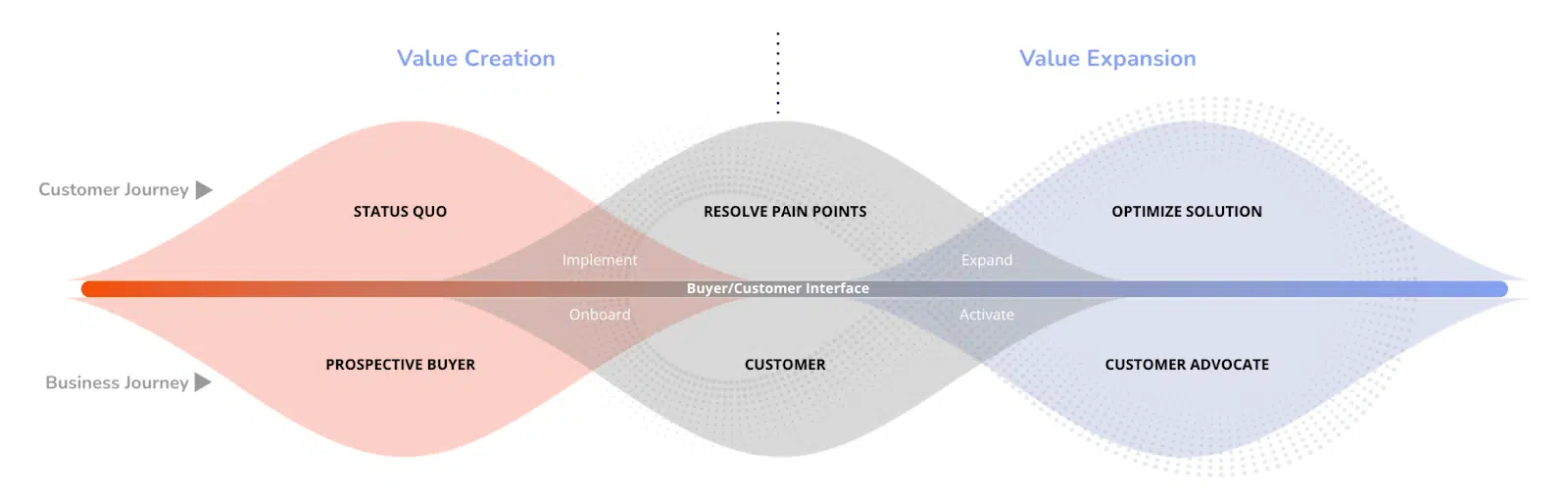

For startup founders, what can be more exciting and fulfilling than successfully growing your company and gaining new and more funding as investors’ confidence in your company’s prospects grow? But there is a flip side to this – equity dilution. Equity dilution occurs when new investors are brought in and new shares are issued, reducing the percentage ownership of existing shareholders. While increased company value can help offset the impact of dilution, there are times when the founders find themselves out-lawyered by investors, ending up with terms that result in loss of much of their equity value. If you are that founder, what can you do?

This article discusses how intellectual property that is developed, and on occasion retained in whole or part by the founder, can be used to protect the founder CEO or C-level executive’s interest in the company.

The Founder Trap

Generally, outside funding for a start-up company is much desired and truly a success event. With adroit use of proceeds, funding can unleash potentially exponential growth. With such funding there is loss of the founder’s total control.

Yet in that loss of total control, it can mean the opportunity for growth in your equity value. There is much truth to the saying, “Do you want to be king? Or do you want to be rich?”

Translating that adage into simple math: Do you want to own 100% of a company worth $100,000 or 10% of a company worth $10,000,000? Certainly, if this example holds true, that if for you, the taking in of outside investor funding means your percentage goes from 100% to 10% but the value of your equity goes from $100,000 to $1,000,000, then dollar-wise, it’s a no brainer.

The rub comes for founders, when taking in funding does not translate into significant growth in value. What if the company grows from $100,000 to $10,000,000 and your percentage declines to 1% or even less so that not only the value you actually see is not much more than you started with, but you also suffer loss of control. That can and has happened to owners when terms for vesting, re-vesting, participating preferred, investor anti-dilution and other investor-friendly terms work to take over the company to the disadvantage of the founder.

Cliff vesting or re-vesting is another great danger. In one of my representations, most of my client founder’s re-vesting was predicated on a change of control and prior to that change of control, she was terminated and thus lost most of her equity.

Leveraging IP in Strategic Transactions

In the case of that particular client, company intellectual property offered her a potential self-help remedy and chance to leverage her awful contract position.

As with so many companies, the intellectual property is the life blood, the guts of the company. Without the IP, the company is a shell. If there is a serious challenge to ownership of the company IP, it can become toxic to new investors, for an IPO or to a potential acquirer.

Where my client was being terminated so she could not re-vest with the change of control, the acquisition, the issues we were able to raise over her potential claims to the company’s intellectual property made a huge difference. These claims unlike everything else got the CEO and Board’s attention, so that her issues were at last addressed.

Where IP Ownership Issues Can Arise

For the Founder CEO or C-level executive to be able to leverage intellectual property ownership in equity negotiations with the company, there often needs to be an ownership issue.

Ownership issues often revolve around transfer of intellectual property. When companies seek investment, investor counsel normally pays close attention to instruments of assignment of intellectual property to the company. However, if those documents have not been fully executed, it might provide an opening.

On other occasions, the company makes an acquisition. In the acquisition, transfer of IP might not be fully transferred.

Finally, the role of the executive can make a difference. Generally, intellectual property created by a full-time employee is owned by the employer. But it is much less clear for an independent contractor. So, if a company acquired your startup, and the acquiror continued your service as a contractor, perhaps to save themselves the costs of employee benefits, that might work in your favor, allowing you a greater claim to your intellectual property.

Issues arising from Types of IP

IP assets include copyrights, trademarks, patents, and trade secrets. Copyrights apply to original works of authorship. Trademarks include the brand name, logo, or slogan for your startup. Patents are for inventions such as a novel and non-obvious process, machine, composition of matter, or design. Trade secrets are valuable information that is not generally known or easily accessible, such as proprietary algorithms, customer lists, or manufacturing processes.

It’s likely that copyrights, trademarks and patents are known up front and properly assigned in the company formation contracts. But startups often overlook the importance of their trade secrets, which might actually be “know how” that can be the secret sauce for success. You might have developed a unique process for ensuring quality, or you have developed a customer list, prior to incorporation, through substantial efforts, investment, or by compiling valuable and non-public information, it may be considered a trade secret.

Transfer agreement can include “know how” but transferring such trade secrets is not as clear and not as easy to complete.

Additionally, you could be pursuing new inventions on the side, using your own time and resources, resulting in new IP that could have a substantial impact on your company’s success, whether positive or negative. Again, you will have the leverage you need to negotiate with the investors.

Last Protection When You Need It

If you have yielded control of your startup and you have been dealt with fairly so you derived great value, then that is a good outcome. However, if, as sadly all too often it happens, you feel you have not been dealt with fairly, this article might offer hope.

As a founder, you sacrificed so much for your “baby”, the company you launched, nurtured and built up to achieve funding or a merger / acquisition, and yet now, you have been out-lawyered to not only lose control, but achieved much less financially than you were promised. Perhaps, then in your hour of need, that intellectual property might be a source of relief.

If that is your circumstance, it may be wise to consult a startup executive employment attorney about potential remedies for you.

Written by Robert A. Adelson, Esq.

Have you read?

The Global Passport Index: The World’s Most Powerful Passports.

Countries With The Most Billionaires, 2023.

Top CEOs in Switzerland, 2023.

Biggest banks in the world, as measured by total assets, 2023.

The World’s Richest Self-Made Women, 2023.

Ready to join the CEOWORLD magazine Executive Council– Find out if you are eligible to apply.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Thank you for supporting our journalism. Subscribe here.

For media queries, please contact: info@ceoworld.biz

[ad_2]

Original Source Link

![‘Stranger Things’ Star Reveals “There Wasn’t a Lot of Oversight” When Filming This Iconic Sci-Fi Crime Drama [Exclusive] ‘Stranger Things’ Star Reveals “There Wasn’t a Lot of Oversight” When Filming This Iconic Sci-Fi Crime Drama [Exclusive]](https://static0.colliderimages.com/wordpress/wp-content/uploads/sharedimages/2026/01/0392347_poster_w780.jpg?q=70&fit=contain&w=480&dpr=1)