[ad_1]

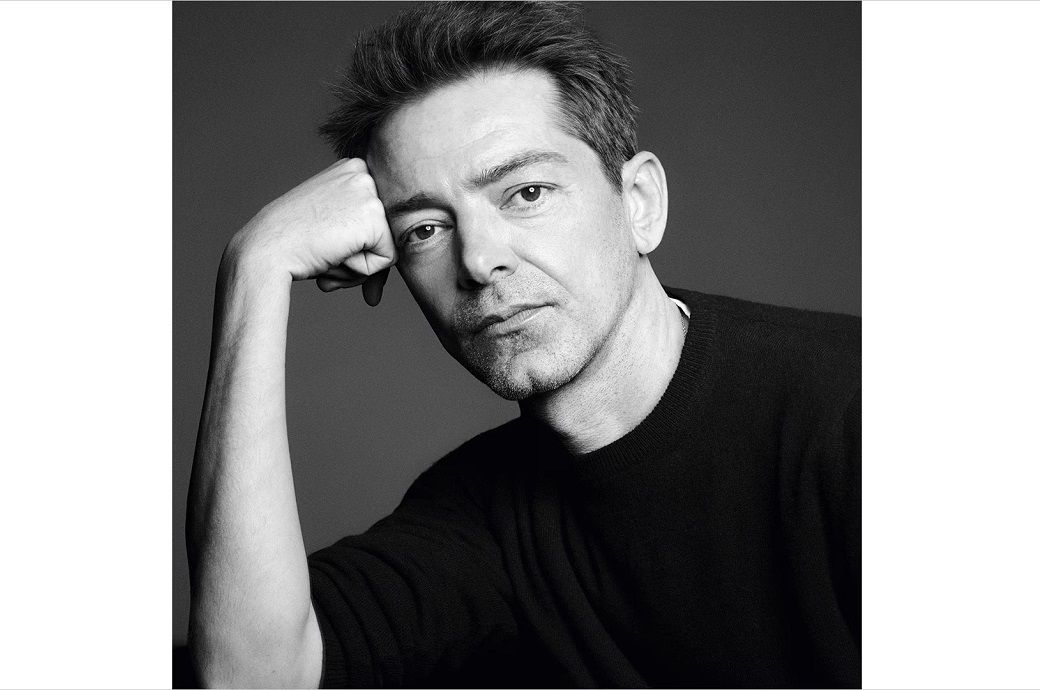

Kiva Allgood is leveraging decades of experience in building tech and manufacturing businesses to move Sarcos Technology and Robotics into a commercial phase. The Salt Lake City-based company is beginning to churn out hundreds of units of robotic systems and exoskeletons that will take on much of the grit, grime and danger of industrial maintenance — and save human lives and labor in the process.

“I’ve always loved being at the forefront of technology, where people say, ‘It’s not going to happen,’ or, ‘I don’t think it’ll happen,’ and I love being surrounded by brilliant human beings,” Allgood told Chief Executive. “We have an opportunity to build a culture, and at this point in my career, that’s the fun part—the people part.”

There’s little question that Sarcos has perfected the technology part of it enterprise: Its robots are capable of taking on perilous and grungy tasks once relegated only to humans, including cleaning ships and scouring the insides of old industrial tanks. Its exoskeletons are clearly capable of helping humans perform other difficult and sticky tasks, such as changing airplane tires on a tarmac and removing vegetation from around power lines.

“We’re also extending the [work] life of people to be able to do some jobs, and brining people into the workforce who couldn’t have access to those jobs before,” Allgood said. “Someone in a wheelchair can become a skilled laborer in a new field.”

But the challenge for Allgood now is to train her vast experience in industrial and technology development on the process of further commercializing, and scaling up manufacture, of Sarcos’s Guardian XT robotic system, XO exoskeleton and other systems in the next 12 months. Already, the company is manufacturing its Sapien 6M robotic systems and Guardian XT tele-operated robotic systems, and next year it plans to make between 300 and 500 units of its XT system.

Sarcos was created by a venture at the University of Utah in the 1980s and was acquired by Raytheon in 2007, soon thereafter attracting media attention for an exoskeleton it had developed for the U.S. military. The defense contractor spun off Sarcos in 2015.

Allgood was chief commercial development officer for GE Ventures and global head of Internet things and automotive for Ericsson before she joined Sarcos as president, CEO and a board member about a year ago. One of her first major actions was to oversee Sarcos’s acquisition of RE2, a robotics company in Pittsburgh, a city that now is Sarcos’s other base.

Here’s how Allgood is going about leading the scaling-up of Sarcos into a manufacturing company from its base in technology:

• Targeting ripe markets. The replacement of labor and advancement of technology are spurring commercial interest in Sarcos’s devices and systems, but some plums are riper than others, and it’s up to Allgood to figure out which and devote proper resources to them.

“The ROI is quick for our products,” she says. “We are focused on those use cases and market segments that have a large total available market and resource constraints.”

For example, companies constructing solar arrays are pressed with demand but lacking workers who are able or willing to build the fields of panels in climates that are often dangerously hot and dusty. And utilities that need to clear weeds from around power line

“The average laborer there is around 55 years old, and it takes about four years to become skilled at doing that,” Allgood said. “But someone dies every year in that job. Now it doesn’t have to be a human in a bucket, at height, doing that anymore.”

• Creating a manufacturing culture. Given Sarcos’s products and markets, Allgood said, employees can “feel good about our mission” and accomplishing goals that “reward them for everything they do.” But she also must “adapt and change the culture’ to one focused on commercialization.

“One of the big transitions I’ve made is rolling out ‘objective and key results.’ That helps us focus , for instance, on where is the market ready for our robots and exoskeletons, and where is adoption going to come from?”

At the same time, Allgood said, “We as an R&D organization love to solve problems. Converting to a manufacturing organization, some things are OK the way they are now, such as our technology readiness. We’ve sped up our supply chain. Now we have to be delivering products on time and on budget for our customers.”

Allgood has turned over some of Sarcos’s top leadership in hopes of bringing products to market faster and to better integrate RE2. “We’ve been able to bring on some great talent that will help us scale.”

• Exploiting the pandemic opening. Timely scaling up is crucial for Sarcos as well, Allgood said, because the pandemic created “an accelerant for more traditional industries that have been slower to change and adapt to new technologies,” Allgood said. “Now there’s an aperture that they’re more open.

“A lot of industries we’re talking to are operating at levels 20% to 30% below” optimal labor retention, she said. “They’re really struggling. They have an aging and retiring workforce. They have to find new ways to work, and that has created some demand and been part of our focus too. We’re making sure we have the right partners to bring our technology into standard operating procedures and make it part of the day-to-day.”

[ad_2]

Original Source Link