“Fear is the mind killer,” wrote best-selling author Frank Herbert in his notoriously popular sci-fi novel Dune. You must not let fear overcome your senses or you will fail to respond to rational thought he portended. It’s important to anticipate, be prepared and have a plan.

So, when darkening economic clouds on the horizon grow darker and sales forecasts grow dimmer in the weeks ahead experts say it may be time to batten down the hatches.

Until recently, the US economy had emerged post-Covid with flying colors. We were the belle of the ball the world over. High growth, low inflation. No recession in sight. We can suppose that after pumping an unprecedented $5 trillion Covid dollars into the hands of millions of US consumers over the last 24 pandemic months that all would be saved.

But then the clouds thickened, and like twin bolts of lightning inflation suddenly sky-rocketed to 8.6% (a 40-year high), and Russia invaded Ukraine, sending food and gas prices up to all-time records. So, what was heralded as a new-era of post-pandemic prosperity in early 2022 is now instead about to hit rough waters.

Adding to the growing swells, the Federal Reserve Board to calm demand and cool inflation pressures decided to substantially raise interest rates recently which will abruptly increase the cost of borrowing for new autos, credit cards, mortgages, and in particular business loans. That move for some captains of finance like JP Morgan Chase CEO, Jamie Dimon means the weather outlook looks pretty grim:

“You’d better brace yourself,” he added.

A technical Recession is two consecutive quarters (6 months) of negative GDP. As it stands, Q1 2022 was negative -1.5%, and forecasts for Q2 2022 according to the Atlanta Fed is tracking a negative -1% GDP, begging his question.

If we are headed directly into a tumultuous economic tempest, which is it — a deep 18-month-long Great Recession like the one from December 2007 – June 2009? Or a shorter one, like the recent barely noticeable Covid shutdown recession, which was deep and devastating like a hurricane, but only lasted two months in early 2020? Nobody knows.

Why not?

For starters, some businesses excel during downturns. To them an economic hurricane means more sales & profits. According to economists there are more than a dozen recession-resistant industries that consumers can’t turn their backs on when times get tough. You should feel lucky if your business is among them.

However, if your business is not among the lucky few it’s time to grab the wheel and have the crew prep the ship for rough seas ahead, you’ll soon know if you’re well prepared or not.

The Dos & Don’ts in a recession

It was just a few years ago. Before Covid hit the economic brakes in 2020, online fin-tech banking firm Bluevine found inside 1000 small businesses they surveyed a whopping 80% were indeed “worried” about a recession in the next few years, but only 44 percent had any plans to do anything about it.

This discovery was the wake-up call for Bluevine CEO Eyal Lifshitz who prophetically warned; “Small businesses should be taking time now to prepare their business while the economy is still strong…”

Looking back 3 years, she was right.

The Bluevine CEO then went on to advise small business owners during a recession to focus on a few key decision areas which are to me pearls of wisdom that ring true today, and well worth repeating given our situation. So, grab a pencil because now would be a good time to start prepping for the Dos & Don’ts in a recession. Are you ready?

The Dos in a Recession:

- Do invest capital wisely: Think short term Breakeven and ROI from inventory to equipment.

- Do hire thoughtfully: Never look away from a high-quality new hire. Contract-to-new-hire is a good interim strategy. Anticipate how everyone will perform in a slowdown.

- Do diversify revenue streams: Create value add-ons to higher margin products. If you have high customer sales concentration, try to lock down new accounts urgently. Spread the risk.

- Do re-access vendors carefully: Check-in with suppliers. Ask them how they are planning for a supply disruption. Do interview new potential suppliers (substitutes and stand-by vendors) asap.

- Do shore up your finances before banks raise interest rates: Cash is still King. Secure short-term working capital financing with your lenders asap. Draw down LOCs, lock-in lower rates and monitor cash flows tightly. Slow any discretionary cash outflows where possible to preserve working capital in the weeks ahead.

And I added a few more:

- Do identify the money-wasting bottlenecks in your work flow processes and remove them.

- Do reformulate your product and market sales strategy to plan for customers switching to lower priced substitutes.

- Do monitor new promotion and customer acquisition costs carefully.

These are the jewels of a real treasure, and I like them. But what about the flip side? What are the things CEOs and business owners should ‘NOT’ do if the economy slows down?

The Don’ts in a Recession:

- Don’t Introduce new untested low margin products.

- Don’t reduce headcount too abruptly simply for short-term gain: Do the math. Even at the height of the Covid shutdown, many smaller companies did not reduce headcount and bounced back more quickly than others.

- Don’t wait to communicate and pass along inflation and supply chain input costs.

- Don’t hesitate to pull the purchase trigger if you find a super under-valued asset.

- Don’t underestimate sudden Cash Flow needs.

- Don’t over-react to anything, think through every choice in the short-term vs long term.

Again, these are pearls of economic wisdom that may help shield you from any severe destructive forces. Will they be heavy, or will they be long? Experts don’t know. Some say yes, others say no. Either way getting well prepared now with a solid plan ahead of the action is still the safest way to navigate a recession and not fear the unknown.

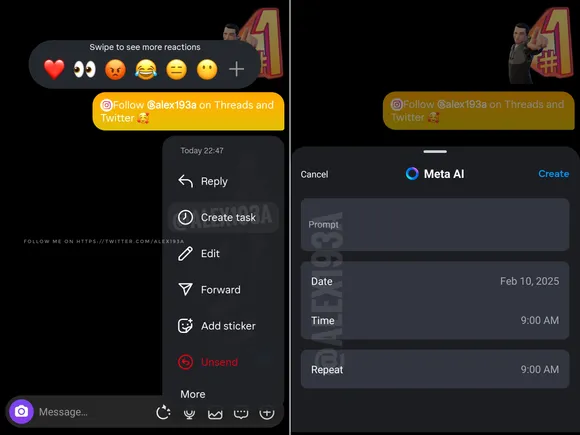

Still, if you need a lift getting started or want first-hand insights, I recommend you watch this Recession-planning webinar. It’s a recession-prep panel discussion with a group of CEOs pulled together by CEO Coaching International leaders Don Schiavone and Randy Dewey.

CEO International helps CEOs address daily issues by sharing insights and results from former CEOs. They introduced a handy new Recession Risk Assessment Checklist along with a Recession Playbook to see how well prepared you are or not ahead of a slowdown. If you want to know the potential consequences and likelihood of getting smashed by an economic hurricane… Take the Assessment and see for yourself.

Lastly, and above all else keep your head. Remember, Fear is the mind killer. So don’t let it take charge of your ship. Keep your hands on the wheel, sails trimmed and focus on the Dos and Don’ts to stay clear of the rocks. And leave the rest for calmer waters on the other side.

Written by Rick Andrade.

Have you read?

6 keys to building a happy, connected global team by Cynthia Dearin.

Where Purpose Meets Planning by David R. York.

Can Artificial Intelligence Defeat Heart Disease by John Farquhar.

Why leaders need to embrace uncomfortable growth by Rowena Millward.

Does your Presence Allow Voice by Tracey Ezard.

The Benefits of a Flat Organizational Structure and How to Make the Switch by Rhea Ong Yiu.