After a string of strong months of growing optimism about the direction of the economy, our latest polling finds CEOs pulling back on their rosy outlook for the year to come. Their main concern? Uncertainty, fueled by the likelihood of yet another contentious presidential election.

The election—its unpredictability and impact—is the most-mentioned topic in our polling this month. A growing number of CEOs say they are unable to accurately predict and make decisions about the future of the economy right now and won’t be able to do so until they know who the next president will be.

Kathy Mast, president & CEO of NeuvoNow, says conditions should improve one year from now if for no other reason than clarity about the winner. “The election will be over,” she says. “Whether good or bad, we will be able to make informed decisions.”

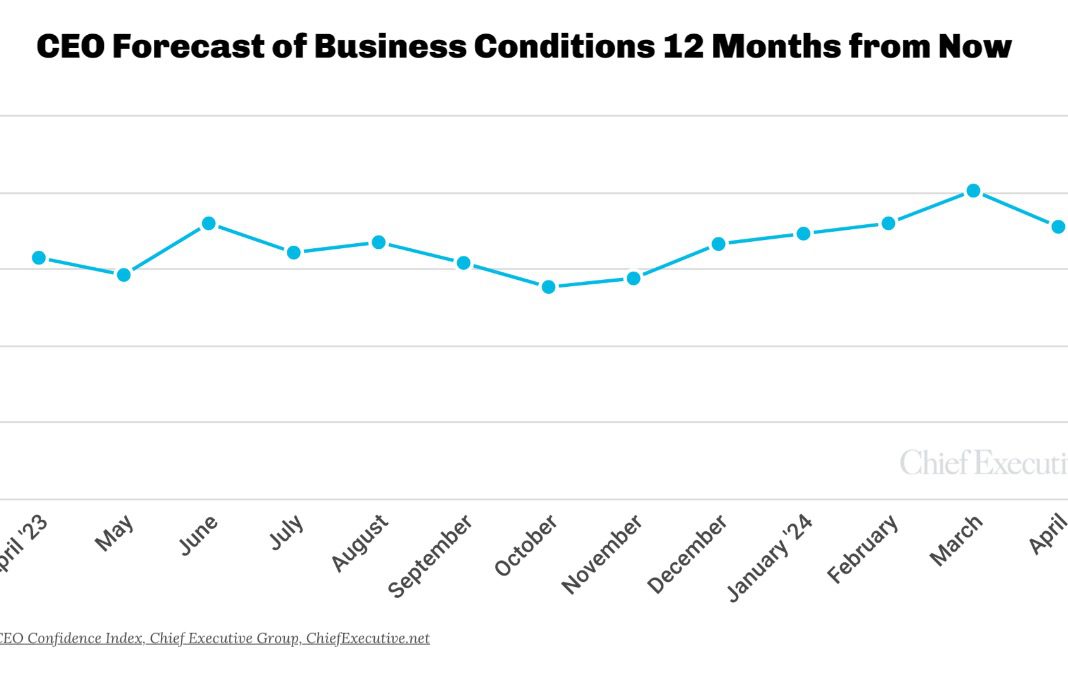

The 2024 race for the White House was hardly CEOs’ only concern, of course. Stickier-than-anticipated inflation and the increasing likelihood that the Fed won’t cut interest rates as quickly as hoped, as well as worries over growing consumer debt and geopolitical risk are all part of the 7 percent drop in CEO Confidence Index in April. The forward-looking indicator, which measures CEOs’ forecast for business conditions 12 months from now on a scale of 1 to 10, where 1 is poor and 10 is Excellent, is now at 6.5 out of 10, after hitting 7 of out 10 for the first time since 2021 in March.

Despite this drop, it’s worth noting that this reading is still 7 percent above the April 2023 reading from one year prior.

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”https://e.infogram.com/js/dist/embed-loader-min.js”);

The 147 CEOs polled April 2-4 also doled out a weaker rating of current business conditions compared to last month, down 4 percent to 6.3 out of 10, but still well above the 2023 average of 6.1.

“The unknowns of the direction of the Fed regarding interest rate hikes or retractions as well as the outcome and possible fallout of the upcoming Presidential election,” explain why Jim Vandegrift, president at R&M Materials Handling, Inc. expects conditions deteriorate slightly by April 2025, down from 8 to 7 out of 10.

Doug Clark, executive chairman at Corcentric, a large IT company, echoes many CEOs when he says, “I believe the economy is fragile — a negative geopolitical or economic event will precipitate a recession.”

Among those polled, 44 percent of CEOs now expect conditions to improve by this time next year. That’s a return to the number who forecasted improved conditions in February, after hitting 51 percent in March. Now, 25 percent of CEOs expect conditions to deteriorate over the next 12 months compared to only 20 percent last month. Meanwhile, 31 percent expect conditions to remain unchanged.

“The forward projection is difficult to assess due to implications of the forthcoming elections and results. This is additionally complicated by persistent inflation and the impact on various sections of the economy. It will continue to be a bifurcated economic outcome well into 2025,” says Steve Leafgreen, president & CEO of Western Vista Federal Credit Union.

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”https://e.infogram.com/js/dist/embed-loader-min.js”);

THE YEAR AHEAD

This month, the proportion of CEOs expecting profits to improve over the course of the next year clawed back almost all of its losses from last month, now at 63 percent, up from 56 percent last month. 69 percent of CEOs now expect boosted revenues over the next 12 months, down 3 percent from 71 percent last month, its third consecutive decline.

Only 41 percent of CEOs are now saying their capital expenditures will increase. This measure is down from 50 percent last month—our lowest reading since November.

The proportion of CEOs planning to increase their headcount is down to 44 percent from 51 percent the month prior, as chiefs say the tight labor market persists.

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”https://e.infogram.com/js/dist/embed-loader-min.js”);

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. See additional information about the Index and prior months data.

The post CEO Confidence Falls In April appeared first on ChiefExecutive.net.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)