[ad_1]

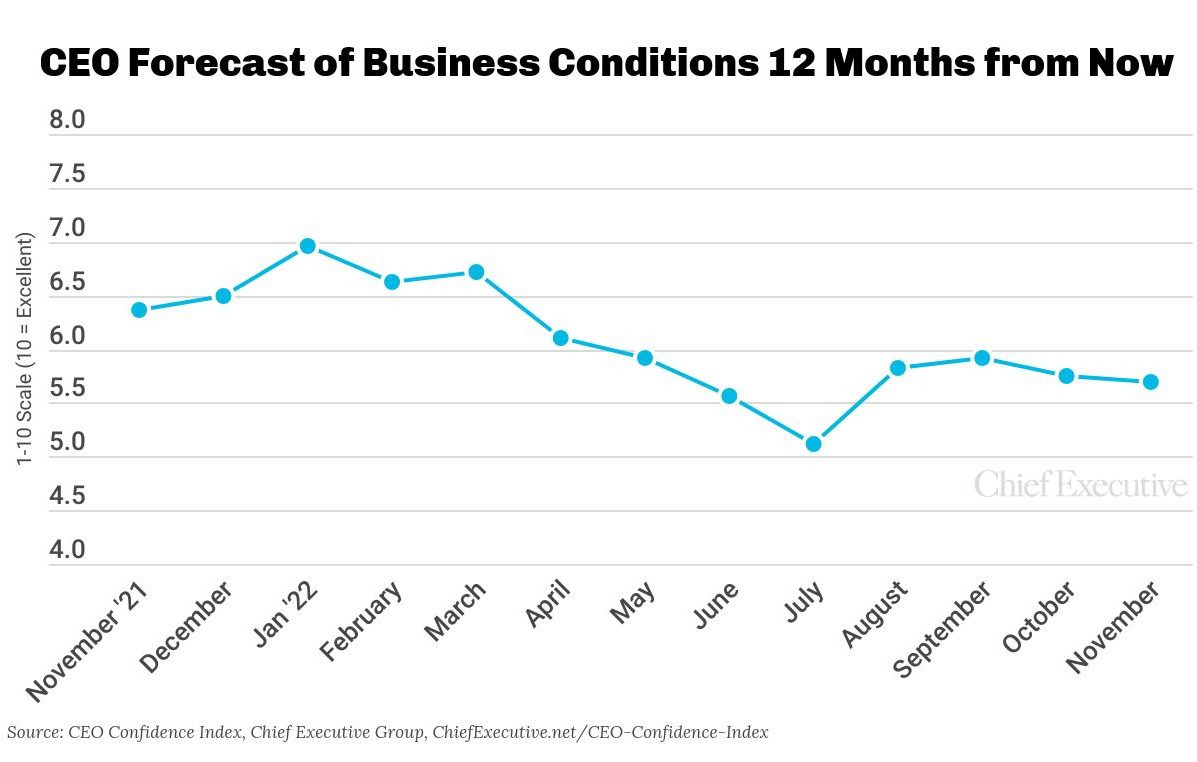

Vandegrift does expect business conditions to worsen in 2023, though, with his biggest concerns pertaining to the Fed’s continuation of rate hikes and the deteriorating economic conditions in Europe.

“Currently, economic growth is still relatively strong,” said Chris Mangum, CEO of Servato, echoing the forecast. “Fed rate tightening will likely drive the economy into a mild recession in 2023, but we believe it could return to growth by 2024.”

Overall, 43 percent of CEOs polled in November said they’re bracing for a slowdown and expect conditions in the U.S. to worsen in the year ahead—a slightly lower proportion than last month (48 percent)—compared to 29 percent who anticipate conditions to start improving again (up from 24 percent in October).

“Hoping for quick and shallow ‘recession’ or at least other news the country/world will be focused on by this time next year,” said Kevin McCarty, chair and CEO of Chicago-based tech consulting firm West Monroe Partners. “We move on from gloom and doom eventually, and I think a year from now we’ll be talking about something else versus the economy, inflation, interest rates.”

Either way, McCarty says business needs to find some clear goalposts soon. “Uncertainty is the worst thing for business. When we don’t know whether to step on the gas or hit the brakes, this is the worst situation for Corporate America to be in, so get to certainty either way, good or bad versus flip flopping,” he said.

[ad_2]

Original Source Link