Australia’s central bank surprised markets in early October with a smaller-than-expected rate hike, a move the Reserve Bank of Australia acknowledged was a “finely balanced” debate even as it vowed to keep inflation in check.

According to RBA minutes from the Oct. 4 meeting that were released Tuesday, two options were considered before the bank eventually raised its cash rate by 25 basis points to 2.6%, a nine-year high.

It marked the bank’s sixth consecutive hike in its tightening cycle to tame global inflation rates.

Prospects of continued “jumbo” interest rate hikes persist as central banks around the world attempt to tackle global inflation. The U.S. Federal Reserved raised interest rates by 75 basis points in its September meeting, after the same move by the European Central bank that same month.

The RBA considered two options: Continuing with the 50 basis point increases in the cash rate, or announcing a smaller 25 basis point hike, the minutes said.

“The arguments for continuing with an increase of 50 basis points stemmed from the inflationary environment and risks to inflation expectations,” according to the minutes.

In the end, the central bank’s board members said they “recognized the benefits of a smaller increase.”

Drawing out policy adjustments would also help to keep public attention focused for a longer period on the Board’s resolve to return inflation to target

Reserve Bank of Australia

The notes from its board members said the case to slow down its hikes was in order to “assess the effects of the significant increases in interest rates to date and the evolving economic outlook.”

“A smaller increase than that agreed at preceding meetings was warranted given that the cash rate had been increased substantially in a short period of time and the full effect of that increase lay ahead,” the minutes said.

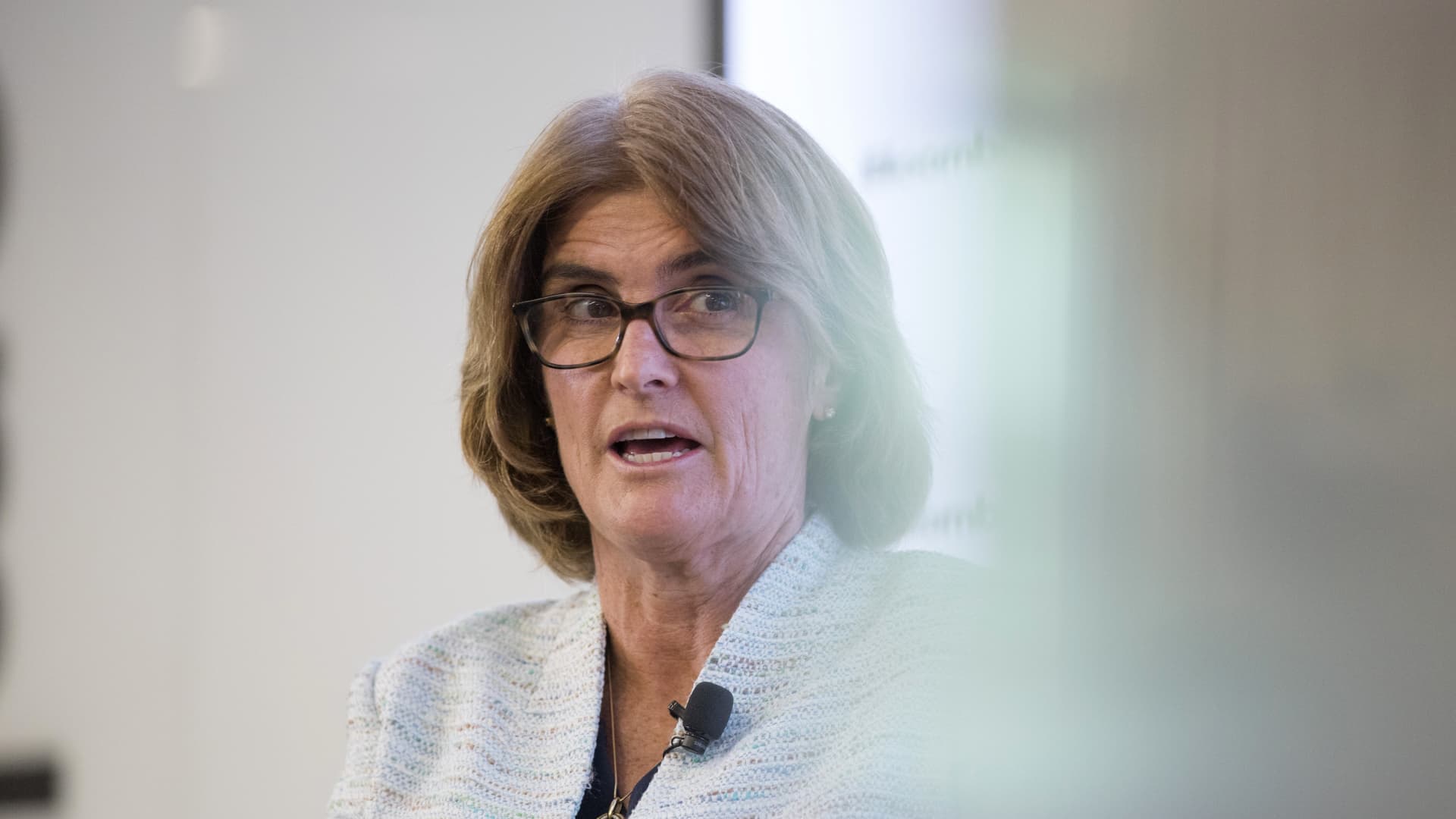

Deputy Governor Michele Bullock said a multitude of factors were taken into consideration for its recent smaller step, including the grim outlook for global markets.

“The international economic environment has also deteriorated quite sharply,” she said at the Australian Finance Industry Association.

“For these reasons, the Board felt that a smaller increase in October was warranted while it took stock of developments in consumption, wages and the international economy,” she added.

She said the central bank has more flexibility for the “size and timing of rate increases” because its board holds more meetings compared to other central banks in the region. The RBA is able to obtain similar effects with smaller individual rate increases, she said.

“It also means that if we increase interest rates at every meeting, we can potentially move much faster than overseas central banks. Or alternatively, we can achieve a similar rise in interest rates with smaller increments,” she said.

The Australian dollar rose close to 0.2% against the U.S. dollar shortly after the increase, and last traded at $0.6284

Inflation fears

The central bank also noted the wider public’s focus on its fight against inflation as a key concern.

The minutes said, “Drawing out policy adjustments would also help to keep public attention focused for a longer period on the Board’s resolve to return inflation to target,” adding that the board remains determined to “do what is necessary” to return inflation to its target.

The Reserve Bank of Australia has an inflation target of between 2% to 3%. Annual inflation in the month of August rose to 6.8% from just under 2% before the pandemic.

The RBA minutes also noted the central bank could lose more if it fails to keep inflation levels under control.

“If the Board were to reduce the size of the rate increase, it would be the first to do so among advanced economies,” it said. “Ultimately, if upside risks to inflation were to materialise, or the credibility of the path to reduce inflation came into question, it would be costly to re-establish low inflation.”

The RBA said that future interest rate increases will be determined by further data and the outlook for inflation and the labor market.

“Inflation is too high in Australia and is expected to rise further,” said RBA Deputy Governor Bullock. “You should be in no doubt, though, that the Board is determined to do what is necessary to return inflation to target.”