[ad_1]

Southwest Airlines is still a stock worth buying despite the recent bout of flight cancellations, according to CFRA Research. CFRA analyst Colin Scarola maintained his rating of the stock as a buy. But he lowered the price target to $41 per share from $47, citing damage to the brand after it canceled thousands of flights in recent days amid scheduling challenges coming out of the winter storm last week. Scarola’s new price target implies a 27.4% upside over where the stock closed Wednesday. He said the stock’s drop this month on the back of the cancellations has made it a smart time to buy in. The stock was up nearly 4% in trading Thursday afternoon, but remained down more than 16% this month and off by about 22% this year. “We think the stock’s roughly 17% decline during December is disconnected from what the actual EPS impact from recent events will be, presenting an attractive buying opportunity,” Scarola said in a note to clients Thursday. “LUV’s Christmas week fiasco has caused us to materially cut Q4 and 2023 revenue estimates, but we don’t anticipate a long-term negative impact.” Scarola cut his per-share earnings estimate on the stock for 2022 to $1.20 from $1.86. He also cut 2024’s estimate to $3.71 from $3.90, while raising 2023’s to $2.74 from $2.38. Southwest has attributed its challenges to internal technology platforms that the company says got overwhelmed by the volume of schedule changes . That created difficulties for pilots and other workers who attempted to get new assignments by phone and travelers who tried to find other flights or alternative means of transportation. But despite the current hit to the brand, Scarola said one thing helping the stock is the fact that customers tend to not permanently stop using airlines even after bad experiences. That’s because of what he called “the commodity-like nature” of booking flights. Since Southwest’s fares typically hover 15% to 20% below competitors, he said customers will likely not choose to pay more to avoid the airline in the future. Raymond James analyst Savanthi Syth said the greatest earnings impact from the storm among airlines would likely be seen at Southwest, though she still expects the airline to generate a “small profit” in the fourth quarter of this year. -CNBC’s Leslie Josephs contributed to this story.

[ad_2]

Original Source Link

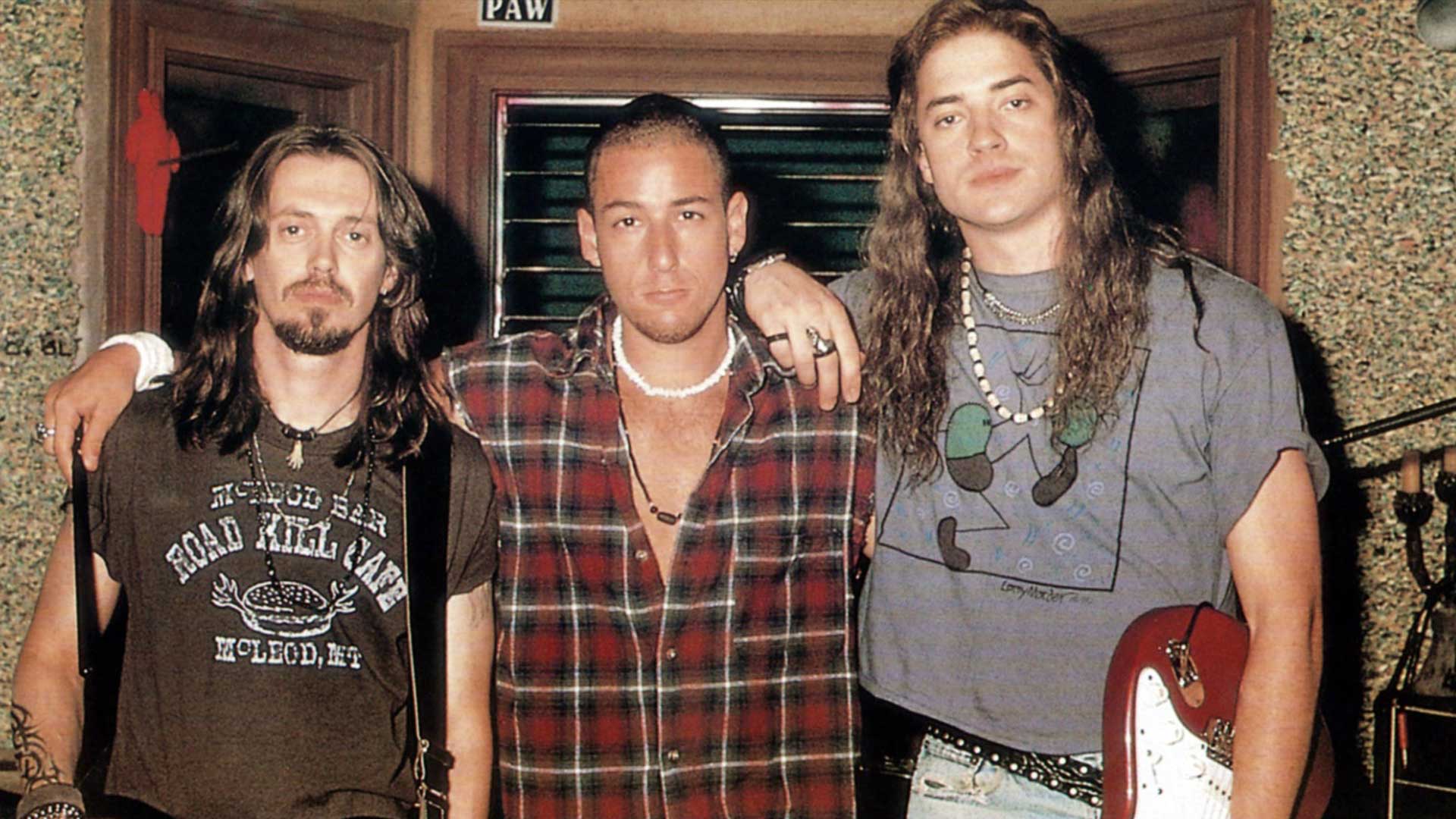

![‘Stranger Things’ Star Reveals “There Wasn’t a Lot of Oversight” When Filming This Iconic Sci-Fi Crime Drama [Exclusive] ‘Stranger Things’ Star Reveals “There Wasn’t a Lot of Oversight” When Filming This Iconic Sci-Fi Crime Drama [Exclusive]](https://static0.colliderimages.com/wordpress/wp-content/uploads/sharedimages/2026/01/0392347_poster_w780.jpg?q=70&fit=contain&w=480&dpr=1)