Siemens missed profit forecasts in its latest quarter, the German engineering company reported on Thursday, noting weakening demand in several markets including China.

The trains-to-factory-automation manufacturer said China, long a driver for global manufacturing and its third largest market, had seen only a tepid recovery after its zero-Covid shutdown last year.

Siemens said it was now seeing a “normalisation of demand” after customers pre-bought last year to avoid shortages. Orders increased by 10% during the three months to the end of June, down from the 13% increase in the previous three months.

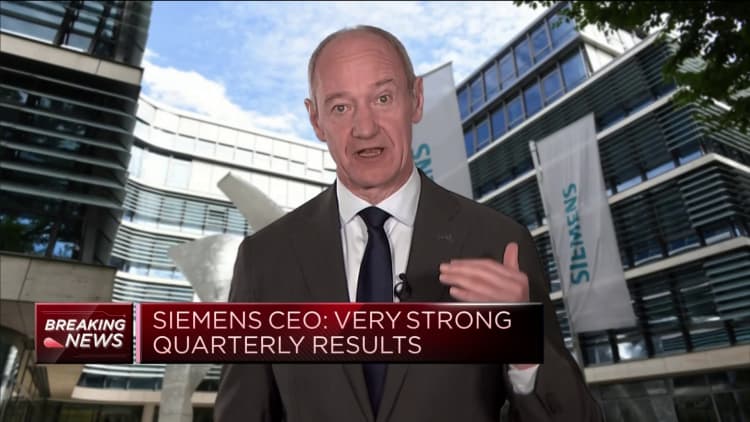

“The normalization of the market [is] a little bit faster than expected,” CEO Roland Busch told CNBC’s Arabile Gumede Thursday, but added that it is not something the company is worried about.

“China is the second largest economy in the world and it is going to pick up. It can take another quarter, maybe two, but this market will pick up,” Busch said. “This will come, therefore I’m not concerned at all.”

For the three months to the end of June, Siemens’ industrial profit – covering its mobility, smart infrastructure and factory automation businesses – fell 4% to 2.75 billion euros ($3.02 billion), missing the 2.90 billion euro expected by analysts in a company-compiled consensus.

The company’s shares were down 3.6% in premarket activity.

Siemens kept its group-level outlook for the year to September-end but lowered expectations for its digital industries business which supplies factories with controllers.

The division, seen by analysts as the jewel in Siemens’s crown, now expects comparable revenue growth of 13% to 15%, lower than its previous outlook of 17% to 20%.

A Siemens logo in Germany. The industrial giant says that a newly commissioned green hydrogen plant in the country will use wind and solar power from the Wunsiedel Energy Park.

Daniel Karmann | Picture Alliance | Getty Images

Order intake in digital industries plunged 37% during the quarter, particularly in the short-cycle factory automation business, Siemens said.

Still, the division increased revenue and profit as it worked through its huge order book, and benefited from higher capacity utilisation at its own factories and the sale of more profitable products.

The fortunes of Siemens, whose products are used to automate factories and equip transport networks, give an insight into the health of the global economy.

Manufacturing activity has been slowing in recent months with weakening purchasing manager data in Europe and China.

During its third quarter, Siemens orders rose 10% to 24.24 billion euros, beating forecasts of 22.19 billion euros.

Revenue rose 6% to 18.89 billion, missing forecasts for 19.27 billion euros. Net profit of 1.44 billion euros also missed forecasts.

Siemens maintained its guidance at group level. It expects comparable revenue growth of 9% to 11% for the 12 months to end-September and earnings per share of 9.60 to 9.90 euros.

— CNBC contributed to this report

![Social Media Spring Cleaning [Infographic] Social Media Spring Cleaning [Infographic]](https://imgproxy.divecdn.com/9e7sW3TubFHM00yvXe5zvvbhAVriJiGqS8xmVFLPC6s/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zb2NpYWxfc3ByaW5nX2NsZWFuaW5nMi5wbmc=.webp)

![5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic] 5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic]](https://imgproxy.divecdn.com/Hv-m77iIkXSAtB3IEwA3XAuouMwkZApIeDGDnLy5Yhs/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9saW5rZWRpbl9zdHJhdGVneV9pbmZvMi5wbmc=.webp)