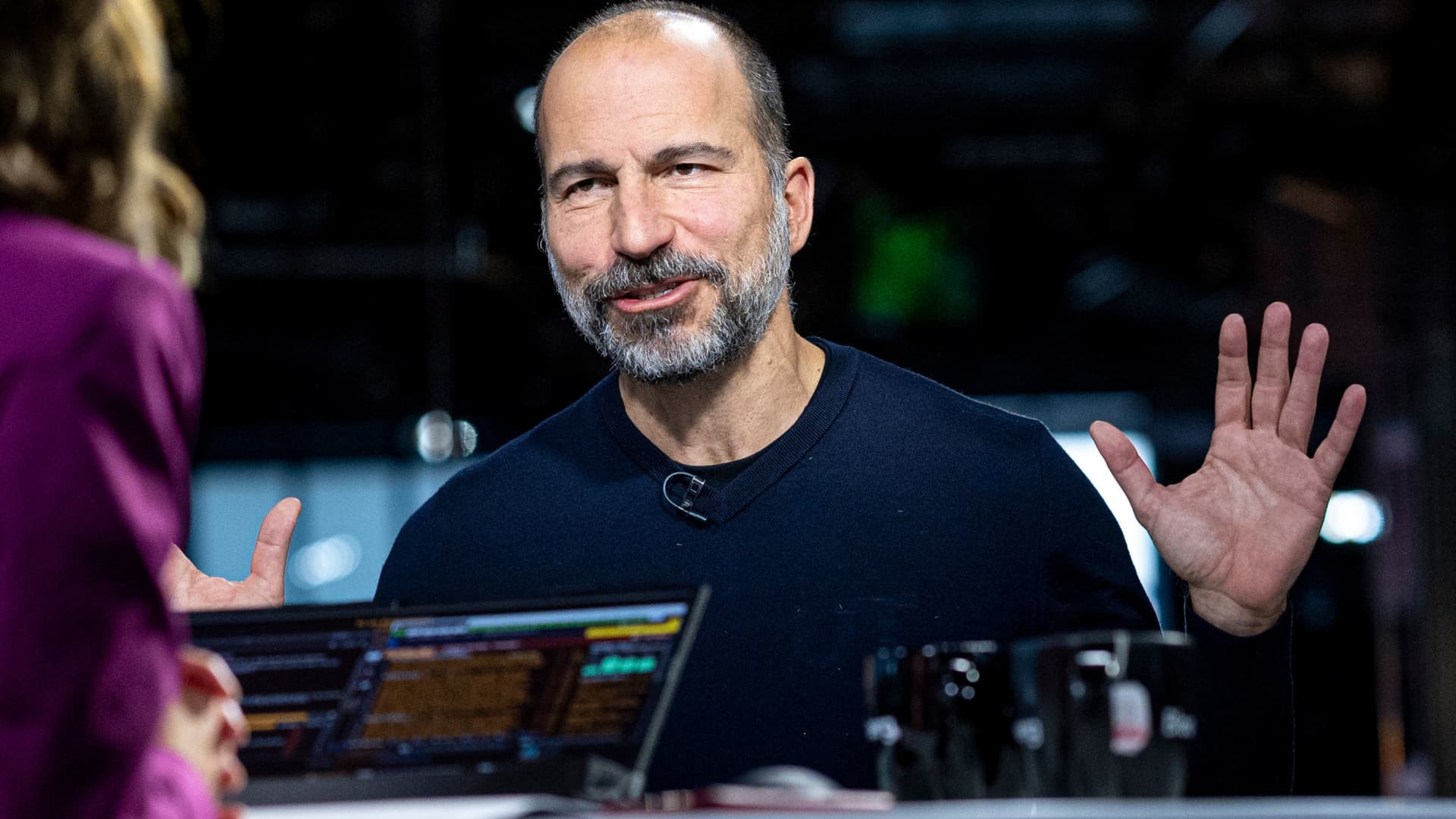

Stock buying by corporate insiders has risen sharply in May, but retail investors may want to hold out a little longer before following their lead. Through May 23, the ratio of insider buy-to-sell value was at its highest monthly level since March 2020, according to data from The Washington Service . The number of inside buyers had already topped 1,200, making it the biggest month of the year so far, and was on track to outnumber sellers for the first time in more than two years. The buyers include CEOs at major companies, such as Uber boss Dara Khosrowshahi, who bought $5.3 million worth of stock on May 6, according to VerityData/InsiderScore.com. Some of the recent buying has come among shares that were down more than 25% for the year . Insider buying is often seen as a positive sign by professional investors. The purchases by executives and board members can be a signal that insiders are bullish on the company’s prospects. Historically, increases in insider buying during a market downturn tend to happen near the bottom of the pullback. The strong buying in March 2020, for example, coincided with the market finding a bottom and roaring back, as the Federal Reserve stepped in to support financial markets. Insider buying also spiked in January 2019, shortly after the sharp Christmas Eve sell-off, according to the Washington Service data. However, investors should be cautious about seeing this month’s increase as executives calling the bottom of a market sell-off, said Ben Silverman, the director of research at VerityData. While the buying has been strong, it hasn’t been overwhelming. “All those periods insiders made really, really astute market bottom calls, and that was clear by the historic volume of buying at the time. While the numbers look good now, they’re at sort of the low end where they were during those periods,” Silverman said. Additionally, the jump in buying volume this month could have been helped by earnings season. Once companies report results, their insiders are allowed to trade more freely. For the first quarter reporting period, that effect is typically stronger in the first half May, Silverman said. As the month has gone on, buying activity has tailed off, according to VerityData’s research. “We really wanted to see buying numbers build, and then sustain for a couple of weeks. And instead we saw buying numbers backtrack,” Silverman said. Still, Silverman said he is “optimistic” that the level of buying shows that some stocks have become undervalued. Insider buying has been particularly strong among Russell 2000 companies, he added. Here are some of the companies that have seen top executives purchase stock over the past month, according to VerityData: Paramount Global Starbucks General Motors General Electric Carnival Corp.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)