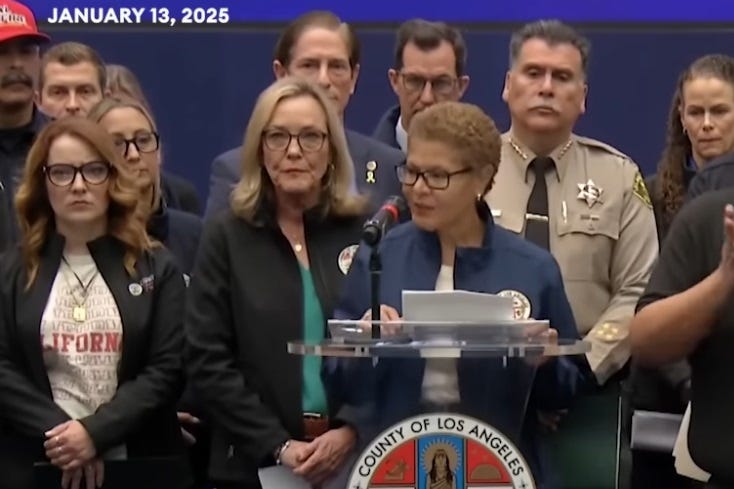

The Honor Magic Vs is on display at Honor’s stand at Mobile World Congres in Barcelona. The near $1,700 device is Honor’s attempt to challenge Samsung in the foldable smartphone market.

Arjun Kharpal | CNBC

It looks like the year of the foldable — a term used to describe a smartphone with a bendable screen.

A slew of foldable devices have hit the international market this year, as electronics giants, mainly Chinese, look to catch up to Samsung in a smartphone category it pioneered.

Analysts have questioned how big the foldable category can actually get, given the high price of the devices and their lack of clear uses right now.

“They’re all lovely, everyone is excited by them, but do we really know how big the market is?” Ben Wood, chief of research at CCS Insight, told CNBC via email.

“We are only at the beginning of the journey for the foldable story, that is a far from mature category.”

Foldables hit global market

Samsung launched its first foldable phone in 2019 and really created this category of smarpthones. These devices have a single screen that can bend, giving users a much bigger display surface in a device that they can carry around in their pockets.

Since the Samsung Galaxy Fold was unveiled around four years ago, the South Korean giant has launched a number of other devices. The Galaxy Fold series opens outwards like a book, while the Galaxy Z Flip opens up like a traditional flip phone.

Samsung accounted for 80% of global foldable shipments in 2022, according to Canalys. The market expects foldable phone shipments to jump 111% year-on-year to 30 million in 2023.

Still, these devices account for just over 1% of the total smartphone market, according to IDC data.

That potential growth is what other firms are chasing, as they try to catch up to Samsung.

Last month, Chinese vendor Oppo launched the Find N2 Flip, and Honor, the spin-off brand from Huawei, came out with its Magic Vs for international markets.

Lenovo CEO Yuanqing Yang told CNBC Wednesday that Motorola would be bringing a new version of its foldable Razr device out later this year. Lenovo owns Motorola.

It comes as speculation rises that Apple could be gearing up to launch a foldable device, though it may be an iPad rather than a smartphone.

Foldables have lost ‘wow factor’

Honor CEO George Zhao told CNBC in an interview last week that there are still a lot of challenges with foldable devices, particularly surrounding battery life, the weight of the devices and their high cost. Honor’s Magic Vs is priced at over $1,600.

But the push from electronics players to launch foldables comes from a desire for these brands to make inroads into the premium end of the smartphone market, which Samsung and Apple heavily dominate.

High-end smartphones — those that cost over $800 — accounted for 18% of the total handset market in 2022, up from 11% in 2020, Canalys data shows.

“As I see foldable devices, they are more connected to [an] attempt improving brand image through showcasing innovation than selling large volumes,” Runar Bjørhovde, analyst at Canalys, told CNBC via email.

The “wow factor” may have worn off for consumers now that Samsung has had folding smartphones on the market for a few years, according to Bjørhovde, who said that, ultimately, a lower price will be needed for rivals to compete with the South Korean electronics giant.

The foldable phone is “no longer surprising and unexpected, and a big part of the reason is Samsung’s big marketing investments that has normalised the form factor,” the analyst said.

He added that revolutionizing foldables will be close to impossible, moving forward.

“Developments will be more about gradual evolution and lowering price points. Lower price points will particularly be key for vendors out to challenge Samsung’s dominance,” Bjørhovde said.

![Social Media Spring Cleaning [Infographic] Social Media Spring Cleaning [Infographic]](https://imgproxy.divecdn.com/9e7sW3TubFHM00yvXe5zvvbhAVriJiGqS8xmVFLPC6s/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zb2NpYWxfc3ByaW5nX2NsZWFuaW5nMi5wbmc=.webp)

![5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic] 5 Ways to Improve Your LinkedIn Marketing Efforts in 2025 [Infographic]](https://imgproxy.divecdn.com/Hv-m77iIkXSAtB3IEwA3XAuouMwkZApIeDGDnLy5Yhs/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9saW5rZWRpbl9zdHJhdGVneV9pbmZvMi5wbmc=.webp)