[ad_1]

The U.S. equity market is often described as the deepest and most liquid in the world, but hedge fund manager Mohnish Pabrai has only one U.S. stock in his portfolio. It’s a semiconductor stock and Pabrai explains why he likes it. After years of market-beating returns, semiconductor stocks took a drubbing this year as market volatility spiked and investors rotated out of growth stocks into safer bets. The iShares Semiconductor ETF, or SOXX , which tracks the performance of semiconductors, is down more than 20% this year. But Pabrai is still bullish on Micron Technology . The veteran investor is managing partner of Pabrai Investment Funds and is known for closely following Warren Buffett ‘s principles on value investing and capital allocation. Micron derives the bulk of its revenue and profit from dynamic random-access memory (DRAM), a type of semiconductor memory widely used in digital electronics, Pabrai told CNBC Pro Talks on Wednesday. The DRAM business is an oligopoly and the three key players own a collective market share of more than 95%, he noted. Samsung Electronics has about half the market share, while SK Hynix and Micron have approximately 25% market share each. “The memory business used to be a horrible business because there were 15 to 20 players beating each other up, but it has changed,” Pabrai said. “It changed in the last few years when it went down to three rational players that are all very interested in making reasonable profits. None of them is actually chasing market share or trying to clobber the other two.” He believes the sector is already saturated and unable to accommodate additional entrants. “These are very protected businesses. I don’t think a fourth player can emerge in this space and I think over the long term, all these players will do well and I think Micron probably might do better than the other two is my guess,” he added. Long-term potential The hedge fund manager believes the sector will also benefit from a host of megatrends that’s driving demand for chips. McKinsey & Company said the global semiconductor industry is poised for a decade of growth and projected to become a trillion-dollar industry by 2030. According to the global consultancy firm, 70% of growth is predicted to be driven by just three industries — automotive, computation and data storage, and wireless. “I think that we are in the very early stages of artificial intelligence, cloud computing, self-driving cars … I think memory usage is going to go up dramatically in the [coming] years,” Pabrai said. “I think it’s a business worth studying. It is at a very low, you know, single digit P/E and, and I think will trade significantly higher at some point,” he said. The price-to-earnings ratio is a metric used by analysts and investors to value a stock. A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings.

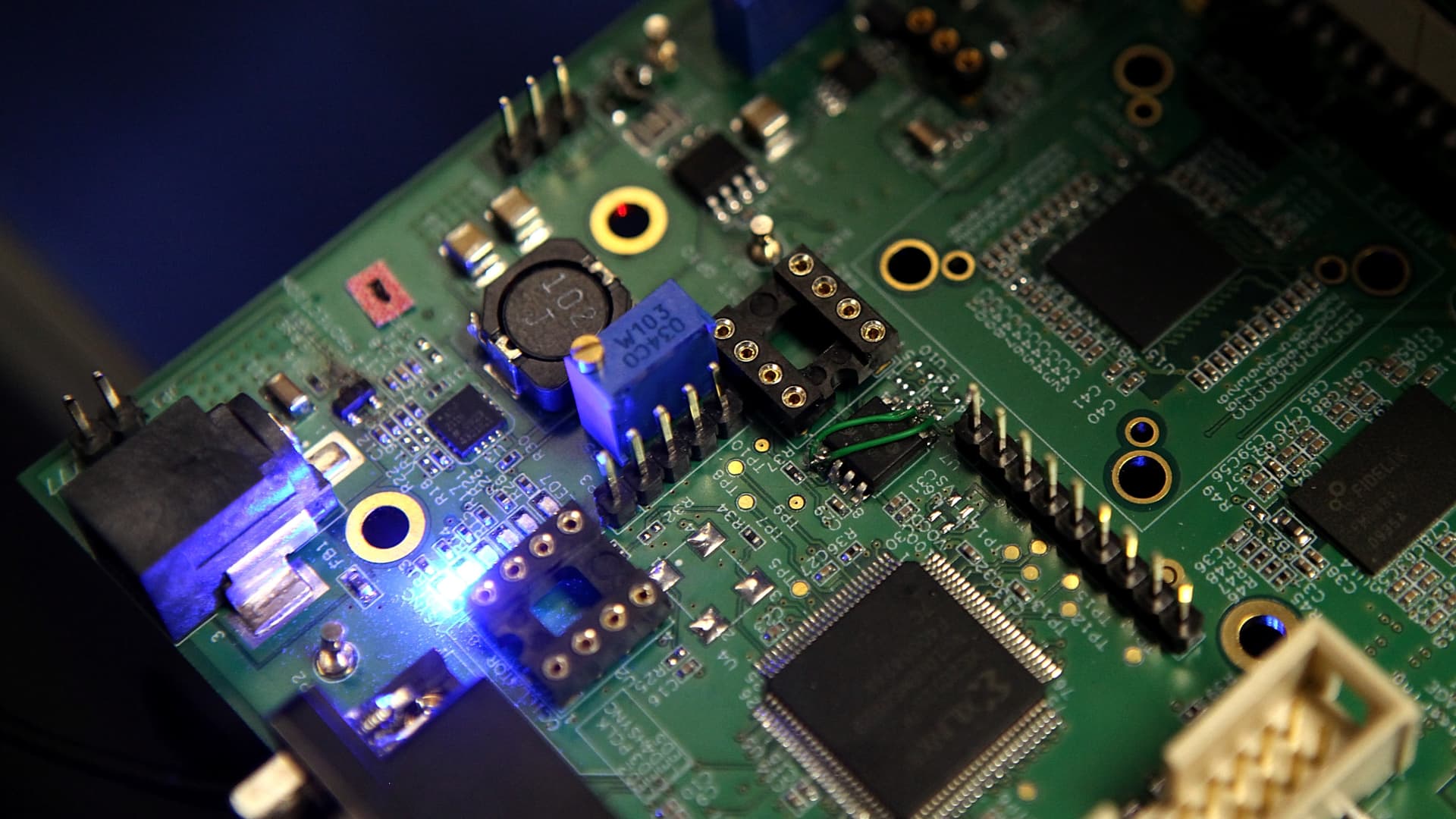

Semiconductors are seen on a circuit board.

Justin Sullivan | Getty Images

The U.S. equity market is often described as the deepest and most liquid in the world, but hedge fund manager Mohnish Pabrai has only one U.S. stock in his portfolio. It’s a semiconductor stock and Pabrai explains why he likes it.

[ad_2]

Original Source Link