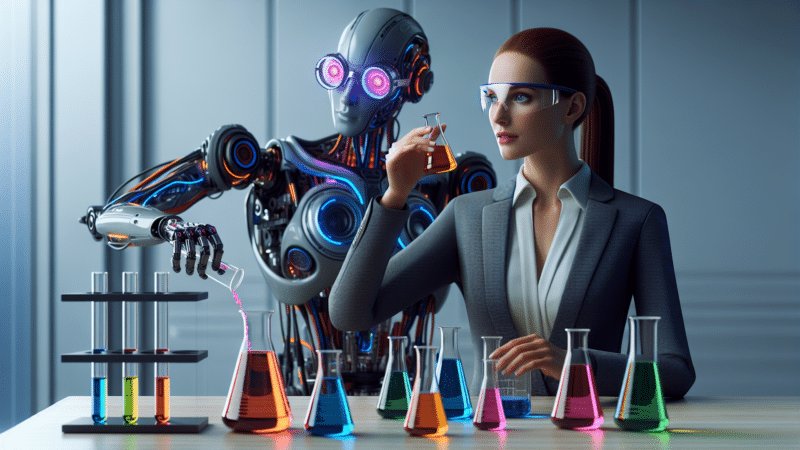

Andy Jassy, chief executive officer of Amazon.Com Inc., during the GeekWire Summit in Seattle, Washington, U.S., on Tuesday, Oct. 5, 2021.

David Ryder | Bloomberg | Getty Images

Amazon will announce second-quarter earnings after the markets close on Thursday.

Here’s what analysts expect:

- Earnings: 13 cents per share, according to Refinitiv

- Revenue: $119.09 billion, according to Refinitiv

- Amazon Web Services: $19.56 billion, according to StreetAccount

- Advertising: $8.65 billion, according to StreetAccount

Amazon is rounding out what’s been a rocky earnings season for Big Tech, as soaring inflation, rising interest rates and other macroeconomic challenges weighed on results. Facebook parent Meta reported disappointing second-quarter numbers and forecast trouble in the current period. Alphabet and Microsoft missed analysts’ estimates on the top and bottom lines. Apple reports on Thursday after the bell.

In one of Amazon’s biggest and fastest-growing markets, digital advertising, news has been particularly bleak. Facebook, Google, Snap and Twitter have all warned of slowing ad demand, as brands and marketers curtail their spending to manage inflationary pressures.

Amazon’s ad unit, which trails only Google and Facebook in the U.S., is projected to show growth of 10% from a year earlier to $8.65 billion.

For Amazon as a whole, analysts expect growth of 5.3%, compared to 27% in the year-ago quarter. That would mark Amazon’s third straight quarter of single-digit annual revenue growth.

The core retail business has slowed significantly from the expansion it experienced the past two years. At the height of the pandemic, Amazon’s sales and profits ballooned, as shoppers shunned physical stores and flocked to online retailers.

Now, Amazon is reckoning with slowing e-commerce sales, along with higher costs. Last quarter, the company acknowledged it had too many workers and too much warehouse capacity after investing heavily in its fulfillment network to deal with the flurry of e-commerce orders during the pandemic.

CEO Andy Jassy told CNBC in May that Amazon has taken steps to defer construction of some new buildings, or let leases expire in order to “grow into this footprint.”

Amazon has delayed, paused or canceled more than 20 capital projects planned over the next year, representing roughly 25 million square feet, William Blair analysts estimated in a note to clients on Monday.

Across the retail sector, inflationary concerns are becoming more evident. Amazon’s stock fell on Monday after Walmart cut its profit outlook for the second quarter and full year. Best Buy also lowered its second-quarter and full-year forecast on Wednesday.

Inflation could also weigh on Amazon’s cloud-computing division. Mizuho analysts said in a note earlier this month that cloud spending could decelerate as companies look to trim costs. Amazon Web Services is forecast to post a 32% increase in revenue from a year ago to $19.56 billion.

One major hit to earnings is likely to come from Amazon’s investment in electric vehicle company Rivian. Last quarter, Amazon took a $7.6 billion loss on its stake in Rivian, a dramatic shift from the preceding period, when it reported a gain of almost $12 billion from its Rivian holding. Rivian shares plunged another 49% in the second quarter after dropping by more than 50% in the first three months of the year.

Amazon shares are down about 27% so far this year, underperforming the Nasdaq, which has fallen roughly 22% year to date.