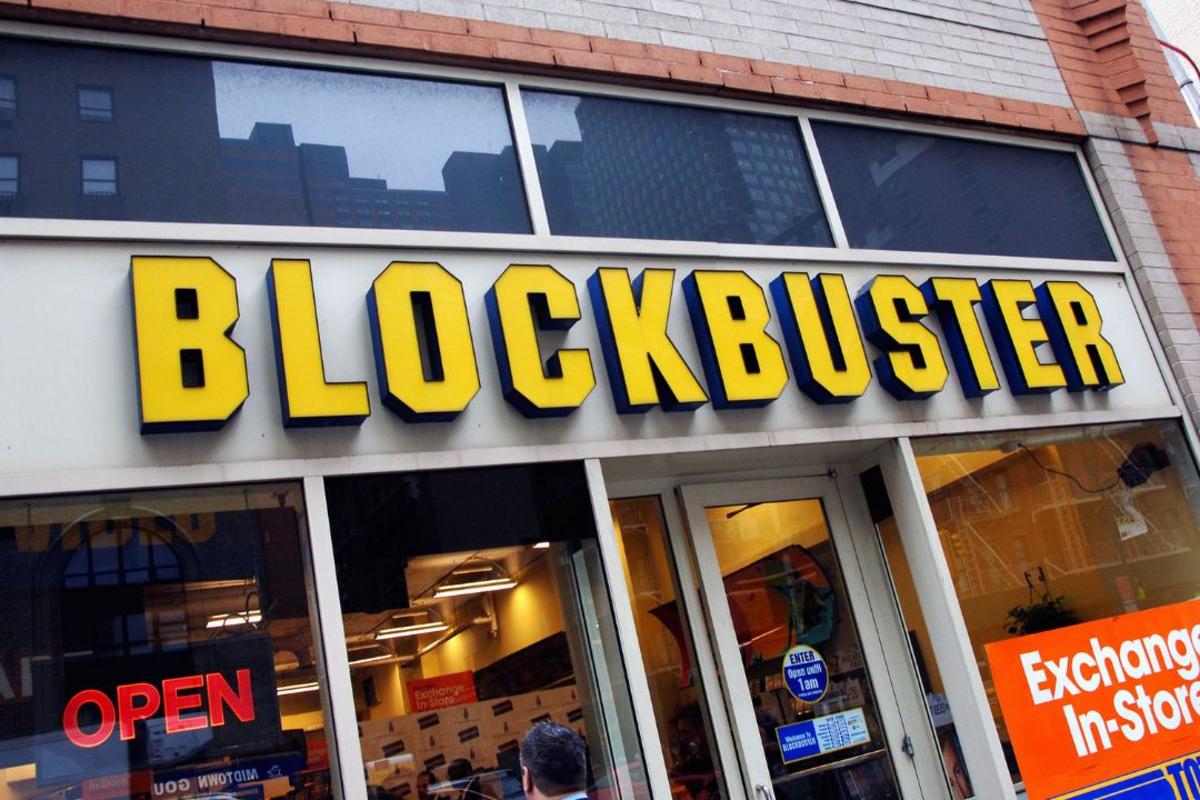

Tech startups and other businesses raced to line up sources of cash for payroll and other immediate needs after their deposits in Silicon Valley Bank, long a linchpin of tech financing, were locked up when

federal authorities took control Friday morning.

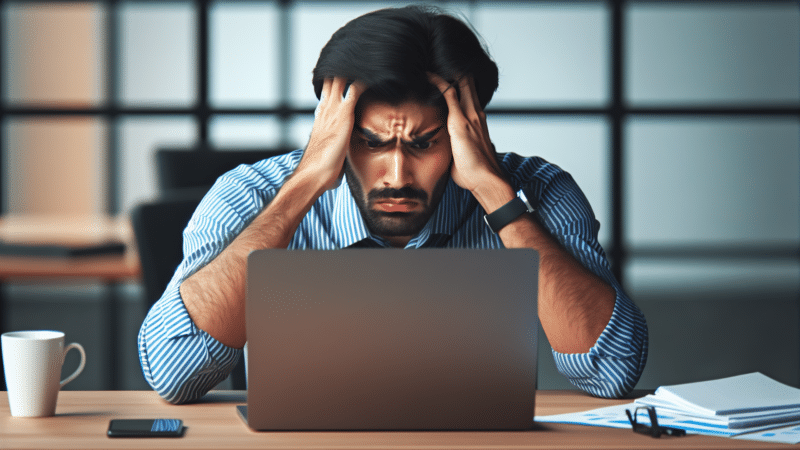

The bank’s sudden collapse fueled uncertainty among many founders over the immediate future of their businesses, and further hobbled a startup sector that has struggled with a sharp slowdown in venture funding and broader economic woes. Its demise will likely further accelerate the shift away from the high-risk and aggressive growth strategies that startups embraced during the decades-plus bull market that ended last year, according to longtime startup investors.

![How Will AI Impact the Global Workforce? [Infographic] How Will AI Impact the Global Workforce? [Infographic]](https://imgproxy.divecdn.com/vhdGY5213MhIJV6-NnwNGwlYkeRCW5mkaDQGgpKM3Qs/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9qb2JzX2luZm9fMi5wbmc=.webp)