This content contains affiliate links. When you buy through these links, we may earn an affiliate commission.

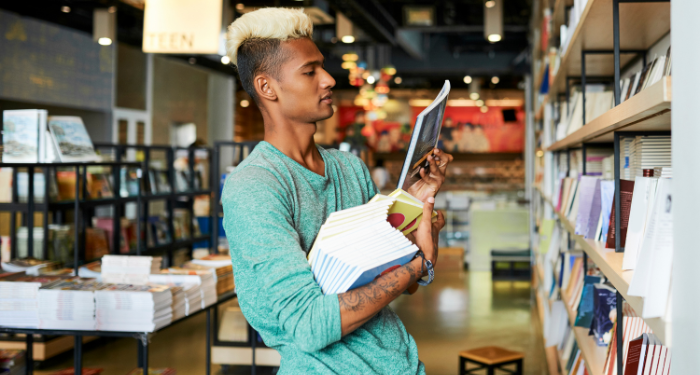

There are several things a person can do with their money. Firstly, they can spend it. Many of us do this all the time, probably more than we should (just me?). Secondly, you can save it in a mattress, a banana stand, or a savings account. We all know it is smart to save our money, but where to save it is often a conundrum. And this is where the third general category of “what to do with money” comes into play: investing. Reading some of the best books to learn about investing is a good starting point if you go with this option.

Unless you’re putting actual cash into a mattress (please don’t do this), your savings are likely invested to some degree. A good savings account in the U.S. has an interest rate of around 0.5-1.0% annual percentage yield (APY), and as such, you are getting a very small return on your money for letting the bank hold it and use it to make more money. In a nutshell, that’s investing. You give the bank your money and they give you back a little bit more.

“But Tika!” I hear you say. “I would prefer to get a LOT more back for giving someone the privilege of trusting them with my money. I would also like to retire one day and pretend to escape capitalism, possibly somewhere sunny or with killer powder.” Fear not! Despite working in the finance world, I have virtually no understanding of investments — a rather embarrassing confession. Putting together this list of the best books to learn about investing has been a very helpful starting point. There are many different places you can choose to invest your money, so I’ve broken the suggestions out into two general categories.

The “Markets:” Stocks, Funds, et al.

Rich Dad, Poor Dad by Robert T. Kiyosaki

When Rich Dad, Poor Dad was first published in 1997, my own father immediately sent me a copy that followed me from apartment to apartment — unread — until I finally donated it at some point. My brother, on the other hand, actually read his copy and is now comfortably invested and owns both a house and a rental property.

Quit Like A Millionaire by Kristy Shen and Bryce Leung

Kristy Shen and Bryce Leung are leaders in the “Financial Independence, Retire Early”(FIRE) movement. They present a mathematical and reasoned approach to managing your money so that you, too, can retire before you turn 65.

How to Buy Stocks by Louis C. Engel and Henry R. Hecht

Engel wrote the first edition of this primer on the investment market in 1957. The latest edition was published in 1994, which explains the cover. How to Buy Stocks remains important because, while the mechanisms to purchase stocks have changed, the underlying process has really not. Understanding the system is critical to making it work for you.

Get Good with Money by Tiffany “The Budgetnista” Aliche

Tiffany Aliche was put out of a job by the recession and lost her nest egg due to some shady financial advice. While working her way back to financial independence, she developed a 10-step plan that will help anyone assess their goals and what stands between them and achieving said goals. No matter where you are in your journey, The Budgetnista has some great advice for you.

The Bogleheads’ Guide to Investing by Mel Lindauer, Taylor Larimore, et al.

John C. Bogle (1929 – 2019) was the founder of Vanguard and the “grandfather of index funds.” If you don’t know what an index fund is, this is a great place to start learning. The authors assume no prior investing knowledge; their goal is to help the reader create a strategy from scratch. Bogle wrote the forward; if you’re interested in more from the man himself, check out his published works as well.

What To Do With Your Money When Crisis Hits: A Survival Guide by Michelle Singletary

German military strategist Helmuth von Moltke is famous for saying, “[n]o battle plan survives contact with the enemy.” A good investing plan needs to be flexible enough to survive contact with the real world and all the economic gobbledegook that entails. Singletary is a financial columnist from an economically disadvantaged background, and helps investors (that’s you!) build a plan that will help ensure economic safety.

I hope you (and I!) are able to get some inspiration from this list of the best books to learn about investing. Hopefully, at least one of these books will show you how to work toward financial independence and teach you how you can achieve early retirement if that’s what you’re after. After all, if we don’t collectively retire early, how are we ever going to get through our TBR lists?!?

If you’re looking for more books on investing, you can check out fellow Book Riot contributor Neha Patel’s list of 15 Top Investment Books for New Investors.