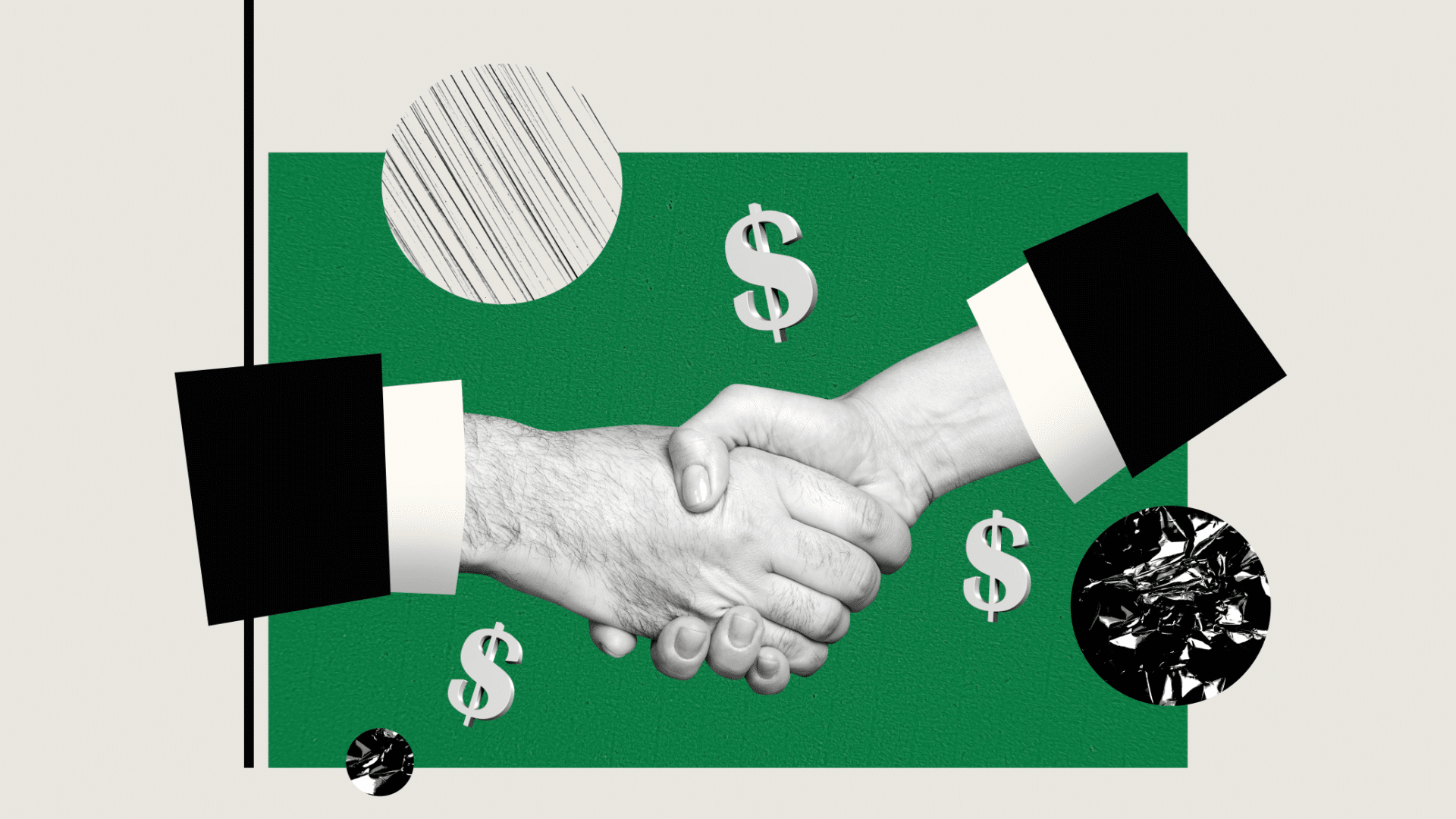

All businesses need legal advice and services at some point; however, many growing small- and medium-sized organizations don’t need (or can’t justify the cost of) a full-time general counsel, let alone an in-house legal department.

But often, these businesses need practical, “get to yes” advice from skilled and experienced counsel with a deep knowledge of their business when navigating the risks and opportunities that come with profitable and sustainable growth.

Hiring a different lawyer or law firm for each new case or issue can be very transactional and highly inefficient, especially when you have to educate them each time on your business before they can provide advice or assistance. This atypical transactional approach to engaging with legal counsel may solve the immediate problem or issue, but it can result in legal whack-a-mole if the larger underlying issues are not addressed from a more strategic and proactive vantage point—something that requires industry knowledge and understanding your company’s structure, risk appetite and growth goals.

With a fractional general counsel (FGC) services model, a company gets the knowledge, ready access and benefits of experienced general counsel with a deeper bench of legal specialists at an outside law firm, all without having to pay relatively high compensation and benefits. Unlike the prevailing and traditional “arm’s length” engagement with a relationship attorney at a law firm, FGCs are passionate about and intentionally invest in building a relationship with you and your leadership team to better understand your company’s challenges and opportunities. As a result, an FGC proactively offers strategic and readily implementable legal advice that is customized to your company’s growth goals and risk appetite, not reactionary, “where the deal goes to die” counsel.

Here’s how the FGC model helped our businesses—and how it could work for yours, too.

A Strategic Partnership Based on Trust

At JANCOA, we were pleasantly surprised that the FGC model offered us more than just legal services—it became a key avenue for trusted business advice and counsel. Our FGC quickly became an indispensable member of our leadership team, offering practical problem solving and a “legal gut check” on the potential impact of critical business decisions.

For example, our FGC proactively notified us of a potential administrative issue and then promptly addressed it—something an outside firm engaged for a specific matter wouldn’t have noticed. He has also helped us to strategize for the future, advising on issues involving transitions and succession planning for our family-owned business.

When our business went through a rough patch, the relationship proved invaluable. Having someone you trust to deliver strategic counsel and engage in difficult conversations can ease the burden on and provide a sanity check to leadership.

Flexibility, Scalability, Affordability

At Innago, we typically hired firms on an ad hoc basis depending on the matter at hand. But when our legal needs increased rapidly, we knew we required a deep bench of attorneys who knew our business, could provide timely advice and offered more measurable and predictable legal expenditures.

By using an FGC backed by a law firm, we gained access to experienced lawyers across a wide range of practice areas, from intellectual property and litigation to labor and employment. As an added benefit, our FGC can advise when to engage attorneys with more specialized legal and industry experience, getting them up to speed on our business (so we don’t have to), while also ensuring they’re delivering the advice we need when we need it. This kind of on-demand access means that we can respond to issues quickly, efficiently and affordably.

What’s more, by not having to employ a full-time GC, early-stage, smaller companies like ours can redirect spending that would otherwise go to a GC’s salary and benefits to other aspects of the business—without sacrificing quality legal advice and work product. Many FGCs operate under a monthly retainer model for a defined scope of services, which allows companies to contact them whenever they need to while avoiding surprise bills.

For example, when the Federal Trade Commission issued a ruling recently, we were unsure how to interpret its potential impact on our business and what compliance measures affected us. Thankfully, because we have an FGC who knows our business inside and out, he immediately connected with someone who specializes in this regulatory area and we discussed our questions about the ruling and how to proceed in light of it.

A Temporary or Permanent Solution

The FGC services model is either a temporary or more permanent way to access high-quality, personalized legal services as your company grows. It’s an especially useful model for organizations in industries with fluctuating or seasonal legal demands—such as transportation or retail—as well as those, like start-ups, which may need to scale quickly, ramp up hiring, enter new markets, or navigate new regulatory requirements.

The FGC model is a proven transitional model for growing and emerging companies too, some of which already use other fractional executives to supplement their leadership team as they scale for growth. This model offers valuable legal advice and counsel without breaking the bank, allowing leaders to tackle pressing issues and plan for the future.

Fractional executives ultimately work themselves out of a job, but for an FGC, the runway is long: The model works for companies generating between $5 and $400 million in annual revenue. When companies ultimately decide to onboard a full-time corporate counsel or general counsel, the FGC can help with a more seamless transition and set that individual up to hit the ground running and ensure long-term success.

Whether temporary or more permanent, the FGC services model combines the responsiveness, trusting relationship and business-orientation of an in-house GC with the extensive capabilities and resources of a full-service law firm. An FGC offers strategic and proactive legal advice to help leaders “get to yes” while managing risk—the trusted advisor every CEO needs.

![20 Predictions for Social Media in 2025 [Infographic] 20 Predictions for Social Media in 2025 [Infographic]](https://imgproxy.divecdn.com/HMVhRh2JvYwAse_QsxNWdYtb_Of31-oCF2OnUe4eZqA/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zb2NpYWxfbWVkaWFfdHJlbmRzXzIwMjVfMi5wbmc=.webp)

![Instagram Shares Tips on What to Avoid to Maximize Post Reach [Infographic] Instagram Shares Tips on What to Avoid to Maximize Post Reach [Infographic]](https://imgproxy.divecdn.com/oeaypf55nGOsin6XxBa9EFYmwtVEiffkp9q_OiAPUGM/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9pbnN0YWdyYW1fZGlzdHJpYnV0aW9uX2luZm9ncmFwaGljMi5wbmc=.webp)