If we were The By God New York Times, we might be a wee bit more careful about credulously printing rosy financial projections about his personal wealth by Donald Trump. Hey, fool us 10,742 times, shame on you. Fool us 10,743 times, shame on us.

But the Times gotta Times:

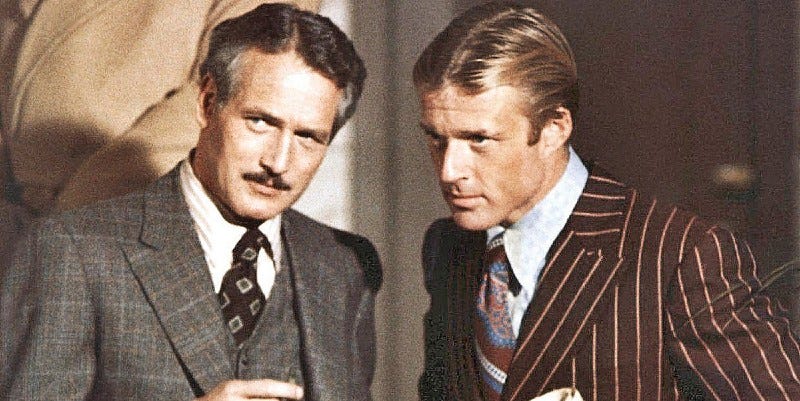

Former President Donald J. Trump’s social media company on Friday completed a long-awaited merger with a cash-rich shell company, raising Mr. Trump’s wealth by billions and potentially providing him a fresh source of cash to pay his mounting legal bills.

That is the lede to a very rosy assessment of the possible financial windfall for Trump.

Based on Digital World’s stock price of $44 a share just before the vote announcement, Trump Media will debut with a market value of more than $5 billion. That means Mr. Trump’s personal stake will be worth more than $3 billion.

Oh damn, you mean Trump might actually make that $450 million payment to the state of New York on Monday so Attorney General Letitia James won’t get to seize any of his overvalued, over-marbled properties with the aesthetic of a Central Asia dictator in the grips of an ether-fueled decorating binge? This is very disappointing, we were really looking forward to that.

Well, no, and this delightfully bitchy evaluation of the entire deal from the Associated Press makes it much more clear that this whole TruthSocial merger is the sort of lazy grift that Trump has made a career of getting involved in and then distancing himself from the instant it goes in the toilet.

Trump owns somewhere around 78 percent of the stock in the new company. But like all other shareholders in the new company, he will be bound by a “lock-up” agreement that prohibits him from immediately selling his shares, a move that could tank the stock price and financially hurt the thousands of MAGA dingbats who have reportedly invested in Digital World — a “SPAC” created only to merge with Trump’s idiot TruthSocial media “platform” — based solely on their faith that Donald Trump is actually a wealthy business genius and not a broke-ass, overleveraged loser.

Instead he has to hold on to the shares for a minimum of six months, to prove to regulators that golly gee, surely this business of his is legit.

IT WAS THIS ONE.

The only way Trump could get rid of any shares is if he transferred them to family members, but those family members would also have to abide by the lock-up provision. The company’s board could also alter the lock-up agreement after the deal closes. But there is a catch there too:

Such a decision by the board could open those directors up to legal scrutiny. They would need to show they’re doing it to benefit shareholders.

But if the value of Trump’s brand is key to the company’s success, and if easing the lock-up agreements could preserve that brand, it could make for a case that would at least spare board members’ lawyers from getting laughed out of court immediately.

We’re pretty sure any lawyer associated with any deal involving Donald Trump is already used to being laughed out of court.

IT’S THIS THING.

And that argument from any lawyers would have to assume that Trump’s brand is worth anything like what it used to be, which it is not. Ask anyone who has followed TruthSocial’s inability to become anything more than a tiny speck in the social media space:

The company lost $49 million in the first nine months of last year, when it brought in just $3.4 million in revenue and had to pay $37.7 million in interest expenses.

CNN broke that down even further: Trump Media had revenue of just $1.1 million in the third quarter of 2023, while also posting a quarterly loss of $26 million. Someone over at the Lawyers, Guns and Money blog points out that a company whose operating losses exceed its revenue by 2,264% may not be attractive as an investment vehicle.

From the AP again:

“It’s losing money, there’s no way the company is worth anything like” what the stock price suggests, said Jay Ritter, an IPO specialist at the University of Florida’s Warrington College of Business.

Ritter also told CNN that this new company falls into the category of “meme stock” like GameStop or AMC, and we all remember how well those worked out.

Given all this, the Times headline “Trump Media Merger Provides Trump a Potential Cash Lifeline” would seem to very much oversell the chances of this lifeline actually appearing for Donald Trump. Sure, TruthSocial gets an immediate $300 million infusion of cash, but given the site’s performance, with an active user base that has shrunk by 39 percent year-over-year since its launch, there is zero reason to think it will do anything other than burn through that pretty quickly.

Basically, this whole SPAC merger is the exact kind of grift on which Trump has built his debt-riddled empire, like Trump Steaks or wanting to be president. It would be pretty cool at this point if our major media organs would lead with that, and not with something approaching servility.

Yr Wonkette is a more functional business concern than TruthSocial, and we’re supported exclusively by you people.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)