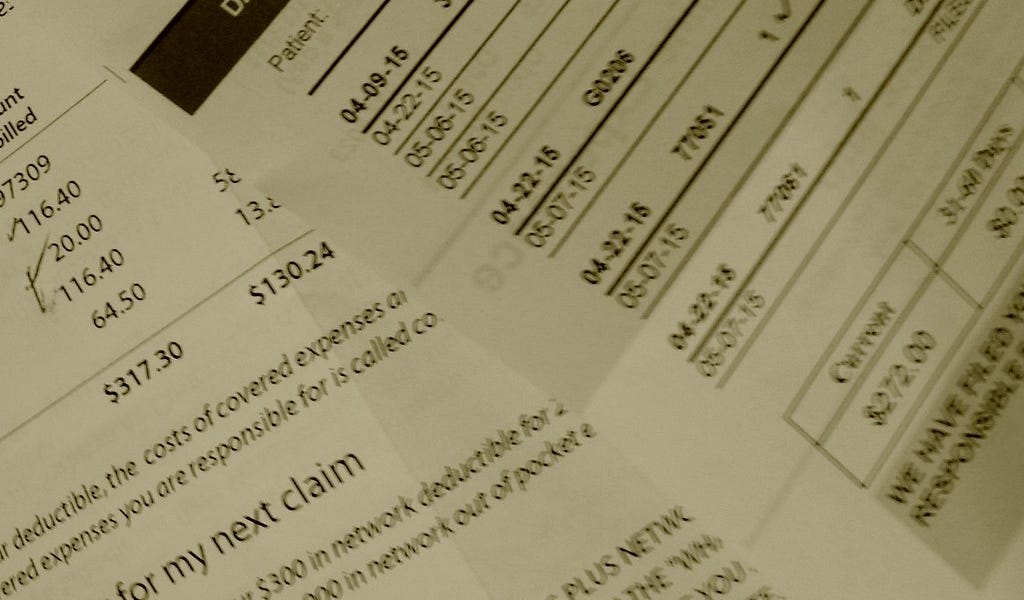

In 2022, US Americans spent an average of $13,493 a year per person on health care. That is more than any other country in the world, and it’s even more bananas when you consider the fact that 40 percent of adults under the age of 55 haven’t even seen a doctor in five years.

A big reason why people avoid going to the doctor, other than the fact that it can be very expensive, is that they already have medical debt and don’t want more — so they will wait and wait to seek medical care until things get really bad, in which case they will be a lot more expensive.

But here’s some good news about that! Connecticut Gov. Ned Lamont announced today that his state is set to become the first state to actually cancel medical debt for eligible residents.

The state is partnering with a nonprofit organization that buys debt at the same discount price at which debt collectors buy it, and will be leveraging $6.5 million in American Rescue Plan Act funds to get rid of $1 billion in medical debt.

“This is not something they did because they were spending too much money, this is something because they got hit with a medical emergency,” Lamont said on Good Morning America on Friday. “They should not have to suffer twice — first with the illness, then with the debt.”

Well that does make a certain kind of sense, at least to those of us who are not monsters.

Who is eligible? Residents whose income is less than 400% of the federal poverty line (so $58,320 for individuals, $124,800 for a family of four, etc.) and anyone whose medical debt is more than 5 percent of their annual income. That’s a lot of people.

The best part is that they won’t have to apply for anything, they won’t have to fill anything out — their medical debt will just go away.

I probably don’t have to get into the kinds of problems that having medical debt can cause — it can affect a person’s credit, their ability to buy a home, etc. etc., which in turn means that other people are going to have a harder time selling things and selling their homes. It’s almost as if everything is interconnected and bad things happening to other people also hurts the rest of us.

About 100 million Americans owe $250 or more in medical debt, and while we don’t have an exact figure on how much we owe in total, one analysis determined that it’s about $195 billion ($88 billion of which is in collections), which you will note is a lot of money. Two-thirds of those who file for bankruptcy do so for reasons related to health care and medical debt.

It’s hard to believe that we live in a world where “medical debt” is even a term to begin with, but it’s part of the price we have to pay for the privilege and wonder of having private health insurance companies. I don’t personally understand the appeal or where anyone is exercising this “choice” I keep hearing about, but I have clearly been outvoted on this one.

If this goes over well in Connecticut, it’s definitely the kind of thing that other states might consider, given that it’s literally less expensive than the cost of having people with that much debt. Of course, most of the medical debt in the US is in the South, in states with governors and legislatures far less likely to find this kind of thing appealing.

In the meantime, the Consumer Financial Protection Bureau is working to make it so medical debt no longer affects one’s credit rating, which would be amazing for all of us.

But good for Connecticut and good for all of the people who are going to be unburdened in this way, I can’t imagine what an absolute relief it must be for them to not have that hanging over their heads anymore.

PREVIOUSLY