[ad_1]

Spotify led a group of high-flying streaming stocks this week by gaining 14.8% to $157.54 per share, increasing its market capitalization by nearly $4 billion to $30.7 billion. The world’s largest streaming company, which boasted 220 million subscribers as of June 30, has clawed back nearly all its losses since its share price dropped 14% following its second-quarter earnings on July 25. Through Friday (Sept. 1), Spotify shares are up 99.5% in 2023, second only to streaming company LiveOne’s 191.9% gain.

The 21-stock Billboard Global Music Index improved 4.7% to 1,359.74, its highest mark in four weeks and the first gain since the week ended July 21. Twelve stocks finished the week in positive territory, seven stocks dropped and two were unchanged. The index outperformed many key indexes. In the United States, the Nasdaq composite gained 3.2% to 14,031.81 and the S&P 500 improved 2.5% to 4,515.77. In the United Kingdom, the FTSE 100 rose 1.7% to 7,464.54. South Korea’s KOSPI composite index climbed 1.8% to 2,563.71.

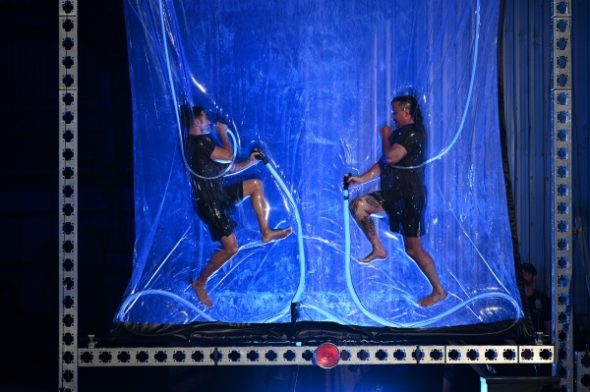

Six music streaming stocks improved by an average of 6.7% this week. Led by SiriusXM’s 11.4% gain, three radio stocks had an average gain of 4.9%. Led by Sphere Entertainment Co.’s 7.9% gain, four live music stocks had an average gain of 1.7%. Eight recorded music and publishing stocks had an average gain of 0.5% and were led by HYBE’s 5.1% improvement.

Close behind Spotify was Chinese music streamer Cloud Music, which gained 13.4% to HKD 79.35 ($10.12). Cloud Music gained 3% last week following mid-year results that showed revenue improved 33.8% to 4.26 billion RMB ($587 million). This week’s gain came amidst a report by Reuters that Cloud Music was forced by Chinese authorities to remove live streaming features that are sometimes used for illegal gambling. One analyst estimated the anti-gambling crackdown to eliminate 20% to 70% of live streaming revenue at Cloud Music, Tencent Music Entertainment and broadcasting platform Huya.

Tencent Music Entertainment shares rose 8.5% to $7.03, cutting the stock’s year-to-date loss to 15.1%. LiveOne shares jumped 11.9% to $1.88. Shares of French music streamer Deezer were unchanged at 2.07 euros ($2.24).

The lone laggard amongst music streaming stocks this week was Abu Dhabi-based Anghami. With its share price down 8.5% this week — the worst performance in the Billboard Global Music Index — investors apparently don’t see Anghami’s need for debt financing as a positive sign for the company. Anghami shares dropped 11% on Thursday after the company announced in an SEC filing the sale of $5 million of convertible debt related to an investment by the venture arm of Saudi media company SRMG that was announced on August 23. After dropping another 9% to 81 cents on Friday, Anghami shares ended the week well below the $1 floor for companies trading on the Nasdaq.

[ad_2]

Original Source Link