Korean music company HYBE is more than getting by with its primary artist, BTS, on hiatus and its members pursuing solo projects and preparing for military duty. In 2022, HYBE’s revenue grew 41.6% to 1.78 trillion won ($1.41 billion at the Dec. 31, 2022 exchange rate), the company announced Tuesday (Feb. 21).

Adjusted earnings before interest, taxes, depreciation and amortization rose 23.9% to 328.8 billion won ($260.5 million). Margins were thinner that in previous years, however. Last year’s operating margin (as a percent of revenue) fell to 13.4% from 15.1% in 2021 and 18.3% in 2020. Adjusted EBITDA margin dropped to 18.5% from 21.1% in 2021 and 20.2% in 2020.

HYBE breaks revenue into two main categories: artist direct-involvement and artist indirect-involvement. Direct involvement revenues cover such things as recorded music, touring and management. Recorded music sales improved 47% to 553.9 billion won ($438.9 million) and was the largest single revenue source. Concert revenue jumped 470.1% to 258.2 billion won ($204.6 million) as artists returned to touring after scaling back performances during the pandemic.

BTS may be taking a break but it’s still HYBE’s sales leader in album-loving Korea. Four HYBE artists were in the top 10 of Korea’s year-end album tally: BTS was No. 1 with 5.75 million units, Seventeen was No. 3 with 5.56 million units, Tomorrow X Together was No. 5 with 2.78 million units and ENHYPEN was No. 8 with 2.64 million units. Le Sserafim was the No. 15 artist with 1.29 million units. As a point of comparison, the top album in the U.S. last year, Taylor Swift’s Midnights, sold the equivalent of 1.8 million units.

Artist indirect involvement revenue grew only 9.7% in the calendar year. Merchandising and licensing improved 24.8% to 395.6 billion won ($313.5 million) and fan club revenue grew 47.1% to 67.1 billion won ($53.2 million).

In the fourth quarter, HYBE’s revenue grew 16.9% to 535.3 billion won ($424.2 million) in the fourth quarter of 2022. Recorded music revenue jumped 76.4% to 149.1 billion won ($118.2 million) and was the largest single source of revenue.

BTS’s global success has allowed HYBE to diversify itself and rely less on the K-pop super group. In 2017, Korea accounted for 72% of HYBE’s revenues compared to 14% for Japan and 9% for North America. In 2022, HYBE had grown 19-fold from 2017 and had almost evenly balanced business between its three main markets: Korea (33% of revenue), North America (32%) and Japan (28%). The rest of the world contributed just 7% of HYBE’s 2022 revenue — but that could change if the company’s newest investment works as expected.

HYBE’s recent acquisition of a leading stake in competing K-pop company SM Entertainment is an opportunity to develop in markets where it currently has little presence. CEO Park Jiwon explained during Tuesday’s earnings call that HYBE artists can benefit from SM Entertainment’s strong network and infrastructure in China and Southeast Asia. Likewise, HYBE believes it can help SM Entertainment in the North American market.

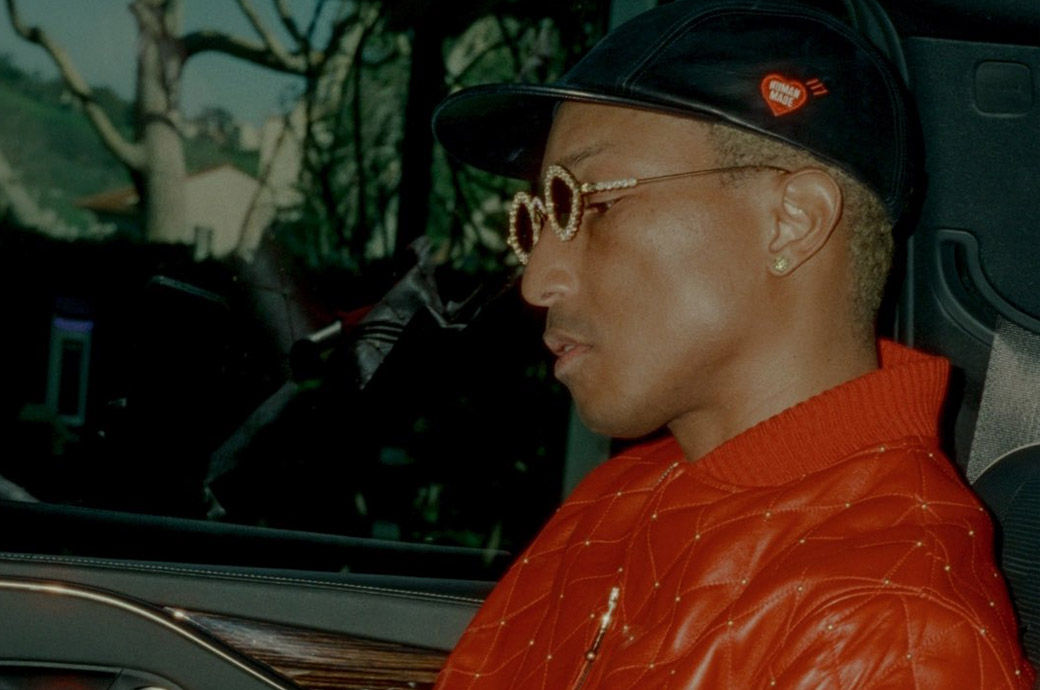

HYBE latest acquisition didn’t impact 2022 results but will help expand its presence outside of Korea in 2023. On Feb. 8, HYBE purchased QC Media Holdings, the parent company of Atlanta-based hip-hop label Quality Control Music, the home of Migos and Lil Baby, for $300 million. Quality Control will sit under HYBE America and the leadership of CEO Scooter Braun, whose Ithaca Projects was acquired by HYBE in 2021.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)