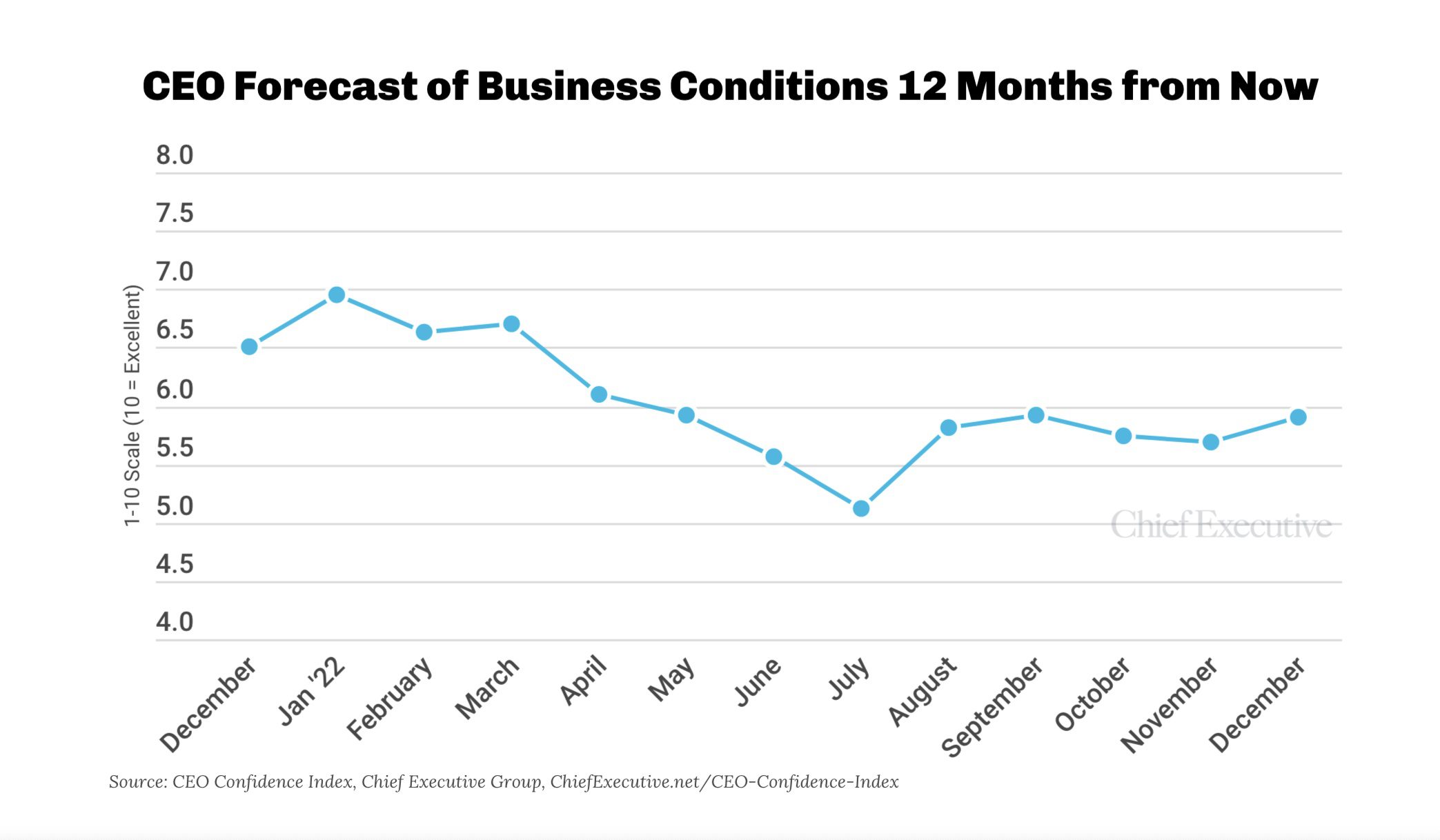

Despite the slight rally, the Index remains 9 percent below its reading one year prior and 15 percent under its January high of 6.95. Many CEOs say that global and domestic uncertainty, coupled with stagflation and falling disposable income for consumers sets the stage for a challenging environment for business, at least in the first half of 2023.

“Getting labor is an issue. Part shortages (even for machinery) is an issue. Demand appears very high but ramping to fulfill is difficult. Costs (especially energy) are sky rocking,” Cheryl Merchant, CEO of TACO Comfort Solutions, a large family owned industrial manufacturer, lists as reasons driving her 7/10 forecast of future business conditions, down from her 8/10 rating of current ones.

A slight majority (50.5 percent) of CEOs say that demand for their products/services is up from the beginning of the year, while 57.7 percent expect demand for their products/services to increase one year from now as well. Both measures have increased since last month, when only 46 percent of CEOs said that demand for their products/services had increased since the beginning of the year, and an even smaller proportion predicted that demand would be up one year down the line.

“Our industry should have improving business conditions by late 2023/early 2024 once the Fed ceases its rate increases and our clients see a stabilizing lending environment for commercial buildings,” says Britt Schmidt, CEO of The Teal System, a clean tech company, echoing what most CEOs believe will happen one year down the line. He expects conditions to turn around significantly over the course of the next year, from 5/10 now up to 7/10.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)