Preliminary data for 2023 doesn’t show much will be changing either: The majority of companies are reporting minimal (<5 percent) change to the median CEO compensation this year, vs. prior year. This comes as no surprise for anyone familiar with senior executive compensation at private U.S. companies. The median YoY change in cash compensation is historically flat—while the top quartile changes in base salaries and bonuses are an average of 3.43 and 6.50 percent per year, respectively, when looking back at the past five years.

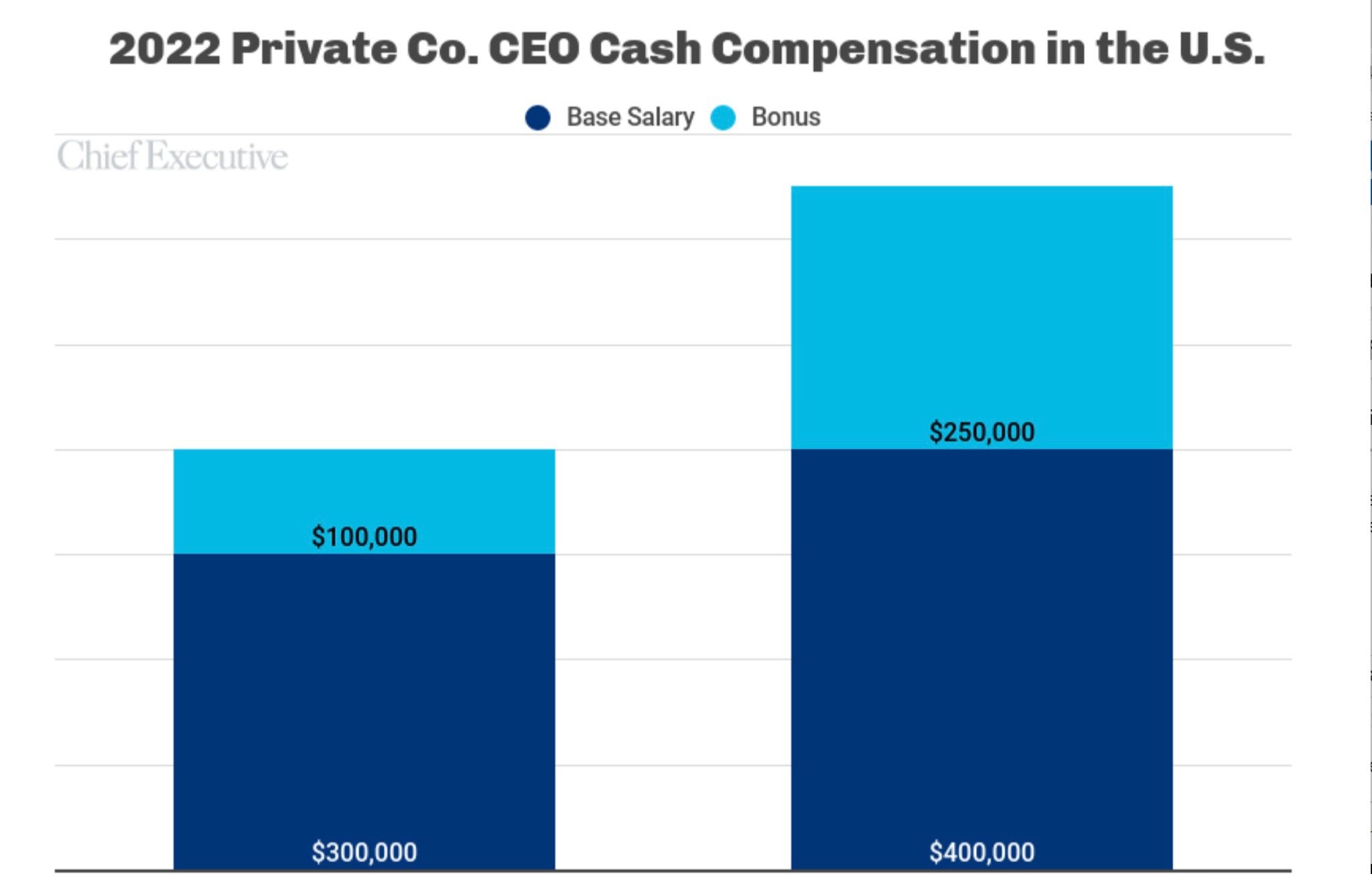

None of which is likely a surprise for readers of Chief Executive. As we’ve pointed out many times before, there is an abundance of anti-business spin surrounding chief executive pay, usually targeting the leaders of the largest 500 companies in the country. But, as you all know, most CEOs in America run private companies, and almost none of them are paid like their public company counterparts, whose pay garners consistent headlines for jaw-dropping salaries and double digit raises.

The Equity Stake

Much of the data reported about large public company CEOs emphasizes the equity portion of their comp plan. Our data shows unlike their public company counterparts, the median private company CEO does not typically receive new equity grants each year.

Nevertheless, Chief Executive’s 2022-23 report shows that the median CEO does own approximately 10 percent of their company’s equity, for a value of $1.75 million. While that’s a sizable interest, the challenge for private companies is determining the appreciation of this equity stake. Unlike public companies, most private companies do not value themselves annually.

However, in 2021, the median CEO overall reported equity gains of $30,000—a figure that has previously remained $0. One reason why this figure increased is that 2021 was a strong year for the stock market and for private businesses. Another reason is that as public companies continue to offer equity incentives to top executives, more and more private companies are estimating their enterprise value increases—and communicating that to their CEO. This may point to a change in best practice where privately held companies have begun to value themselves more often.

And even when the data is available, it is highly correlated to various factors, particularly company size. For instance, the median increase in equity value in 2021 for CEOs of companies with $5 to $9.9 million was $27,800. At the other end of the scale, the median CEO at companies with $1 billion + in revenues reported a $682,000 increase in their equity value in 2021.