“Our business backlog is low, supply chain issues still exist, [it’s] still hard to find employees,” said Elizabeth Pecha-Poelker, CEO of consumer manufacturing company PrintFlex Graphics, to explain her 5 out of 10 rating of business conditions.

“Customer orders are down across most sectors. Seems to be too much finished goods in the pipeline as consumer spending drops,” said Chris Conard, president of Bloomer, WI-based PMI, inc.

“We have seen customer demand, from across many markets we serve, erode rather significantly. A portion is due to customers leaning their inventories, and the rest is due to actual falling demand for goods,” said Tim Zimmerman, president and CEO of Mitchell Metal Products.

Despite this, Zimmerman said he is hopeful the Fed will be able to curtail interest hikes in the next one or two quarters. “If so,” he said, “I think there is a reasonable chance the economy will begin expanding again by late 2023.”

He’s not the only CEO polled who said they remain optimistic that this slide could be short-lived. Jim Nelson, president of Parr Instrument Company, said although rising interest rates and a persistently strong dollar will eventually dent demand going forward, he believes CEOs will still invest in their businesses, propelling growth on the other side of an economic downturn.

“Capital equipment investment is still strong. Supply chain pressures are easing. Labor market is easing. I believe the Fed has made their impact and will start to slow/ease rate hikes,” said David Cox, CEO of industrial manufacturer The Bradbury Group. “I think if we get government spending under control with a change in Congress and the Fed stops rate hikes, we will have inflation under control and the overall economy will be fine. CapX and infrastructure spending will be a boon to our U.S. economy.”

The Year Ahead

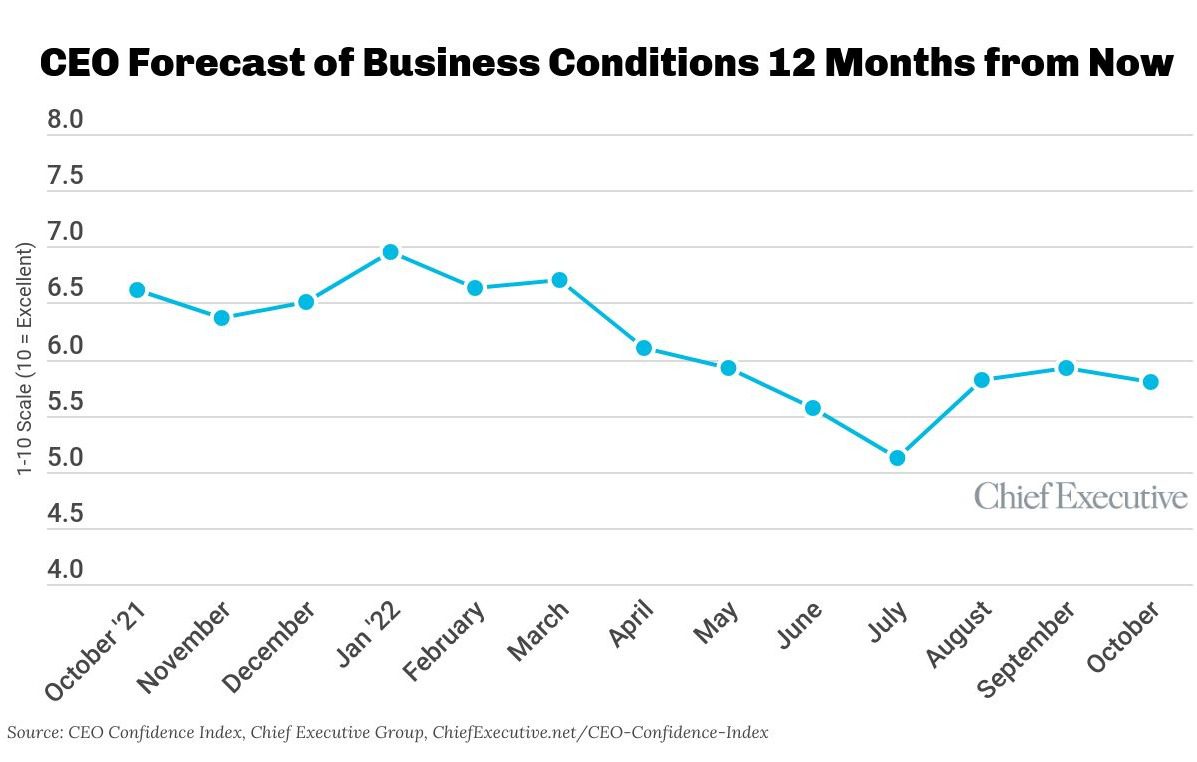

Forecasting for the year ahead, 53 percent of CEOs say they expect profits to be up by this time next year—6 percent fewer than in September and 26 percent less than in January. Similarly, 69 percent expect revenues to increase over the next 12 months, 4 percent lower than in September and 21 percent less than when we started the year.

Despite the fact that 78 percent of the CEOs we polled expect to cut costs across various areas of the business in response to rising wages and overall inflation pressures, 48 percent intend to add to their workforce in the year year—up 4 percent month over month and the first increase we’ve seen in this metric since May.

“Cutting costs does not necessarily improve revenues, and reducing employee benefits causes discontent,” said Lorna Phillipson of the Phillipson Institute. “We want to retain our current staff, reduce turnover, so investments in our staff and improving customer satisfaction will continue,” she said.

Another area that is seeing an uptick is capital expenditures, where 45 percent of CEOs say they intend to have upped spending by this time next year. That proportion is 8 percent higher than in September, though it remains 27 percent lower than in January. Like labor, it is the first time we record an increase in that area since May.

“I believe this is the time to invest to be in a position to take advantage of the opportunities as the economy recovers,” explained Karl Fritchen, president of metal machinery supplier SafanDarley North America, who plans to increase capex within the next 12 months.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)