Five years ago, it seemed like customer journey orchestration technology was having a moment.

Since then, the marketplace for standalone journey orchestration engine (JOE) platforms has receded. A plateau in sales and numerous vendor acquisitions absorbed nearly all the independent JOE vendors.

What happened, and what does it mean for you, the martech leader?

First, a bit of history

JOE technology has roots in the pre-digital era, where many “decisioning” platforms helped inform direct mail and telephony-based customer engagement.

Vendors like Infor, SAS, and Pega acquired and merged much of this tech into larger suites and slowly adapted them to the digital age.

Then the 2010s saw many enterprises undertake “customer journey mapping” projects, often led by external agencies conducting specialized workshops to uncover “as-is” and “to-be” customer journeys.

The diversity of approaches to visualization, terminology, and even the definition of a “journey” should have been a warning that full-cycle orchestration would prove difficult.

Not surprisingly, most of these projects led to more tactical, test-and-optimize projects at discrete touchpoints rather than systemic omnichannel overhauls.

Read next: What is customer journey orchestration and how does it work?

Promise and pitfalls

At the same time, a handful of independent, born-digital JOE vendors emerged. They served forward-looking enterprises seeking to provide a more coherent, omnichannel experience for customers.

Interestingly, the customer data platform (CDP) market — which emerged simultaneously — grew to become a multi-billion dollar arena with dozens of plausible alternatives.

Yet, the JOE market never really took off. Why not?

First of all, omnichannel journey orchestration is more complicated than it looks. An enterprise specialist might imagine themself sitting at a complex control panel, adjusting dials and knobs to optimize outcomes.

But it turns out that modern customer engagement can be as complicated as nuclear controls, and require comparable levels of education, training and risk reduction.

For JOE technology to work, you need to have at least three things in place, and none of them are easy:

- Comprehensive, unified and accessible customer data. Almost no firm has this, though everyone is working on it. Sometimes JOE vendors would build in mini-CDPs just to accelerate this process, with predictably poor results.

- Performant, reliable, customizable, bi-directional connectors to your most important customer engagement touchpoints so you can adequately listen and respond. The term “reliable connector” should give you pause.

- Interdepartmental strategy and governance to figure out and then execute your tactics across numerous channels: media buys, web, apps, messaging-oriented campaigns, e-commerce, and customer service. Often, we see marketing take the lead here, but this is an enterprise-wide endeavor, and those are hard.

Get the daily newsletter digital marketers rely on.

A changing market

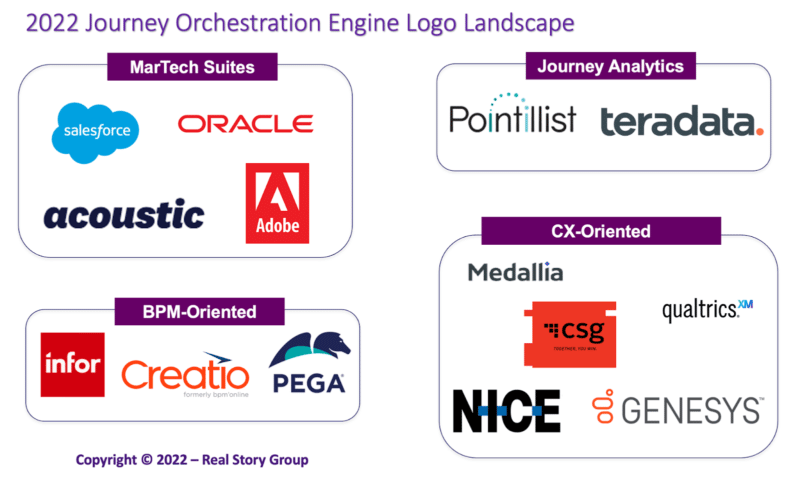

After initial excitement, the JOE market plateaued.

Salesforce dropped its reseller agreement with the largest indie JOE vendor, Thunderhead. Acquia quietly dismissed its JOE partner, Kitewheel.

Other suite vendors like Adobe and Acoustic only have limited investments in omnichannel orchestration as they focus more on outbound messaging platforms.

Most pointedly, all the major JOE independents have gotten sold off, primarily to “CX” (read: customer listening/service) vendors like Medallia and Qualtrics.

Here again, the contrast with CDPs feels apt. CDPs have become almost a “cost of doing business.” In most cases, the large enterprise needs to deploy one.

Yet JOE technology has remained more aspirational, requiring a tougher return on investment justification. Recent M&A activity seems to indicate the most profitable thing JOE technology does circa 2022 is to reduce both customer churn and costly call center volumes.

The future of journey orchestration technology

This story doesn’t have a sad ending. The need for journey orchestration is not going away.

While marketers may remain enamored with outbound, message-oriented campaigns, consumers are less optimistic about the resulting deluge of emails, texts, and in-app messages.

The listen-and-respond motif of journey orchestration platforms will become even more critical as firms transition to subscription-like models that emphasize maximizing lifetime customer value.

Meanwhile, a growing set of CDP vendors is adding lightweight orchestration services to their platforms.

At first, we at Real Story Group were skeptical at this CDP+journey coupling — proper separation of concerns and all that. Yet, we’ve learned that decisioning seems to want to reside close to data.

Some of our clients find this bundled approach a useful introduction to a complex opportunity.

They are already moving more heavy-duty artificial intelligence and machine learning operations lower in their data stack (where they can be more closely governed). Putting a light, data-centric orchestration layer on top could present a simple way to leverage some of those models.

In any case, decisioning and journey orchestration are not going away. Instead, they’ll take more time to mature on both the vendor and enterprise sides.

Larger questions revolve around where these services will reside in your future stack. And for that, you have many choices.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

![Key Metrics for Social Media Marketing [Infographic] Key Metrics for Social Media Marketing [Infographic]](https://www.socialmediatoday.com/imgproxy/nP1lliSbrTbUmhFV6RdAz9qJZFvsstq3IG6orLUMMls/g:ce/rs:fit:770:435/bG9jYWw6Ly8vZGl2ZWltYWdlL3NvY2lhbF9tZWRpYV9yb2lfaW5vZ3JhcGhpYzIucG5n.webp)