This year, mobile gaming is set to surpass a 60% market share of global in-game advertising, according to a new study by marketing intelligence firm IDC and app analytics platform data.ai.

Mobile gaming spend will climb from $120 billion in 2021 to $136 billion in 2022. This makes mobile gaming advertising 3.2 times bigger than console, and growing at 1.7 times the rate of the industry overall.

That’s saying a lot when, in the US, we saw console gamers grow by 21% year-over-year in 2021. Meanwhile, the global gaming community is estimated at 3 billion.

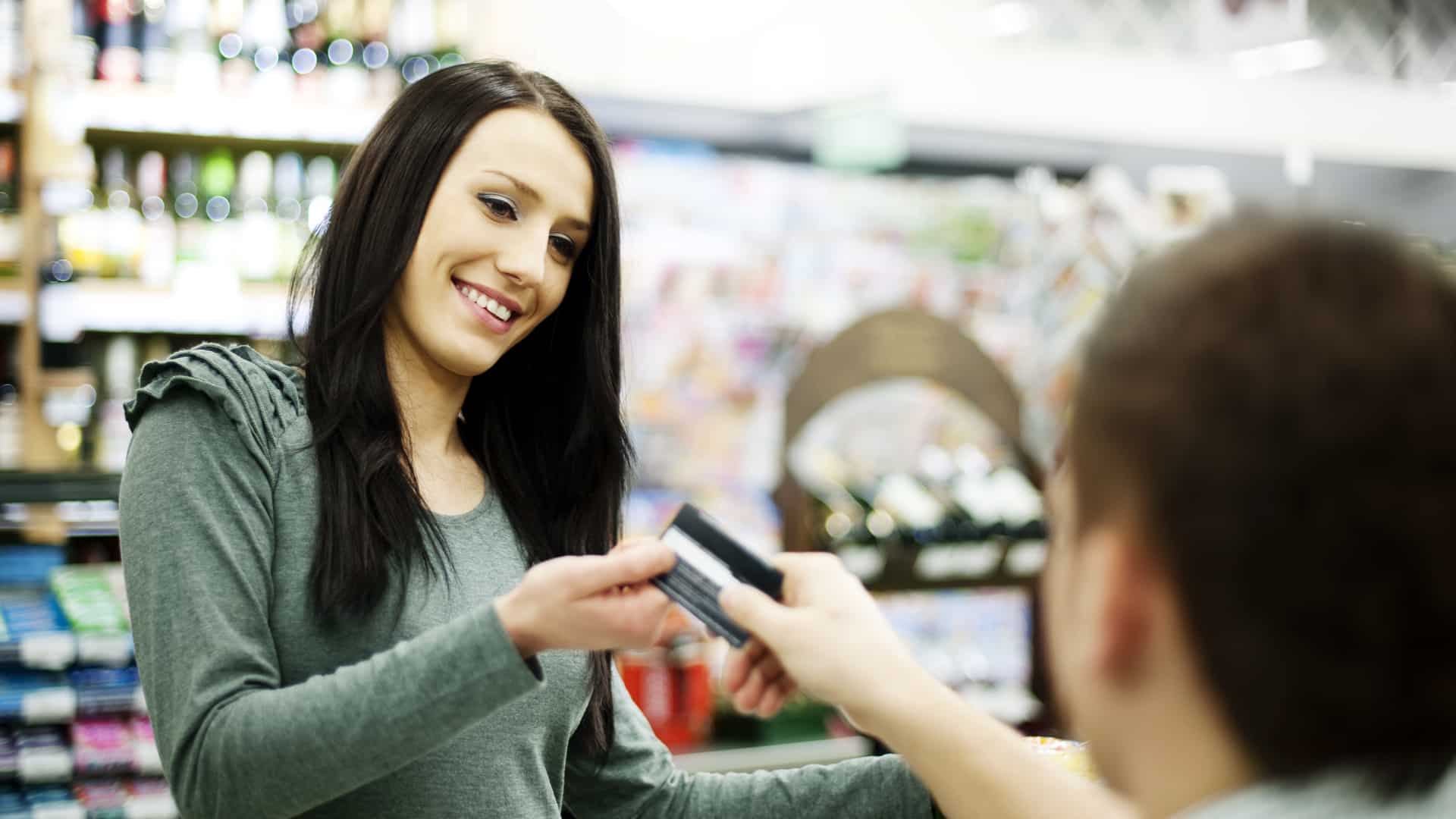

Tolerance for mobile ads. Mobile app gamers are willing to see ads in exchange for free content and services, the IDC/data.ai study found. Gamers who welcome ads outnumber those who don’t three-to-one.

Read next: PepsiCo’s strategies for marketing via online games and esports

However, top mobile games are also a cash cow for consumer spending. This applies for Gen Z consumers, as well as those in the higher age brackets. Forty-seven percent of the top 1,000 grossing mobile games skew to Gen Z, up from 41% two years ago. For gamers ages 45 and up, monetization from games skewed to them accelerated even faster, up to 31% of the top 1,000 games, up seven percent from two years ago.

Somewhere in the middle, Millennials are likely too busy with children and careers to be spending as much time and money on apps.

Get the daily newsletter digital marketers rely on.

Why we care. The value proposition for gaming ads is similar to what streaming services like Netflix are mulling over. Will consumers understand and accept more ads for free or reduced payments and subscriptions?

Regardless, the game experience can’t be compromised by a negative ad experience or negative consumer sentiment toward the ads. Marketers have to understand the communities of gamers who play these games and how a brand or inventive ad idea might be integrated into the gameplay.

![Social Media Ad Spend by Platform [Infographic] Social Media Ad Spend by Platform [Infographic]](https://imgproxy.divecdn.com/fFyzSSAT7wH3XZmR-_UrPekb785HJmuBOImrd_p4QWI/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9kaWdpdGFsX2FkX3NwZW5kX3Zpc3VhbGl6YXRpb24yLnBuZw==.webp)