[ad_1]

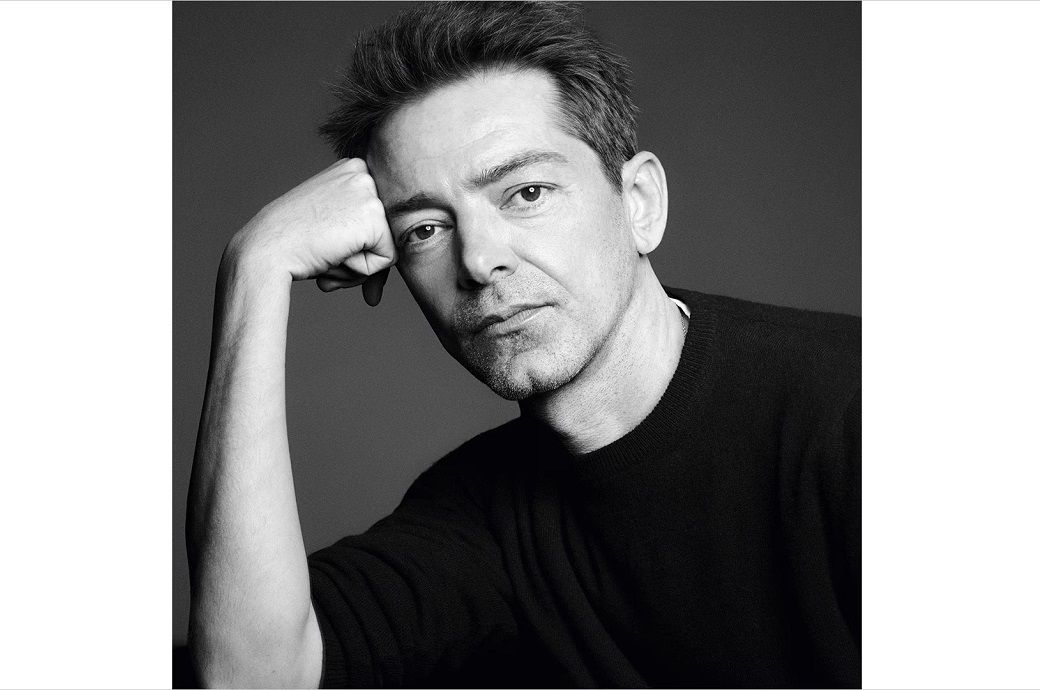

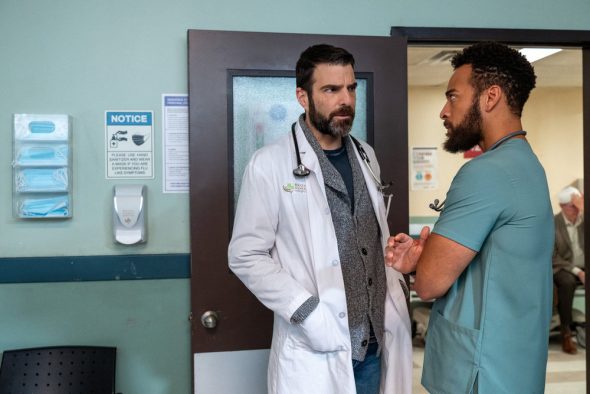

Charles P. Rettig, commissioner of the Internal Revenue Service, testifies during the Senate Finance Committee hearing titled The IRS Fiscal Year 2022 Budget, in Dirksen Senate Office Building in Washington, D.C., June 8, 2021.

Tom Williams | Pool | Reuters

The IRS is making progress on its backlog of unprocessed tax returns, but millions remain, the agency said on Tuesday.

As of June 10, the IRS had completed around 4.5 million of the more than 4.7 million individual paper returns from 2021, and the agency expects to finish error-free individual filings from 2021 this week.

The agency has also processed most of the 2022 filings — more than 143 million returns — and issued nearly 98 million refunds worth $298 billion.

More from Personal Finance:

What a federal gas tax holiday could mean for prices at the pump

Tax pros ‘very skeptical’ about expanded IRS voice bots for payments plans

Beyonce’s ‘Break My Soul’ is an ode to the Great Resignation

However, the IRS still faces more than twice as many unprocessed tax returns compared to a typical year, the agency said.

There were 11 million pending individual returns as of June 10, including filings received before 2022 and new 2021 returns, according to the IRS.

“Completing the individual returns filed last year with no errors is a major milestone, but there is still work to do,” IRS Commissioner Chuck Rettig said in a statement.

“We remain focused on doing everything possible to expedite processing of these tax returns, and we continue to add more people to this effort as our hiring efforts continue this summer,” he said.

Backlog should ‘absolutely’ clear by year-end

The pileup, created by years of budget cuts, understaffing, pandemic-related office closures and added duties, should “absolutely” resolve before December, Rettig said in March, appearing before the House Ways and Means Committee.

“As of today, barring any unforeseen circumstances, if the world stays as it is today, we will be what we call ‘healthy’ by the end of calendar year 2022, and enter the 2023 filing season with normal inventories,” he said.

Rettig’s promise to House lawmakers came about a week after the agency unveiled plans to hire 10,000 workers to tackle the backlog, with 5,000 new employees in the coming months.

However, Ken Corbin, chief taxpayer experience officer for the IRS, told the House Oversight Subcommittee in May that the agency hadn’t yet hired half of the 5,000 workers.

[ad_2]

Original Source Link